The hidden risks in dormant Basel III bond rule

Thanks to a two-year-old political deal, European banks are protected from losses in their liquidity portfolios – for now. But some in the industry are starting to worry about the risks that will emerge when the filter is removed

A lot of surprises can lurk beneath the placid surface of an economy at rock-bottom rates. One could spring from a currently dormant rule that, for the first time, exposes banks' core capital to changes in the value of their huge liquidity reserves of government bonds.

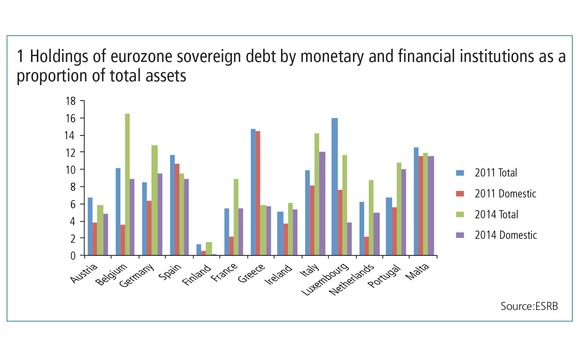

In some of Europe's periphery countries, sovereign bond holdings have grown significantly in recent years; crisis-scale swings in their value would now expose some local banks to losses of more than €1 billion, wiping out 15% or more of their capital at a stroke (see figure 1). Bigger banks face complications too, partly because removing the filter that previously protected capital ratios from unrealised gains and losses on these bonds will overlap with other rules – on liquidity and the hedging of interest rate risk – that are yet to be fully implemented.

"Is it good or bad? It depends," says Gerald Podobnik, Frankfurt-based head of capital solutions at Deutsche Bank. "Nowadays, yields are so low, so most people have gains on their sovereign bond portfolios. The question is what happens in the next crisis? Then it could mean you get another spiral problem and unwanted linkage between banks and sovereign bonds.

"In my view it would not normally be a total game-changer, because there already aren't filters for other assets. However, it's aggravated by liquidity regulations and the fact that, following the crisis, banks have been investing more in sovereign bonds than before."

You need someone who has a lot of funding and who can take a lot of risk and carry the market until it re-normalises. Who else could do it?

The removal of the filter is part of Basel III, which tells banks to count accumulated other comprehensive income (AOCI) when calculating core equity Tier I capital (CET1). The AOCI portion of bank balance sheets is where unrealised gains and losses show up for securities that are designated as available for sale (AFS). Banks often slap the AFS badge on their liquidity buffers. If the portfolios were designated as trading assets, banks would have to recognise their volatility in earnings, while if they were bracketed as held to maturity (HTM), banks would have limited ability to adjust the portfolio: AFS provides the flexibility to manage the portfolio, without fluctuations in value being recorded as profits and losses.

In the past, these unrealised gains and losses were also kept out of equity capital - a useful arrangement that European politicians sought to preserve when transposing Basel III into local regulation. EU member states were allowed to retain the filter for a limited period of time and only Greece, Sweden and the UK are known to have turned down that option. For the rest, the filter will have to be removed when International Financial Reporting Standard 9 comes into force, which was originally expected to be 2015, but is now likely to be 2018 at the earliest.

For banks that don't apply the filter, and for the rest of the AFS portfolio, the inclusion of unrealised gains and losses is implemented through a phase-in laid out in Europe's Capital Requirements Regulation (CRR), which in 2014 requires 100% of unrealised gains to be excluded from CET1, and between 20% and 100% of losses to be included. From 2015, 60% of gains are excluded; then inclusion of losses is increased and exclusion of gains decreased by 20% per year through to 2017. Or banks can choose to remove filters completely from 2015, subjecting capital to 100% of unrealised gains and losses in the AFS portfolio.

Though it's hard to imagine rates rising in Europe now, it becomes far more likely by the time the filter is axed. At that point, the value of AFS bonds would take a hit, and so – absent the filter – would CET1. Initially at least, banks say this is not likely to be a big deal, citing the shorter tenor of a large portion of government bonds taken on in the post-crisis years: these will soon roll off, and the value of shorter-dated bonds is also less sensitive to interest rate movements.

