Risk technology rankings 2016: no bank is an island

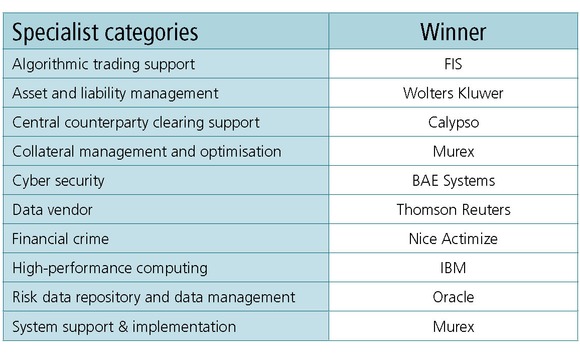

Murex, FIS and Calypso take the top spots in this year’s rankings, as banks’ technology needs inspire more collaborative approaches

CLICK HERE TO VIEW THE TABLES IN ONE PDF

CLICK HERE TO VIEW THE RESEARCH

Over the past few years, banks have been coming to terms with the fact that much of their capital markets and other technology is no longer fit for purpose. Individual systems do not have the functionality or performance to meet current regulatory or business requirements, while the infrastructure as a whole is inconsistent, inefficient, inflexible and far too costly.

Many banks already have infrastructure upgrades underway, but at the same time are having to meet a barrage of regulatory deadlines. Some of these deadlines make new demands of the banks’ systems, while others go far beyond that, with implications for computing power, data and governance. In the latter camp, vendors give the example of new rules on market risk capital – the Fundamental review of the trading book (FRTB) – and revamped loan-loss accounting standards.

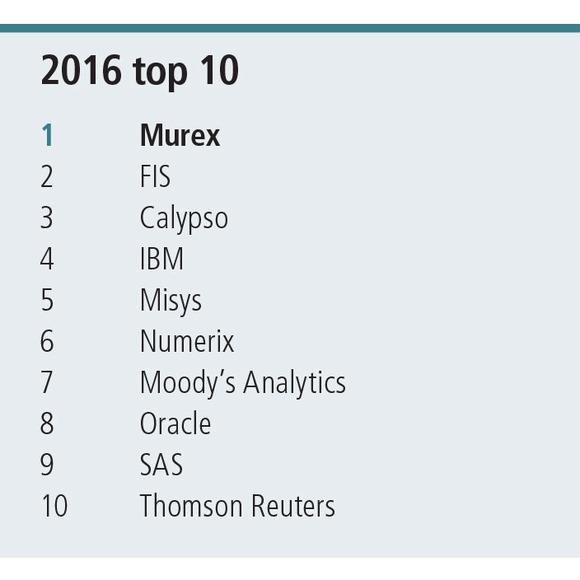

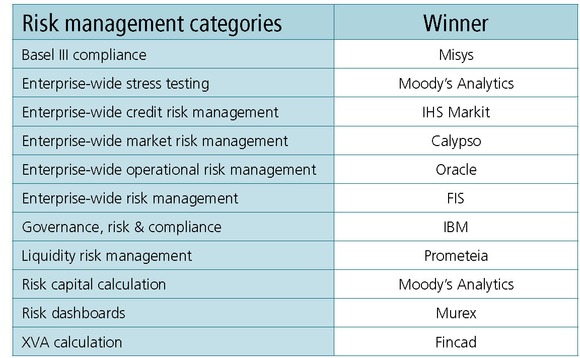

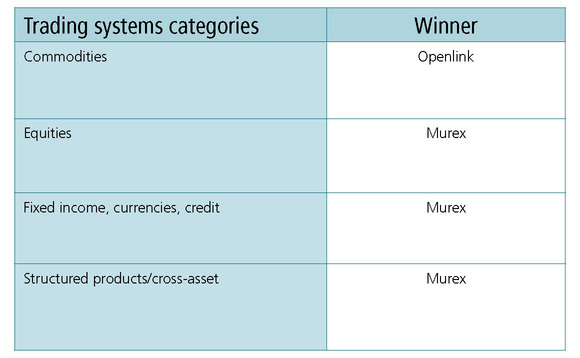

“Implementing FRTB is not something a bank can do by just buying a component and sticking it on top of its existing setup. You have to redesign your capital markets infrastructure,” says Maroun Edde, chief executive officer of Murex, who is based in Paris. Murex once again topped the Risk technology vendor rankings, dominating the trading systems categories and scoring consistently well across many others.

