This article was paid for by a contributing third party.More Information.

Using alternative data to spot ESG risks

- Despite growth in environmental, social and governance (ESG) disclosures, investors still often lack sufficient indicators of financially relevant ESG risks. Alternative data sources can help fill the disclosure gap.

- Overlaying alternative data sets such as flood maps with our MSCI ESG Ratings model can bring new insights to potential future event risks.

- This approach helped MSCI identify China as having one of the highest risk profiles for tailings dam risks.

The amount of ESG-related information disclosed by corporations is on the rise, but investors often still lack a full understanding of financially relevant ESG risks. How can they gain a better sense of where their investments are most vulnerable to ESG-related disasters?

In January 2019, the collapse of the tailings dam at mining giant Vale’s Córrego do Feijão mine in Brazil killed 270 people. In the aftermath of the deaths, the chief executive officer resigned and the company reported the worst quarter in its financial history, recognising almost $5 billion in charges from related liabilities and risks and costs that may continue to escalate. Prior to the incident, Vale – like most mining companies in the world – provided only limited data on the tailings facilities it managed, and had stated in its most recent sustainability report that, at the end of 2017, 100% of its audited tailings structures “were certified to be in stable condition, physically and hydraulically.” This disclosure gave investors little indication that Vale faced such major risks, even though Vale had suffered a devastating and costly tailings incident in November 2015.

Company-provided data, taken at face value, may not reveal the greatest risks that companies face – and may even mask them, diminishing the value investors receive from integrating ESG considerations into their portfolios. How can investors identify both company- and issue-specific risks across the globe when company disclosure is insufficient? One answer is to integrate alternative data sources that help fill the informational gaps and use advanced analytical techniques to develop stronger indicators of risk.

