Covariance matrix

Overcoming Markowitz’s instability with hierarchical risk parity

Portfolio optimisation via HRP provides stable and robust weight estimates

Fat-tailed factors

Independent component analysis is proposed as an alternative to principal component analysis

Bayesian nonparametric covariance estimation with noisy and nonsynchronous asset prices

This paper introduces a Bayesian nonparametric method to estimate the ex post covariance matrix from high-frequency data.

Performance measures adjusted for the risk situation (PARS)

This paper proposes the use of a new class of performance measures adjusted for the risk situation (PARS), as the perception of risk depends on the individual situation including risk preferences.

Random matrix theory provides a clue to correlation dynamics

A growing field of mathematical research could help us understand correlation fluctuations, says quant expert

Finding the nearest covariance matrix: the foreign exchange market case

The authors consider the problem of finding a valid covariance matrix in the foreign exchange market given an initial nonpositively semidefinite (non-PSD) estimate of such a matrix.

Better risk reporting doesn’t need an IT upgrade

By revisiting certain calculations, new insights into risk and profit drivers can be gained, says data scientist

Risk premia strategies – Lessons learned for the future

After a difficult 2018, investors are increasingly wary of risk premia, concerned that factors leading to underperformance might be a recurring problem. Imene Moussa, executive director at UBS, clarifies this issue

Managing energy market volumetric risk

Krzysztof Wolyniec presents a volumetric risk management model for energy markets

When it comes to correlation, cleaning is a chore that pays

Recent trends in research may help firms obtain reliable correlations from limited data

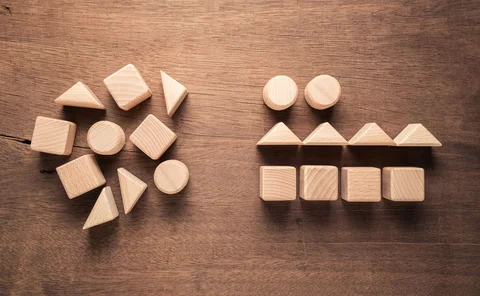

Cleaning correlation matrices

Bun, Bouchaud and Potters present a technique that allow cleaning in-sample noise from correlation matrixes

Hybrid correlation matrices

Hybrid correlation matrices