Banks are responding to these parallel demands – the immediate need for regulatory compliance and their own longer-term strategic goals – by asking more of vendors. New projects need to resolve multiple needs, rather than being pursued in isolation.

“Our new projects are more than twice as big as they were a few years ago,” says Edde.

The scale of the work is hinted at in the survey that accompanied this year’s Risk technology rankings. Sixty per cent of the 608 financial institutions that responded to the question said they planned to increase their technology spending in 2017, with almost 23% of those respondents anticipating a spending increase of a fifth or more. Obsolete systems, support for growth plans and regulatory compliance are the main drivers of their increased spending.

The result is a drive for greater efficiency: the idea of selecting individual ‘best of breed’ systems for each asset class – and sometimes even for different functions within an asset class – is gone, say vendors. So are piecemeal attempts to tackle technology issues. Facing a cascade of demands, banks are looking for smart ways to combine projects across risks, regulations or business functions, says Arnaud Picut, Hong Kong-based global head of risk practice at Misys. Misys came fifth overall in the rankings.

“Every bank – and vendor – has talked about enterprise risk management, but few have done it. Tackling the various risks individually and in isolation across the trading and banking books will cost a fortune. In the past six months, we have started seeing true enterprise risk projects coming up for the first time,” says Picut.

Victor de Oliveira Pinto, sales director at Moody’s Analytics in Paris, is seeing the same trend: bank requests for information and proposals are now more likely to insist multiple requirements are satisfied at once. “Banks have realised an increasing number of areas are becoming more interlinked. It has, therefore, become essential for banks to invest in solutions that leverage a common infrastructure to respond to most of the regulatory requirements for risk and finance,” he says. Moody’s Analytics came seventh in the rankings overall.

Like FRTB, loan-loss accounting – in the form of International Financial Reporting Standard (IFRS) 9 – has implications that stretch beyond the immediate requirements, but where there is even greater urgency because of the looming January 2018 implementation deadline. The new rules change the way credit losses, or impairments, on certain financial assets, such as loans and debt securities, are recognised. The calculation of impairments is currently based on incurred losses, but the new standard introduces an expected loss model with varying time horizons – in some cases calling for the loss forecast to span the entire life of the loan.

Implementing FRTB is not something a bank can do by just buying a component and sticking it on top of its existing setup. You have to redesign your capital markets infrastructure

Maroun Edde, Murex

“Organisations are finding it difficult to change the processes that calculate credit impairments, including how to carry out the assessment, simulation and deployment of the impairment methodology in a robust, timely and efficient manner. Meeting the January 2018 implementation deadline is a widespread challenge,” says David Ferguson, consultant for risk and customer management at SAS in Dublin. SAS came ninth in the rankings overall.

FIS, which came second overall in the rankings, shares this view. “Banks will realise they have to consider the impact of impairment, and that impairment is no longer a pure accounting figure, but needs to be managed by the business. Therefore, we’ll see a transition of responsibility for impairment from accounting to the front line. This is the true change in paradigm, and requires the alignment of the traditionally separate divisions of business and finance,” says Jonathan Berryman, risk strategy for Adaptiv risk management and Ambit asset and liability management products for FIS’s institutional and wholesale banking business in London.

Mixed interpretation

At first glance, IFRS 9 may not appear so daunting to implement. Its rule book is a fraction of the length of its predecessor, International Accounting Standard (IAS) 39. “The bad news is that the rule book is very open and reliant on interpretation,” says Misys’s Picut. The prescription and detail of IAS 39 meant projects were similar across banks. Not so with IFRS 9, where banks are interpreting and implementing the rules according to their own business.

In practical terms, IFRS 9 is about managing business events, says Picut. Banks must monitor events, such as prepayments or non-payments, which will trigger a recalculation of the expected loss. Under the old rules, the maximum number of events banks had to capture and monitor on average was 10–15, and they could build a workflow around each. Misys is working with one European bank that has identified around 70 possible events that could trigger recalculations for just one of its lending books.

A fundamental part of meeting the requirements of IFRS 9, as with FRTB and other new regulations, is the gathering, cleaning and managing of the relevant data. “The common point to address these challenges is data. Many banks have minimised the amount of data required in the impairments process because they thought the data was already available in other risk and finance systems. However, IFRS 9 components like the forward-looking estimations of cashflows, collateral value and probability of default – for example – require data for their segmentation criteria and different scenarios, all of which present new challenges to banks,” says de Oliveira Pinto of Moody’s Analytics.