Satellite-derived imaging renders better understanding

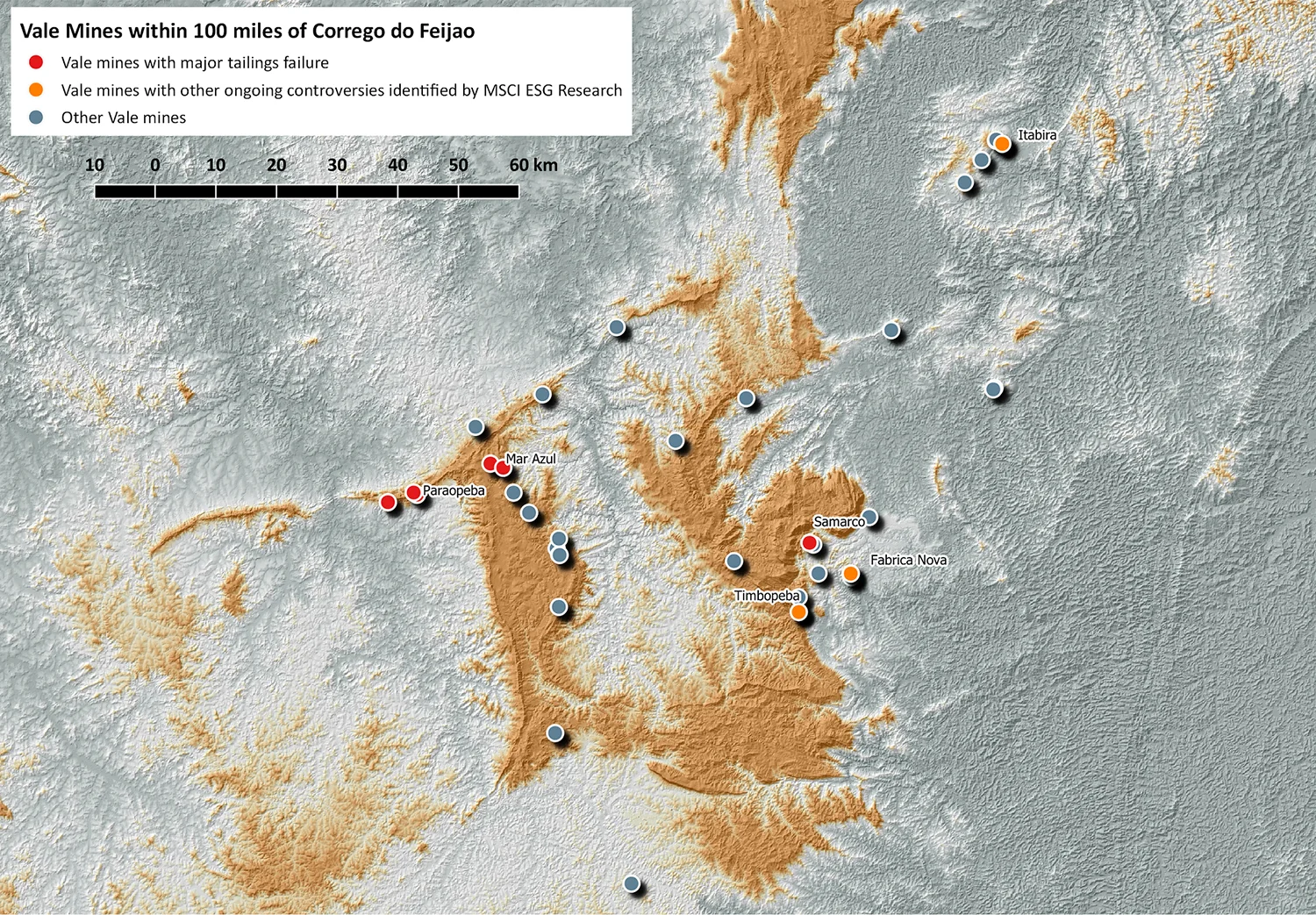

In Vale’s instance, we employed geospatial analysis and satellite-derived imagery to identify repercussions and potential hotspots. Immediately, we could see not only that Córrego do Feijão and Samarco (the sites of the past two tailings dam collapses) were very close together, but that one-third of Vale’s 2017 production value was located within a 100-mile radius, and thus likely shared similar characteristics and risk factors.

