Index options

QIS 3.0 ‘bonanza’: hedge funds pivot from options to swaps

Pod-level scramble for max-loss exposure gives way to central risk books seeking overlays

Traders dredge 0DTE data for intraday gamma insights

Firms such as UBS, BofA and OptionMetrics are investing in continuous net options position monitoring

Long gamma puts brakes on post-election US stock rally

Call selling by ETFs helped fuel largest net gamma positioning among dealers since July

Pre-market trades blamed for record Vix surge

Traders rushed to cover short vol positions before the market opened on August 5

After the selloff, competing theories on dealer gamma

Tier1 Alpha sees $74 billion short gamma catalyst; SG says rapid return to positive territory had calming effect

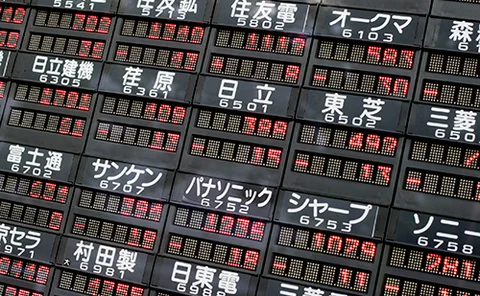

Vega peak was foothill in historic Nikkei selloff

JFSA scrutiny has curbed issuance of autocallables, so stock plunge generated light re-hedging

Continued decline of the one-stop shop

Dealer Rankings 2024: Only two banks make the top 10 across all rankings tables – others have focused on vertical dominance

Often fluid. Not always liquid

Dealer Rankings 2024: On the buy side and the sell side, the make-up and depth of OTC mini-markets can change rapidly

SG trader dismissals shine spotlight on intraday limit controls

Risk experts say many banks rely on daily reports and can’t effectively monitor intraday limits in real time

‘Fear gauge’ within expectations, some say

Several options specialists dismiss claims that structured products are distorting the Vix

Zero-day hedging takes root in new asset classes

Option users move beyond equity indexes in search of cheaper, sharper hedging tools

Professional investors behind ‘witching day’ options spike

Study says retail investors are the losers from anomaly that costs more than $3.8 billion

Bank QIS teams take zero-day options plunge

JP Morgan sees better risk/reward profile for 0DTE-based trend strategies

US life insurers piled into index options in Q2

Counterparty Radar: Lincoln Financial, Global Atlantic lead expansion; Goldman claims top dealer spot

‘Witching day’ price spikes point to options market manipulation – study

Data reveals patterns that can be explained no other way, researchers say

HKEX eyes options contracts on MSCI A-shares index

Warrant issuers could benefit from roll-out of additional hedging instruments

Same instrument, different market

Dealer Rankings 2023: For buy-side firms, the list of banks you can trade with depends on who you are

Calamos grows equity index options book amid put U-turn

Counterparty Radar: US retail funds cut $39.3 billion notional in Q4

Simplify bursts into equity index options lead

Counterparty Radar: US mutual funds added exposure to sector in Q3

‘Perfect’ VKO trades knock the smile off vol

Dealer hedging of options which profit from ‘spot down, vol down’ may have amplified rare dynamic

Index vol has been a poor hedge for equity rout, traders say

Single stock ‘micro’ hedges have offered more protection in this year’s selloff