Everything changes, though, in a period of stress.

"In a crisis with a lot of volatility, where the solvency of sovereigns is in question, the removal of the filter means it won't be the commercial banks stepping in any more," says the head of trading desk strategy for a large US bank. "The European Central Bank, through quantitative easing, will have to play the stabilising role that used to be done by commercial banks. That is a second-best outcome, and it may take them two or three months to get there while in the meantime the functioning of the government bond market suffers."

"You need someone who has a lot of funding and who can take a lot of risk and carry the market until it re-normalises. Who else could do it? The insurance companies, hedge funds, asset managers – none of them have the mandate, the stable funding or the mark-to-market accounting to perform that role," he adds.

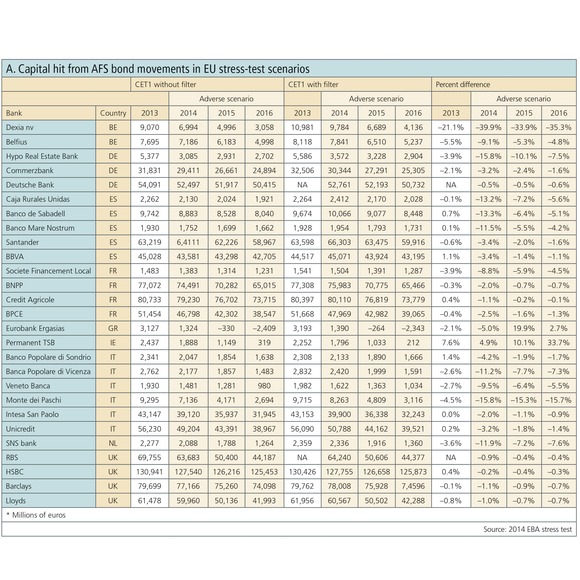

The EU stress test administered last October by the European Banking Authority (EBA) can illustrate the potential consequences. In the test's adverse scenario, US long-term government bond yields jump by 100 basis points in the first year and 250bp in the second. This is followed by a rise in European rates, ranging from 137bp in Germany to 380bp in Greece.

The EBA methodology applies the CRR's phase-in of filter removal, but if the phase-in is excluded, then the rate rises have a big impact on core capital for some banks. For example, in 2014, with a shock to long-term rates of 205bp in Italy, Monte dei Paschi loses €1.2 billion, or 16%, from its CET1 capital (see table A). The bank was given these numbers to review, but declined to comment.

Spain's Banco Sabadell also takes a hit of around €1.2 billion, or around 13% of its capital with a rate shock of 191bp. Belgian bank Dexia is worst off, with a €2.8 billion drop that brings CET1 capital down by 40% on the back of a 142bp shock.

"The strict treatment applied to sovereign exposures significantly impacts Dexia, as measured by various financial indicators, given the share of sovereign securities in its portfolio," says a Dexia spokesperson. "The deduction of the AFS reserve linked to sovereign securities is disadvantageous to the group, as it does not reflect the actual benefit of measures granted by supervisory authorities." The spokesperson adds that with the full filter the bank had a CET1 ratio of 7.49% in year 2016 of the adverse scenario.

A spokesperson for Banco Sabadell says the impact on the bank is larger because other institutions cut the size of their portfolios in order to perform better in the stress tests.

So far, the retention of the filter has arguably been a hollow victory for European banks. In the prevailing flat, low-rate environment, annual reports for 2014 show the industry missed out on billions in unrealised gains that would have accrued to their capital – ranging from 1% to as high as 11% of total CET1.

From a philosophical point of view, bankers say the removal of the filter is part of a package of measures designed to break the mutually destructive ties that formed between European banks and sovereigns during the debt crisis, and also to stop banks using AFS as a general-purpose bond warehouse.

"The idea is to get people to be conscious of the feedback loop between banks and sovereigns," says a senior treasury source at an Irish bank. "It's also about stopping banks from having bigger than necessary bond portfolios in AFS, rather than in the mark-to-market environment. If you have current accounts at zero, you might have investments against those to manage the margin of the bank. But regulators want banks to be explicit about what these bonds are for. They want institutions to show explicitly where they are hedging non-interest liabilities, and where they are using the AFS portfolio in a less transparent way to take risk positions."