Organisations are finding it difficult to change the processes that calculate credit impairments, including how to carry out the assessment, simulation and deployment of the impairment methodology in a robust, timely and efficient manner

David Ferguson, SAS

The centrality of comprehensive, high-quality data to the risk management process has been recognised by the Basel Committee on Banking Supervision and addressed in its rule 239, Principles for effective risk data aggregation and risk reporting.

The biggest banks were supposed to be in conformance with the principles from the start of 2016, but many still have work to do – medium-sized banks are also wrestling with its layers of change.

“BCBS 239 has been a challenge for our clients for a number of years,” says Berryman of FIS.

The scale of the data challenge was made clear by the participants in this year’s survey, with nearly 50% saying it would take up to two years to raise their data quality and aggregation capabilities to the level required by the regulators, with a further 14% saying it could take up to four years.

The accumulating regulatory and business demands, culminating in the onerous requirements of the FRTB and IFRS 9, are reshaping relationships with banks, say vendors. Although the competition among vendors for contracts remains fierce, once the bank has selected a provider, the discussion is very different from how it was in the past. No longer does it turn primarily on price and delivery date, but is more far-reaching and open-ended.

“Banks realise the transformation they are trying to go through, which is technical, organisational and functional, is not something they can do alone. They don’t have all the necessary elements. They don’t know what is being done elsewhere. They cannot build all the required functionality. They need others who can pick up a significant portion of the load,” says Murex’s Edde.

FIS has been working with clients with large FRTB and other programmes to understand the various technology options for their market risk infrastructure. “Most banks’ infrastructure has grown piecemeal over time and is simply not robust enough to meet the additional demands of FRTB, so they need expert guidance,” says Berryman.

Calypso Technology, which came third overall in the rankings, concurs that today’s engagements go beyond simple technology delivery by the vendor. “We are helping clients who are considering the advanced approach to FRTB assess both the calculation burden and the capital impact, and we are helping them determine the internal structure of their desks so they are aligned with the new regulations,” says Pedro Porfirio, London-based chief product officer for Calypso.

But the vendors also recognise they don’t have all the answers, or the resources – in many cases, they are calling in additional support. Consultancies and systems integrators have always been part of the technology process, the former often engaged in the project scoping and systems selection, the latter carrying out the implementations. The scale and complexity of current projects means the consultancies and integrators are becoming more integral to the whole process.

“When a bank comes to us with a programme to change 30 years of legacy systems and implement an integrated platform – and do it in five years – it is so far-reaching that we need help from specialised integrators who understand our tools and methodologies and who can work with us from end to end in the bank,” says Murex’s Edde.

The same applies to IFRS 9, says Picut of Misys. “When you go into an IFRS 9 project, it has to be on the basis of a true partnership.” Banks must accept the task is likely to stretch beyond the original requirements set out in their request for proposals and the proofs of concept made by vendors. “Inevitably, there will be significant aspects that weren’t anticipated, so the development process must be flexible.”

There must be mutual understanding at the outset that the bank and vendor are embarking on a process of discovery, adjusting their methods and solutions – and will probably have to call on others as well, Picut says: “With IFRS 9 projects, we have learnt there is no way Misys alone can do it. We need a partner – a consulting firm.” To this end, Misys has been developing its relationship with a number of major consultancies.

Shared roadmaps

Given the scope, scale and timeline of the technology transformation projects and the fact that both regulations and banks’ business strategies are either not yet finalised or will inevitably evolve further, vendors cannot possibly offer comprehensive, complete solutions. Instead, banks are demanding that vendors share their development roadmaps – their plans for evolving their applications and underlying technologies – before they commit to long-term relationships. Although neither side has a completely clear picture of the destination, the banks want to know what direction a vendor plans to take, how it will help map out a route and facilitate the journey.

In the case of Calypso, the need to adapt has seen it developing a range of cloud-based microservices – self-contained software components that perform particular tasks and communicate with one another over a network and that can be deployed quickly. The company is currently building microservices for confirmation management – to replace Swift Accord, which is being retired – regulatory capital calculations and collateral management, says Porfirio.

