Sponsored content

For further information on creating and publishing sponsored content, please click here.

Regulatory compliance – A little proactivity goes a long way

Regulatory compliance has historically been viewed by the majority of capital markets participants as an unavoidable cost of doing business. Refinitiv explores why it may be time for firms to change their perspectives and approach various compliance…

A risk-based approach to AML and financial crime risk in Asia‑Pacific

Financial institutions across Asia‑Pacific are grappling with fast-changing risks and digital transformation in their efforts against money launderers and financial criminals. Risk.net hosted a webinar in association with NICE Actimize to discuss the…

How financial Institutions can manage risk for business recovery

Hosted by Asia Risk, this webinar – ahead of this October's Risk Hong Kong conference – addresses the latest market trends and challenges faced by Hong Kong’s risk management practitioners

FRTB – Special report 2020

Throughout FRTB’s troubled gestation, regulators were warned that making the internal models approach too operationally complex and capital-intensive would mean few outside the biggest banks wanted to use it – with the potentially dire consequence that…

The top risk management trends in the Asean region

Setting the scene in preparation for the Risk Asean conference in October, a group of industry experts debate and discuss the top trends in risk management the Asean region will need to look out for in 2021 and beyond

FRTB implementation – Covid-19 and Libor pressure

Industry leaders discuss the pressures FRTB is placing on banks’ data infrastructure and systems, how FRTB may constrain banks’ ability to manage future volatility, and the potential complications to implementation caused by such factors as the Covid‑19…

Revised FRTB deadline poses further challenges for Asia‑Pacific banks

Essan Soobratty, product manager for regulatory data, New York; Eugene Stern, global head of product, market risk, New York; and Vicky Cheng, head of government and regulatory affairs, Asia‑Pacific, Hong Kong, at Bloomberg explore the additional…

The changing shape of buy-side risk technology

Buy-side risk managers and FactSet’s global head of quantitative analytics gathered for a Risk.net webinar to discuss topical risk management trends for asset managers and to consider the industry challenges posed by the recent Covid‑19 pandemic

Alternative markets give edge to Florin Court strategy

By concentrating on exotic and alternative markets, Florin Court Capital Fund has sidestepped overcrowding and correlation to the main trend following commodity trading advisers, offering investors a diversified alternative to the standard systemic macro…

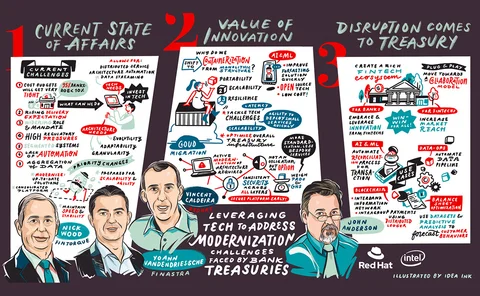

Leveraging technology to address modernisation challenges faced by bank treasuries

Bank treasurers and technologists convened for a Risk.net webinar in association with Red Hat to consider how technological innovation could help treasury functions meet rising expectations

Lessons from the past – The evolving importance of historical tick data (Part I)

A recent Risk.net webinar in association with Refinitiv examined the opportunities and challenges for using historical tick data in today’s volatile markets. Panellists outlined the variety of ways the industry is harnessing historical tick data, but…

Lessons from the past – Overcoming historical tick-data challenges with the cloud (Part II)

The panel at a recent Risk.net webinar in association with Refinitiv outlined some of these challenges, including the expense of data cleaning, maintenance and storage; access to relevant data; and dataset integration. They agreed that cloud-based…

China Minsheng Bank MStar shines in volatile markets

Sponsored content

Managing financial risk in cross-border emerging markets M&A

BNP Paribas’ Djamel Bruimaud, strategic sales lead for foreign exchange and local markets for European corporates, and Stephane Benhamou, head of forex and rates solutions sales, France, discuss the creation and execution of a hedging solution designed…

From crisis to the new normal in banking – How the Covid-19 pandemic has influenced products, services and op risk

This webinar explores how the Covid-19 pandemic has impacted banks' interaction with clients, how consumers carry out transactions and the knock-on effect for mitigating operational risk

Webinar – Nowcasting the US economy

Join CME Group Chief Economist, Blu Putnam, as he shares insights using alternative data and nowcasting to monitor developments in the US economy.

Letting go of Libor – How banks and buy-side firms are navigating the road to transition

Libor’s demise as a trusted benchmark presents a seismic challenge to the financial services industry. As time ticks down to its planned replacement in 2021 and alternative rates and new products emerge, market participants must determine the risks to…

Eurex passes volatility test with flying colours

Eurex explores how Covid‑19 volatility across the industry has tested market participants’ resilience, and how the central counterparty itself has proved its credentials as a reliable and sustainable euro liquidity pool

How the Covid-19 pandemic is furthering understanding of crisis management frameworks

This webinar explores what can be gleaned from Covid-19, and how it can help inform recovery

Managing AML and fraud – A risky business needs a risk-based approach

Financial services organisations (FSOs) are expected to meet strict financial crime regulations regardless of their size, and those with smaller budgets and fewer resources are finding this increasingly difficult as regulations, guidelines and threats…

Continued change and volatility impacting Solvency II reporting

The capital impacts of Covid-19 mean increased Solvency II monitoring and reporting challenges for insurers. This is occurring against a backdrop of continued regulatory change. Faced with the evolving challenges of Solvency II, Refinitiv highlights why…

The evolution of pricing bonds and the data journey

Jason Waight, head of regulatory affairs, Europe at MarketAxess, considers why access to flexible data is key to using new trading protocols in fixed income

Stress-testing amid Covid‑19

The Covid‑19 pandemic has proved to be a real-life stress test for the banking sector as firms adjust to new ways of working. Here, SAS explores how the pandemic has magnified the importance of stress-testing, scenario analysis and contingency planning…

Libor Risk – Quarterly report Q2 2020

Detaching an estimated $350 trillion of financial contracts from Libor was always going to be an uphill struggle. For a rump of so-called “tough legacy” contracts it’s a near impossible task. Now their future lies in the hands of legislators