Asian banks plead for extra time on Basel credit risk reforms

Switching to the standardised approach for credit modelling could have an impact on their legacy books

New constraints on the way banks are allowed to model credit risk for both the banking book and derivatives counterparties could have a significant impact in Asia if they are brought in too soon, warn senior treasury managers.

Proposals from the Basel Committee on Banking Supervision on March 24 seek to limit the use of the internal ratings-based (IRB) approach for modelling exposures where a lack of data means the probability of default cannot be estimated easily. Thus exposures to financial institutions and very large corporates – those with total group assets in excess of 50 billion euros – will be forced on to the standardised approach.

"Asian banks' exposures to financial institutions are not small and the capital impact is quite significant, especially in the areas of bank risk trade finance," says Frankie Phua, head of credit and country risk management at United Overseas Bank (UOB) in Singapore.

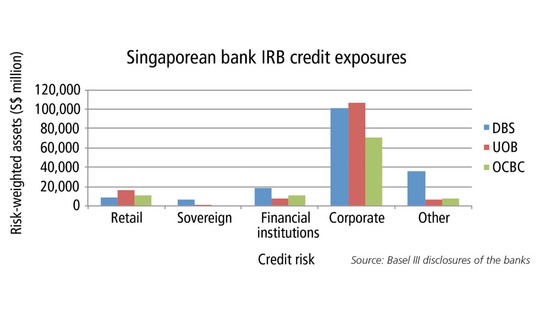

While Asian banks do not tend to have high exposures to very large corporates, their exposure to financial institutions can be significant. For example, financial institutions account for 10.65% of the credit risk-weighted assets that DBS, Singapore's largest bank, models under the foundation IRB approach, according to the latest Basel III disclosures (see graph), and 11.11% at OCBC. Exposure at the other large Singaporean bank, UOB, is lower, at 5.18%, but this is still significant.

"The global financial crisis has shown banks can and do fail and... with [Basel's] intent to decouple the link between sovereigns and banks, the inherent default risk for banks has changed," says Phua.

Trade finance and letters of credit are a big source of exposure to financial institutions in Asia, Phua suggests. He concludes it is probably too early to assess the exact impact of moving all of the bank's financial institution exposures to the standardised approach, since this will depend on exactly how the standardised risk weights are calibrated.

"This is something we still need to engage with the Basel Committee about," Phua says.

Nonetheless, Wolfram Hedrich, Singapore-based partner at consultancy firm Oliver Wyman, says banks should prepare for a significant increase in capital costs as they are forced off the IRB approach.

The impact of moving to the standardised approach depends on the level of conservatism already built into the calibration of existing IRB models and the composition of the portfolio

Wolfram Hedrich, Oliver Wyman

"The impact of moving to the standardised approach really depends on the level of conservatism that is already built into the calibration of existing IRB models and the composition of the portfolio in question," he says.

"Most banks originally achieved lower risk-weighted assets from moving to IRB, and therefore are at risk of a reversal now. However, there is still a lot of uncertainty about the final rules at this point, so it is hard to generalise the impact. We strongly recommend each bank to do a detailed impact assessment and keep it updated as proposed rules develop," Hedrich adds.

Calculating CCR

A second aspect of the March 24 paper that could be significant is the proposed change to how banks calculate derivatives counterparty credit risk (CCR). The Basel Committee mooted imposing a floor for internal model outputs, set at between 60% and 90% of the standardised approach to CCR. Many Asian banks already use the standardised approach, but some, such as DBS and the major Australian banks, use internal models.

One senior manager in the treasury department of a global bank, which has been doing several novation trades with regional Asian banks to take some of their counterparty credit exposure off their books, says the length of the transition period is key: "If this is three to five years, I don't think the impact will be huge, because all of the financial institutions should by then be margined and the legacy portfolio will have largely run off. But if the rules come in earlier, the impact could be massive."

Credit support annexes (CSAs) can help to lower standardised credit risk weights by allowing derivatives exposures and collateral to be netted off against one another. But while these are now signed almost automatically for new business, some legacy trades still do not have them.

"Not all of these legacy deals can be renegotiated. Some of them have been wrong trades, done simply from a relationship perspective or an overall returns perspective. People have done these transactions for the spot regulation and not thought about what happens in the next three to five years – and now they are having to," says the treasury manager.

Some might have a massive 20-year tail of uncollateralised project finance or some horrible deals like that, which could be very destructive

Treasury manager

The treasury manager says this is why many banks in the region are opting to simply wait for their legacy portfolio to run down. But the expected implementation date of these Basel reforms – January 2019 – might not give some banks enough time.

"This very much depends on the shape of banks' portfolios," says the treasury manager. "For some banks, the average weighted duration of a derivatives portfolio might be three to five years, but some might also have a massive 20-year tail of uncollateralised project finance or some horrible deals like that, which could be very destructive."

Not all banks are simply letting their legacy books run off though. Mindful of the looming change to the counterparty credit-risk framework and other developments in Basel, some are moving to renegotiate their International Swaps and Derivatives Association master agreements to incorporate CSAs.

One bank is looking at renegotiating more than 500 such deals. "This is not a small task for my legal department, particularly when [some Asian banks] don't like CSAs," says a treasury manager at the firm.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Regulation

EU trade repository matching disrupted by Emir overhaul

Some say problem affecting derivatives reporting has been resolved, but others find it persists

Barclays and HSBC opt for FRTB IMA

However, UK pair unlikely to chase approval in time for Basel III go-live in January 2026

Foreign banks want level playing field in US Basel III redraft

IHCs say capital charges for op risk and inter-affiliate trades out of line with US-based peers

CFTC’s Mersinger wants new rules for vertical silos

Republican commissioner shares Democrats’ concerns about combined FCMs and clearing houses

Adapting FRTB strategies across Apac markets

As Apac banks face FRTB deadlines, MSCI explores the insights from early adopters that can help them align with requirements

Republican SEC may focus on fixed income – Peirce

Commissioner also wants a revival of finders’ exemption, more guidance for UST clearing

Streamlining shareholding disclosure compliance

Shareholding disclosure compliance is increasingly complex due to a global patchwork of regulations and the challenge of managing vast amounts of data

Banks take aim at Gruenberg’s brokered deposit rule

Regulatory lawyers question need to reverse 2020 rulemaking just four years later