Diversification

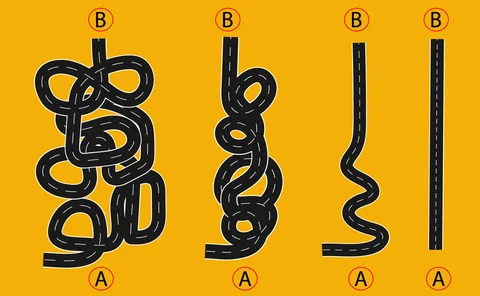

Can pod shops channel ‘organisational alpha’?

The tension between a firm and its managers can drag on returns. So far, there’s no perfect fix

FX alternative risk premia as a key diversifier for equity bond portfolios

Siddharth Grover, head of QIS structuring at BBVA, discusses how the BBVA FX Risk Premia Indices can aid investors seeking diversification, and provides insight into potential trends moving forward

A guide to home equity investments: the untapped real estate asset class

This report covers the investment opportunity in untapped home equity and the growth of HEIs, and outlines why the current macroeconomic environment presents a unique inflection point for credit-oriented investors to invest in HEIs

Regulators’ FRTB estimates based on faulty premise – industry study

US market risk capital requirements could more than double if banks abandon IMA

Cboe’s new options add diversity and liquidity to the credit market

Cboe has recently launched two options on futures products to help investors manage exposure and mitigate risk in corporate bond portfolios: options on iBoxx high-yield corporate bond index futures (IBYO), and options on iBoxx investment-grade corporate…

Optimal allocation to cryptocurrencies in diversified portfolios

Asset allocation methods assign positive weights to cryptos in diversified portfolios

Diversification is even better than a free lunch – study

Data back to 1926 shows that spreading bets brings higher returns as well as lower risk

Podcast: Jan Rosenzweig on fat tails and LDI portfolios

An optimised portfolio can look very different when extreme moves are given more weight

SocGen’s VAR up 33% in Q4

Gap with French rival BNP Paribas shrinks to just €9 million, the least since mid-2020

Keep risk parity simple, stupid

In times of volatility, simpler risk parity strategies may outperform more elaborate counterparts

Crédit Agricole’s VAR jumps 88% on fixed income blow-up

Trading risk gauge reached the highest since Q2 2020

Exploring the equity–bond relationship in a low-rate environment with unsupervised learning

The authors apply k-means clustering to low interest rate periods in order to analyze the equity hedging property of government bonds.

The risk-reversal premium

We show that including risk reversals in an equity portfolio creates a better portfolio compared with a pure index position.

Stocks and bonds start to move in step, making quants jittery

Long-established inverse correlation between asset classes breaks down during first quarter

EU lawmakers’ demand for local capital floors alarms banks

Multiple output floors applied to each entity raises fears of capital increase for large groups

Nordea’s trading VAR keeps climbing amid rate hike jitters

Trading risk gauge surged 17% through Q4

JP Morgan’s VAR falls to lowest since 2018

Gauge of trading risk drops 20% quarter on quarter, driven by commodities and equity desks

An examination of the tail contribution to distortion risk measures

This paper reports a method for analyzing the influence of the tail in calculations of distortion risk measures.

Correlation diversified passive portfolio strategy based on permutation of assets

This paper proposes a new idea to determine the adjustment weight vector in order to construct a passive portfolio with lower risk than the risk of the benchmark index.

JP Morgan’s fixed income VAR dives 69%

Average trading VAR down 59% over the previous quarter

Random matrix theory provides a clue to correlation dynamics

A growing field of mathematical research could help us understand correlation fluctuations, says quant expert