This article was paid for by a contributing third party.More Information.

New directions – Diversification of alternative risk premia strategies

Despite a difficult year, investors remain keen to use alternative risk premia strategies. However, current approaches may be less diversified than they appear, especially given cross-contamination in cash equity factors. According to Nomura, a more diversified approach making use of fixed income has led to better returns and a more resilient portfolio

The search for alternative sources of return and greater diversification has piqued investor interest in the alternatives space in recent years. Rather than allocating capital solely according to asset class benchmarks, alternative risk premia strategies invest in the market according to well-known underlying performance drivers that exist within these asset classes. As such, these programmes invest systematically according to long/short factors such as value, momentum, volatility, trend, carry and size.

The growing interest in risk premia investing is a result of stretched valuations in standard asset classes, according to Steven Loeys, head of index structuring at Nomura. “Equities and bonds both look expensive relative to historical norms, and underperformance is likely,” he says. “Investors are looking for alternatives as they cannot rely on negative correlation between bonds and equities in risk‑off events as they once did.”

However, performance among many alternative risk premia products has been weak for most of 2018. Many suffered during the sharp equity reversal in February, then recovered somewhat before experiencing further losses starting from late April – in particular with the equity sell-off in October. As a result, average losses across the space have reached nearly 5% since the start of the year (figure 1).

Despite recent market turbulence, investor interest in risk premia strategies remains undimmed. A survey of more than 70 investment professionals undertaken in October 2018 by Nomura and Risk.net showed confidence in this type of strategy, with 93% of respondents reporting confidence unchanged or higher in the past 12 months. In fact, allocations to risk premia strategies are set to increase to some degree over the next year at 64% of the organisations polled, according to the survey.

Nomura and Risk.net sought the views of asset managers, hedge funds, pension funds, banks, insurers and family offices. Of those that completed the survey, 63% already use risk premia strategies, while 37% are currently considering this type of investment.

Although investor interest in risk premia strategies remains high, the experience of the past year suggests some lessons can be learned. So how can investors build an alternative risk premia strategy that will provide solid returns and better protection from negative market events in the future?

Diversification and performance

The survey indicates there may be room to improve understanding and awareness of the finer details of this type of strategy, including the benefits of diversification into other asset classes. The highest asset class concentration of survey respondents (70%) is currently invested in equities-focused risk premia strategies.

Similarly, style factors often associated with equities-focused strategies are currently among the most popular investment styles for risk premia investors. One-third of respondents use size factors to invest in this space, 52% use quality, 49% use momentum factors and the largest number (60%) use value as a risk premia factor.

“Size, quality, momentum and value are traditional cash equity factors. We consider those ‘micro’ factors, as they normally involve trading one basket of individual equity shares against another,” Loeys explains. “On the other hand, carry, trend following and volatility selling are macro factors that apply across asset classes and use more scalable instruments. For example, in equities they would be applied to index futures rather than individual shares.” Respondents indicating current use of these factors were relatively lower, at 47%, 36% and 32%, respectively.

Established players in this space, such as Nomura, already use other asset classes as a way to diversify risk premia exposure, says Loeys. However, even though the majority (78%) of respondents to the survey value diversification as one of the main benefits of risk premia strategies, the highest proportion of investors (70%) remain invested in the equities space.

“In February, many alternative risk premia products exhibited losses coinciding with the sharp reversal in equity markets, reporting losses coming from both short volatility and trend-following exposures,” says Loeys. “Thereafter, both equities and risk premia products recovered, but from late April a number of funds underperformed again and, in this case, it was often cash equity factor exposures reported as the main driver of underperformance.”

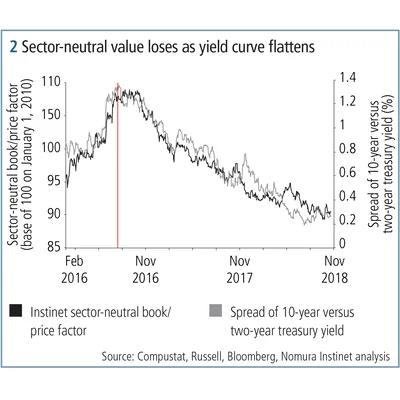

As Loeys explains, this is because some cash equity factor implementations in beta-neutral form, as typically implemented in risk premia products, have had a high co-movement with bond duration, causing these factors to underperform as bond yields have risen and yield curves flattened (figure 2).