Layering risk factors, looking for patterns

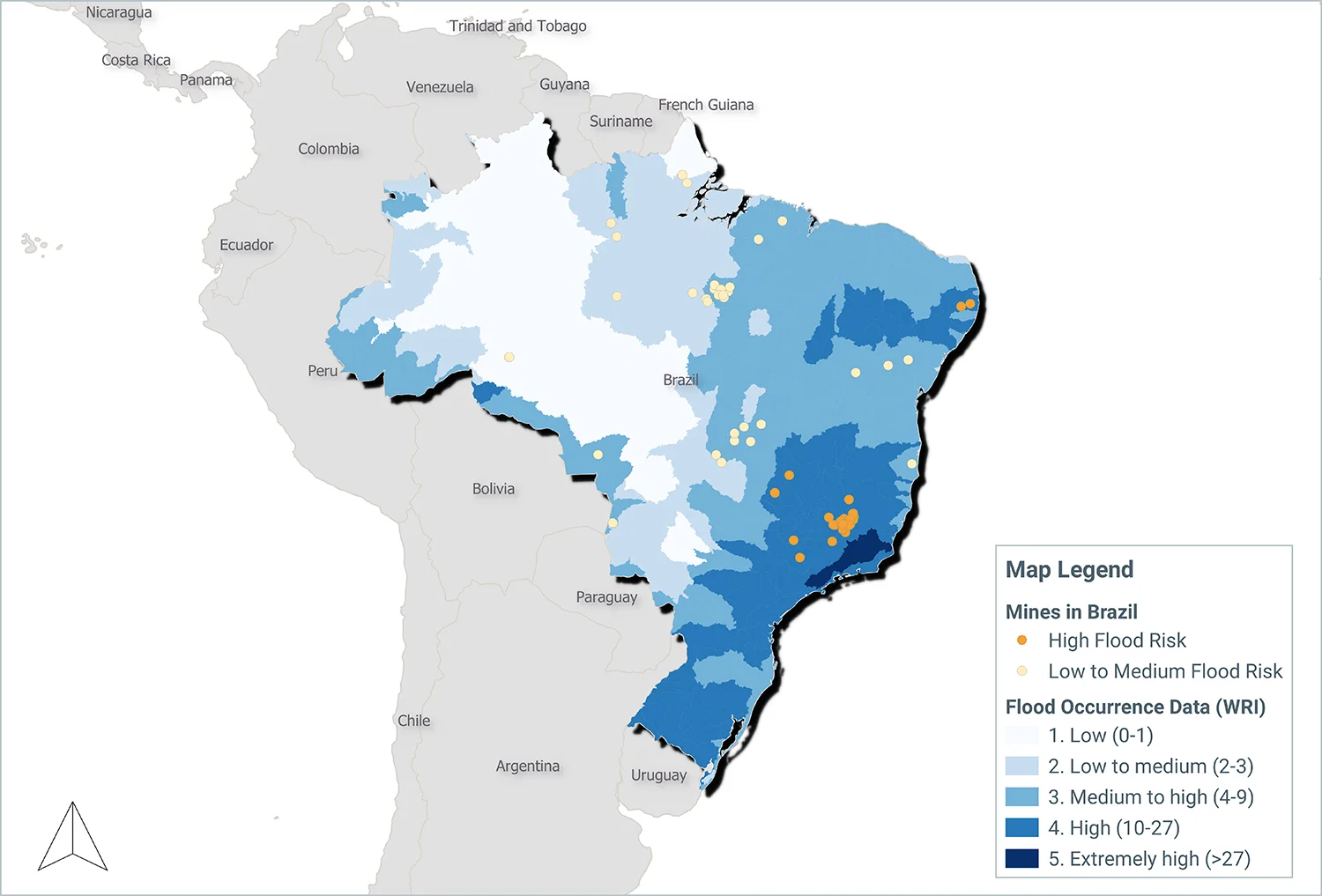

Two risk factors account for about 80% of all dam failures: ‘overtopping’, or floods that exceed outflow capacity, such as after too much rain; and quality problems or defects that reflect failures of oversight and risk management. We suspect both weather and weak governance may have played a role at the Córrego do Feijão incident,1 but neither problem is limited to Brazil.

