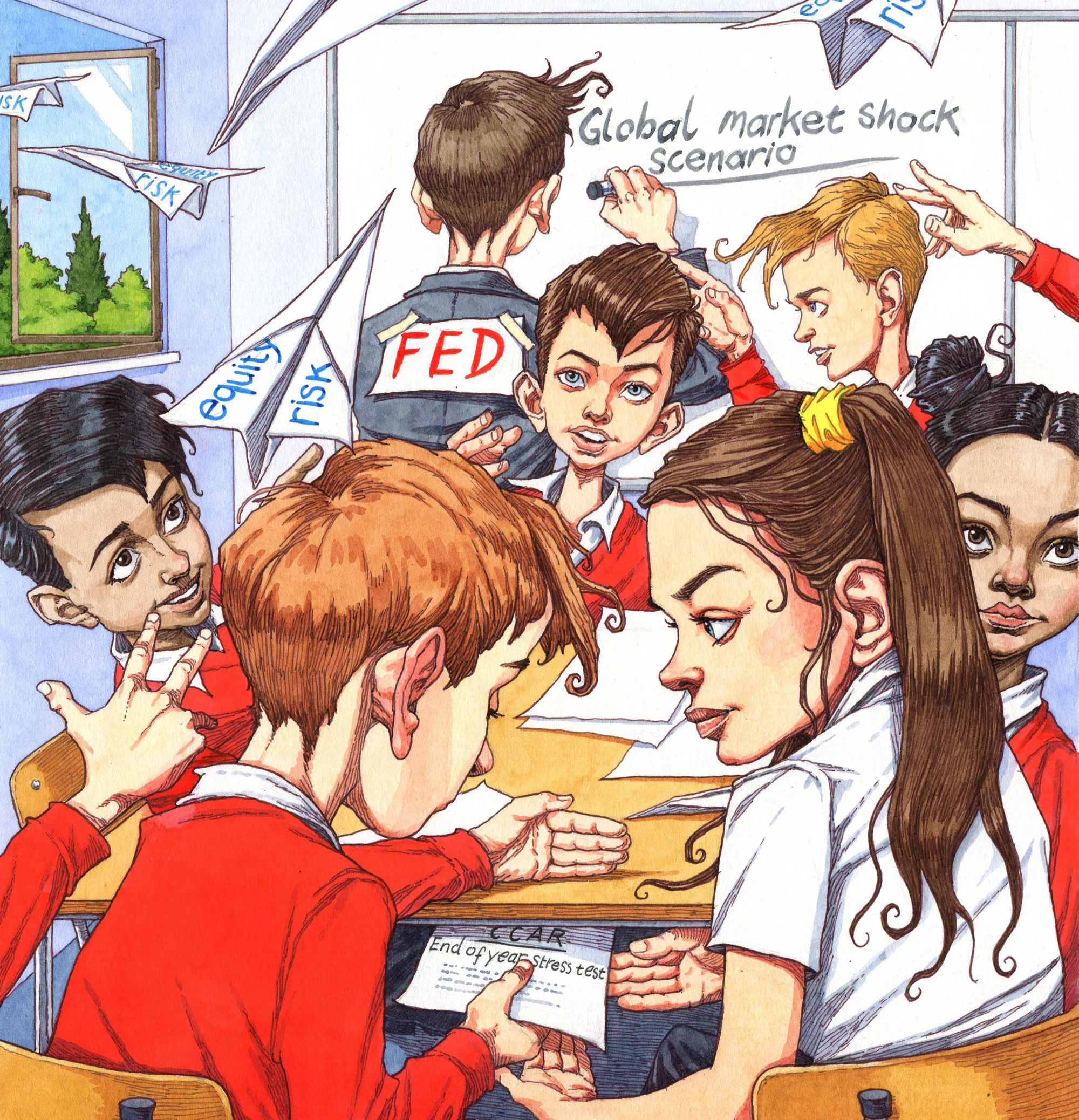

How banks game stress tests: the ‘shocking’ truth

Leaked memo exposes effort to swap out risky assets despite Fed’s push to end “window dressing”

It seemed innocuous enough. A large US bank approaches a European dealer proposing to swap equities for bonds on a triparty basis, in an arrangement it describes as an “upgrade trade”.

Later discussions, detailed in a memo dated May 2018, show the underlying purpose of the trade: to help the US bank with “liquidity needs during stress test periods”. In other words, the bank wanted to massage its trading book in the lead-up to the US Federal Reserve’s annual stress test by temporarily offloading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Regulation

CFTC aims to settle ‘hundreds’ of enforcement cases within 30 days

Remediation initiative accompanies new effort to slash penalties for technical violations

Gilt repo clearing mandate on Bank of England’s radar

Sources say regulator mulling benefits of US-inspired regime, but is non-committal

Delving into the European Commission’s proposed overhaul of FRTB

Raft of potential changes would benefit both IMA and SA banks – but only temporarily

Why the survival of internal models is vital for financial stability

Risk quants say stampede to standardised approaches heightens herding and systemic risks

Crypto custody a bit(coin) closer after US accounting U-turn

Federal banking supervisors expected to eventually relax regimes for safeguarding digital assets

Japan’s regulator stands firm behind Basel as peers buckle

Japanese banks fear being at a disadvantage to rivals as Basel III implementation falters

EU racing to comply with active account rules

Industry wants simpler route to exemptions ahead of ‘challenging’ deadline for new clearing regime

CFTC acting chair: ‘We don’t need a Dodd-Frank for crypto’

US regulator wants real-time market surveillance; focuses on rise of liquidity risk