Hidden sensitivity

Research from Nomura examines why cash equity value has underperformed over the past 12 months and indicates this trend may continue. In a September 2018 research note, Joseph Mezrich, head of quantitative strategy at Nomura Instinet, explained that a flattening yield curve during a period of rate hikes tends to make corporate debt financing more difficult. His analysis shows that, since value companies hold lower levels of cash and therefore usually rely more on debt financing than growth companies, the current cycle of rate hikes has caused value company stocks to underperform. “Going forward, as rate hikes continue and the yield curve further flattens, we would expect value to continue to underperform growth,” Mezrich says.

This is a major issue in the risk premia space, and for equity value factor investing in particular, according to Anthony Morris, global head of quantitative strategies, fixed income, at Nomura. “The value factor, if used in a beta-neutral way, embeds a lot of sensitivity to the yield curve. As Mezrich has found, this is one of the reasons equity value performance has been so terrible this year,” he says, adding that many risk premia investors do not realise the level of sensitivity equity factors have to interest rates.

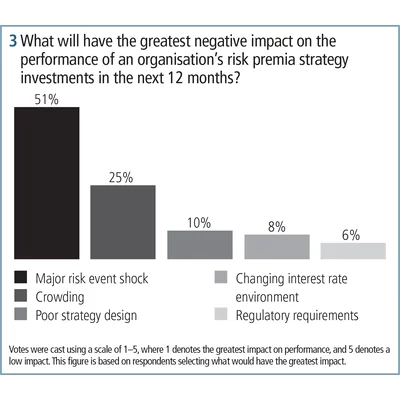

Indeed, the survey results show that only 8% of respondents see the changing interest rate environment as the top risk factor in relation to future performance of risk premia strategy investments. On the other hand, more than half (51%) ranked a major risk event shock as the number one scenario likely to negatively impact the performance of their organisation’s risk premia strategy investments over the next 12 months (figure 3).

A prime incentive for using alternative strategies such as risk premia is that investors can gain some level of protection from wider market turbulence, such as that seen over the course of 2018, says Loeys. While many alternative risk premia strategies underperformed this year, he argues that those offering a different approach to risk premia investing – by concentrating on opportunities outside of equities, for instance – have fared better. For example, the Nomura Emerging Market Momentum Index1, which tracks momentum in 10 emerging market currencies against the dollar, had outperformed the JP Morgan Emerging Market Index by 20 percentage points in 2018 to the end of October.

“We’ve been advocating this approach in the context of trend following for many years,” Loeys adds. “Even though it is more expensive to implement in emerging markets than developed markets such as Group of 10 foreign exchange, we think it makes more sense at the moment because developed markets have been relatively stagnant with very low interest rates and fewer trends or dispersion. Emerging markets still show signs of an economic cycle and some volatility, which results in better performance.”

Looking ahead

To achieve a greater level of protection going forward, Loeys believes greater focus on strategies beyond equities could be pivotal. But are investors ready to explore new asset classes when it comes to alternative risk premia investments? According to the survey, the sector has traditionally concentrated on equities markets to deploy risk premia investments, but the idea of asset class diversification is starting to take root.

While seven in 10 risk premia strategy users are currently invested in equities, these survey respondents are also becoming more interested in other markets, with fixed income, commodities and currencies each attracting consideration from more than one-quarter of respondents. “There is definite interest there [for fixed income strategies] and we are very much in support of that,” Loeys says. “While many organisations have built their alternative risk premia offerings around the core of their equities businesses, Nomura’s approach has a fixed income heritage.”

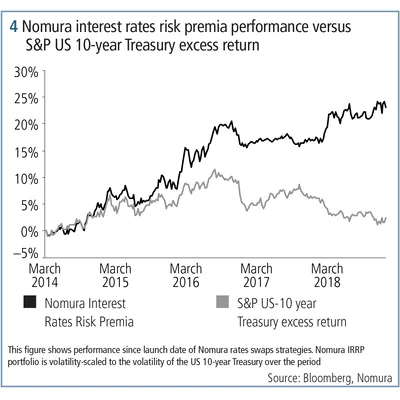

“One of the most ironic things about this space is that some interest rate risk premia strategies have less exposure to bond duration than some cash equity factors,” Morris adds. “The good news in this is that interest rate strategies followed a very different path from both duration and traditional equity-based strategies in 2018, generating diversification and positive returns” (figure 4).