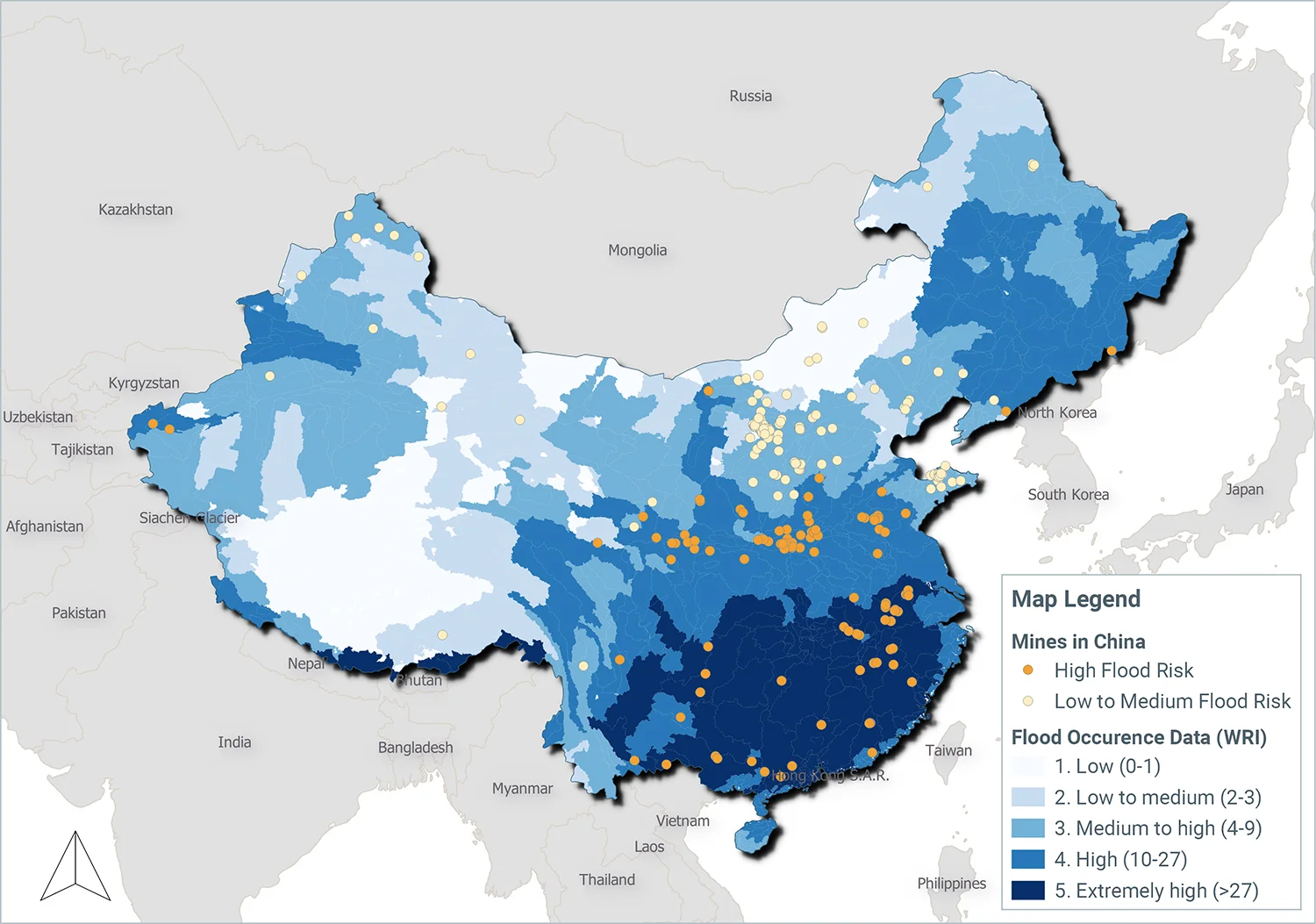

We mapped all the mines owned by a constituent of the MSCI ACWI Index globally2 and then layered on geographic data on flood risks and tailings volume, and our own assessments of companies’ environmental and governance risk management.

We found that China had almost as many mines (owned by MSCI ACWI Index constituents) in flood-prone areas as Brazil, and that many of them were operated by companies with poor governance and environmental risk management systems – indicating that investors might want to give these companies and these mines a closer look.

Using unconventional methods and alternative data sources to understand ESG risks is not limited to tailings dams. We use alternative data sources such as regulatory emissions data to inform us of where company assets are located or how pollutant-intensive their business lines are. We can also use regional statistics such as safety rates or wildfire frequency to help us measure companies’ exposure to these risks. In fact, we estimate that only about 35% of the data inputs in our MSCI ESG Ratings model are derived from voluntary ESG disclosures.

Company disclosure is often missing key information that investors may look for to understand financially relevant ESG risks. This may be particularly relevant in emerging markets, where ESG risks may be higher but ESG transparency is often lower than the level of disclosure to which investors in developed markets are accustomed.

Related reading

Notes

1. While there was no single extreme weather event preceding the dam collapse, in nearby Brumadinho, the average rainfall in January 2019 was in the 13th percentile of the previous 10 years, and that month was preceded by the three months with the highest average rainfall since January 2009, according to World Weather Online.

2. A total of 2,554 mines as of February 5, 2019.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net