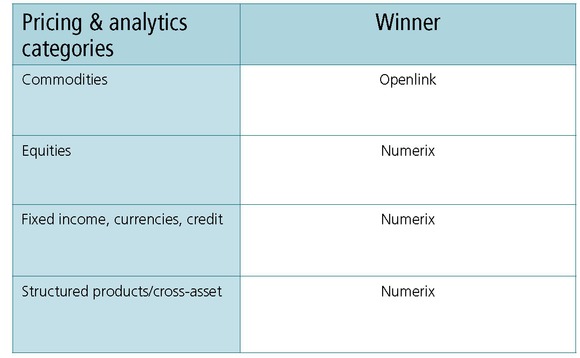

The importance of the alignment of roadmaps between bank and vendor was illustrated in April last year, when the Reserve Bank of New Zealand (RBNZ) announced it had selected Numerix as its “strategic partner for the enterprise transformation of its trade valuation and risk management analytics”. The bank chose Numerix’s Oneview platform not only for its present capabilities, but also because the company’s roadmap for the platform’s future development was consistent with the bank’s own plans.

Current implementation at the bank includes functionality for market standard trade valuation, position and collateral management, and risk and performance reporting, with future phases planned for enhanced liquidity, collateral and trade management, as well as extensive front- to middle-office workflow. “Our vision for Oneview is fully consistent with RBNZ’s strategy, where they sought to transform their business using an analytics platform that supports front-office trading and middle-office risk in a unified way,” says Steven O’Hanlon, chief executive and president of Numerix in New York. Numerix came sixth in the rankings overall.

Pricing

These longer-term and more open-ended engagements with banks are also affecting how vendors price contracts. “You need commercial arrangements to reflect the fact you are not just selling software and then moving on. During the life of the transformation project, the bank and the vendor are intertwined. We have to be able to correlate some of our revenue with the success of the project. It is necessary because some of the projects are so complicated that the bank and vendor must be totally aligned,” says Murex’s Edde.

Misys’s Picut agrees, particularly with reference to IFRS 9 projects: “There can’t be fixed costs. You must have flexibility and transparent discussion from the beginning. It is a journey where both sides will discover things along the way.”

The good news in all this is that while banks have been wrestling with their regulatory and infrastructure demons, developers have been driving technology forwards. Nowadays, IT infrastructure is conceptualised as a stack, with layers of component technologies that interact to perform a given task, from hardware up through operating system, data management, processing engines, applications and user interface.

Vendors point to rapidly advancing technologies at every level of the stack that are bringing significant benefits in scalability, performance, security and reliability. This includes in-memory data handling and non-relational databases, new programming languages and graphics processing units for parallel processing, cloud computing and web-based microservices.

The ability for vendors to exploit these advances is becoming critical to their competitive standing. Like the banks, vendors are having to transform their technology, with those that grasped the nettle earliest now reaping the rewards. “We had to make the difficult technology transition ourselves, so we are able to engage with our clients about how they can evolve their IT ecosystems,” says Jim Jockle, New York-based chief marketing officer with Numerix.

While many in the industry remain buried under the accreting layers of technology change, some see glimmers of light. Flexible, integrated trading and risk platforms, fully compliant with the new regulatory regime could eventually unlock a new wave of innovation, says Jockle. “We see an opportunity for new and innovative products to come back into the market, but in a healthier way because of regulatory enhancements with improved transparency, as well as better documentation, market education and liquidity backstops.”

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Risk management

Independent audits drive compliance in FRTB data solutions

The EU and the Basel Committee have introduced strict audit standards for data vendors to uphold the FRTB rules. With deadlines approaching, audited solutions are critical for banks to ensure compliance, minimise NMRFs and reduce capital requirements

New CME guidance to drive tighter margin call management

Clearing house rule clarified to limit the use of grace periods to cases of admin/operational errors only

Too ’Berg to fail? What October’s Instant Bloomberg outage means for the industry

The ubiquitous communications platform is vital for traders around the globe, especially in fixed income and exotic derivatives. When it fails, the disruption can be great

SEC leadership change puts Treasuries mandate under scrutiny

FICC clearing models approved, but critics think delay could revive prospects of done-away trading

Markets Technology Awards 2025: Untangling the knots

Vendors jockeying for position in this year’s MTAs, as banks and regulators take aim at counterparty blind spots

Risk Awards 2025: The winners

UBS claims top derivatives prize, lifetime award for Don Wilson, JP Morgan wins rates and credit

An AI-first approach to model risk management

Firms must define their AI risk appetite before trying to manage or model it, says Christophe Rougeaux

BofA sets its sights on US synthetic risk transfer market

New trading initiative has already notched at least three transactions