Response

So, how are banks likely to respond?

In the US, the repeal of the filter only applies to banks with more than $250 billion in assets. But, already, numbers seem to point to a move of AFS assets into HTM, with some banks acknowledging it is an attempt to insulate their capital ratios from bond volatility.

Among European countries that have also ditched the filter, there is no clear trend. For Greek banks, HTM portfolios are not obviously growing when compared to AFS. Holdings of sovereign bonds, particularly Greek bonds, have shrunk.

"For Greek banks after the Private Sector Involvement [PSI] programme, it's a different story than other jurisdictions," says an investor relations representative at a Greek bank. The PSI programme, part of Greece's debt restructuring deal in 2012, called for private investors to write off more than half the face value of their Greek government bonds.

"It had a devastating effect, so the desire to load up on sovereign bonds has been quite small. Since then, we have almost eliminated our exposure to Greek bonds. The exposure we have is very short term and close to maturity," he adds.

In Sweden, the impact of the sovereign bond filter removal is even less evident, which one senior vice-president in global risk advisory at a Nordic bank says is because holdings of sovereign bonds are small in Nordic banks, as liquidity buffers are met largely with covered bonds.

In the UK in 2014, HSBC reclassified £11 billion in debt securities from AFS to HTM, while RBS reclassified £3.6 billion.

"It's added a layer of complexity to the management of capital and liquidity," says the head of capital management at a large UK bank. "Our knee-jerk reaction to this was to seek to understand far better the new capital dynamics of our main AFS, which we primarily use for liquidity management. You think about holding some of your liquidity portfolio in held-to-maturity books instead. Or, for those parts you can't hedge using cashflow hedges, even possibly the trading book.

"We've sought to assess the risk under different stress scenarios and set limits on our appetite for movements, because ultimately we are not going to hedge the capital position much, because it's not always possible to put into place a precise accounting hedge."

This kind of analysis is set to become more complicated. Sovereign bonds are at the nexus of a number of post-crisis regulations, which create conflicting incentives in some cases. While regulators are increasingly wary of the risks of large holdings and concentrations of sovereign bonds, liquidity requirements encourage it.

There could also be conflict between the removal of the filter and regulations being drafted around interest rate risk in the banking book (IRRBB). In one plausible scenario, regulators may cap the duration of deposits at a level shorter than the sovereign bonds banks are holding for hedging purposes; conversely, banks may opt to hold bonds that are shorter-dated than their deposits in order to reduce AFS volatility. Both would invite capital penalties.

Shifting a large part of the AFS portfolio to HTM may seem an easy way out, but held-to-maturity securities are supposed to be just that: in theory, the portfolio would be frozen until the bank suffered a liquidity squeeze. An alternative is to place more liquidity holdings in central bank reserve accounts, a trend some say is already occurring in the UK.

But in the long run, bankers say the most likely outcomes are greater demand for higher-quality government bonds, the use of more derivatives, and a shortening of tenors.

Movement to short tenors

Although the trading desk head says he hasn't yet seen a marked strategic shift to shorter tenors, he is expecting it as a direct consequence of filter removal. Others agree. "The removal of the filter and increasing price volatility are working in unison to encourage shorter tenors," says the Irish bank treasury source. "At the moment I can invest in 10 years at 0.5% or five years at 0.2%, but the price volatility over 10 years is much greater. So I'm happier to invest three-to-five years – I don't feel I'm being rewarded enough for the volatility with that extra 20bp or 30bp going down the curve."

For bank treasurers in Switzerland, the issue is not new. The country's prudential regulator has long required unrealised losses to be counted in CET1, while gains cannot be included.

"We don't necessarily limit the size of our AFS portfolio per se, but we do have internal limits on unrealised losses on AFS securities, because that's a direct hit to capital. That indirectly limits the size and tenor of portfolios, as if you have quite short tenor you can afford to have a bigger volume in general," says Bruce McLean-Forrest, Zurich-based head of banking book treasury risk control at UBS. "If you get close to the limit, then the decision would be potentially to sell securities and realise a certain amount of losses, and replenish them with new par securities."