Continued confidence

Investor confidence in the future performance of risk premia strategies is also strong among respondents to the survey: 77% are either confident (66%) or very confident (11%) about performance over the next 12 months. Respondents that are not confident are more likely to be asset owners (18%), rather than asset managers – 88% of whom were either confident (74%) or very confident (15%).

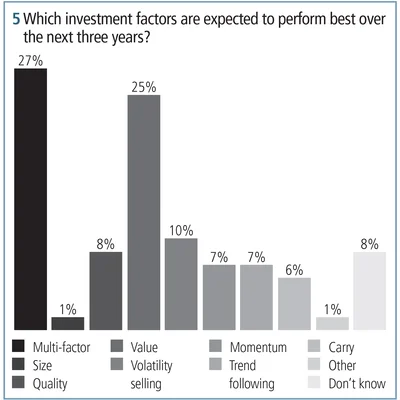

In terms of specific investment styles, while multi-factor strategies were expected to perform best over the next three years by the largest percentage of respondents (27%) – a possible indication of increasing awareness of the need for diversification – one-quarter predict the value style will perform best during this time (figure 5).

Although he believes this ’value’ result probably still relates to cash equity factors, Loeys agrees that value could continue to perform well – but he suggests a broader definition of what value should encompass. “When we think of value, it’s essentially mean reversion. But mean reversion can exist in any asset class. One needs to be objective about analysing where it is most likely to perform, and focus exposure on those instruments. In our view, the best places to achieve mean reversion at scale seem to be outside of equities.

Future trends

Similarly, Nomura would caution investors to eschew industry buzz around technology innovations such as artificial intelligence (AI) and big data – certainly in relation to the risk premia space. The application of machine learning and AI techniques is the trend most likely to have the greatest influence on this area of investing over the next three years according to 55% of respondents, with greater use of big/alternative data coming a close second (46%). However, Morris urges investors to focus on fixed income products instead – in comparison, this was seen as a top trend by only 12% of respondents.

“We think it’s unlikely that performance in risk premia strategies can be changed with a dollop of AI,” Morris explains. “One of the problems is that any statistical technique in finance involves looking at historical data and trying to find patterns in that data. With AI, big data or machine learning, the possibility of overfitting becomes far more dangerous because, instead of having two or three parameters to fit, you could have thousands. Furthermore, as models get more divorced from economic intuition, it becomes more difficult to see this danger coming.” So, while it’s possible to use such techniques to create backtests that look very successful, the danger of overfitting is high. Morris adds: “One has to ask: does the risk premia industry really need more opportunities to overfit parameters in backtests?”

“It’s interesting that fixed income products – which to us are underutilised and have actually delivered the goods, especially this year – received the lowest score in the survey [12%],” he continues. “Is it really a good idea to explore more of the same by applying ‘AI-branded’ algorithms to equities? Wouldn’t it make more sense to see how relatively straightforward approaches to fixed income can radically enhance portfolio risk and return properties?”

According to Morris, Nomura is in a good position to help investors explore these less crowded asset classes, such as fixed income, from a risk premia perspective. “What makes us different is that we come from the fixed income world – the structured rates world, in particular,” he says. “We have offered hybrid products for a long time and are very comfortable in this space.”

The interest in alternative risk premia strategies looks set to continue, with investors showing a high level of confidence in this area of investment and even an eagerness to increase allocations to products in this space. However, Nomura believes those investors that expand beyond equities into asset classes such as fixed income will create a more robust portfolio and can gain better access to alternative sources of return.

1. Nomura International plc (NIP) is the Index Sponsor of this index, and is therefore responsible for maintaining it, as well as calculating and publishing its levels, based on proprietary models and relying on market information.

For further information on the Nomura and Risk.net alternative risk premia survey, please contact Nomura Quantitative Investment Strategies on +44 (0)20 7103 3169

Note to investors: This article is not intended to form the basis of any investment decision, is not investment research and does not constitute or form part of any offer to sell or an invitation to subscribe for, hold or purchase any securities or any other investment, and neither shall form the basis of or be relied on in connection with any contract or commitment whatsoever. The value of investments can fall as well as rise. Investors may get back less than the amount invested. Past performance is not necessarily a guide to future performance.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net