Derivatives stand to benefit because banks can offset the interest rate risk on their holdings of AFS government bonds using swaps. The hedging of IRRBB may also be done increasingly with swaps rather than more government bonds.

"It will make bonds less suitable as a hedge instrument, and make derivatives on the other hand maybe a bit more competitive," says a capital strategy expert at a European bank. "Right now, when you use these bonds as a hedge, it is nearly free of charge because you get a 0% risk weight, while if you use a derivative you have risk-weighted assets attached, which is costly and impacts the leverage ratio."

But hedging those sovereign bonds held as a mitigant for interest rate risk is not as easy.

"Securities held for liquidity purposes can be hedged against interest rate risk with a mark-to-market instrument that goes through profit and loss, so you get an immediate, upfront offset to compensate for the hit on your AFS and capital. If you are hedging interest rate risk in the banking book, though, you would be gaining on the underlying, but it would be a slow accrual gain over time. You would get compensated in your capital base, but it just wouldn't be immediate," says UBS's McLean-Forrest

And using more derivatives comes at a cost. Not only are swaps more expensive, their spread risk hits banks' so-called Pillar II capital, which is a buffer bilaterally agreed with national regulators meant to capture risks left over from Pillar I. In the UK, those left-over exposures are supposed to be captured during the internal capital adequacy assessment process (Icaap).

"It's easy to hedge the interest rate risk with a swap, but you can't really hedge the spread risk, so that component of pricing is something banks in the UK now need to model as part of their Icaap. That's probably the most substantial thing that has happened in a jurisdiction where a filter is reversed – you have to think of impact on your Icaap and capital assessment," says Ian Tyler, London-based head of financial institutions treasury advisory at consulting firm Deloitte.

Stable bonds

Banks will also likely switch to holding government bonds from more stable sovereigns such as Germany. While that might seem like a feather in the cap of regulators trying to cut the ties between sovereigns and their domestic banks, it sparks questions that are just as political.

"It will just reinforce the flight to quality again," says Deutsche Bank's Podobnik. "You already see banks holding a lot of bunds or Treasuries as their LCR measure, and the question is, what do those banks do in peripherals where the sovereign is still very much dependent on the banks to hold their debt? If we completely break the links that encourage banks to hold too much sovereign debt, for example, by addressing the zero risk weights, all of this could work. But so far we have not seen specific proposals by global regulators on how the future environment should look."

This raises a debate around what is more dangerous: high concentrations of domestic sovereign bond holdings, or the inability of sovereigns to bolster funding in times of stress?

"I'm not sure what the risk/reward is in doing this, but I'm pretty sure I understand what you're losing," says the US bank head of trading strategy. "A capital charge on government bonds is never going to be high enough that you have a real disconnect between sovereigns and commercial banks. So putting a bit of capital against a government bond portfolio is not going to shield the banks in a serious sovereign crisis. But it will most likely stop commercial banks from stepping in and controlling market shocks that could otherwise spiral out of control."

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Risk management

EU racing to comply with active account rules

Industry wants simpler route to exemptions ahead of ‘challenging’ deadline for new clearing regime

Banks urged to track vendor AI use, before it’s too late

Veteran third-party risk manager says contract terms and exit plans are crucial safeguards

JSCC plans to open JGB clearing to foreign investors

Clearing house aims to boost cleared market liquidity in Japanese government bonds

Large banks safer for CCPs than they get credit for

Plentiful pre-positioned liquidity softens the blow of resolution, new research argues

JP Morgan, Eurex push for DLT-driven collateral management

The high-stakes project could be a litmus test for the use of blockchain technology in the capital markets

Start planning for post-quantum risks now

Next-gen quantum computers will require all financial firms to replace the cryptography that underpins cyber defences, writes fintech expert

US Treasury clearing mandate poses riddle for Asian markets

Participants unclear on how far the rules will reach, or the role of inter-affiliate exemptions

Looming US Basel endgame redraft sparks calls to save IRB

Experts say 20 years of data makes credit risk models more appropriate than standardised approach