Banks explore spin-offs for cleared swaps desks

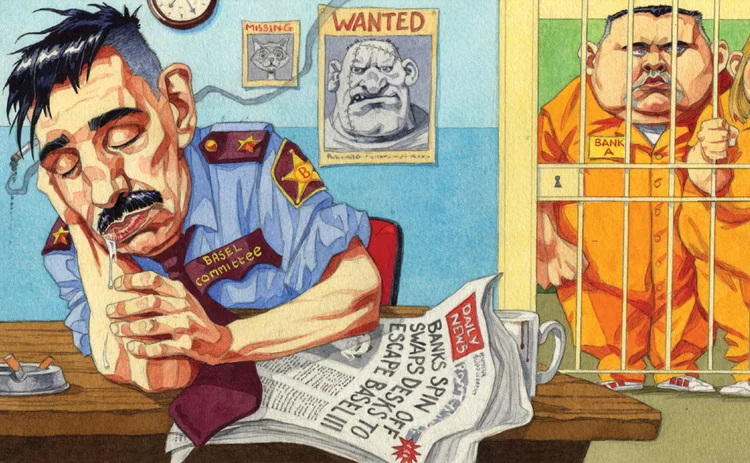

Banks are quietly exploring the sale of cleared swap desks to private equity firms in order to cut the amount of capital the business consumes and help it compete with aggressive new entrants like Citadel Securities. The question is whether regulators will allow it

Large derivatives dealers in the US and Europe are exploring the spin-off of their cleared swaps desks, in a move that could slash the capital they consume – by more than a half, according to one estimate – and help them go toe-to-toe with aggressive new entrants such as Citadel Securities.

Lawyers are now quietly helping the banks sketch out the terms of a divestment, answering questions about how big a stake the current owners could retain – US law sets the maximum at 24.9% – and how the

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Regulation

Endgame manoeuvre: US banks put SLR reform back in spotlight

Plan to ease Basel III brings renewed focus to impact of leverage ratio on US Treasury market

More disclosure touted to temper pre-hedging ills

Transparency could help investors choose a dealer, but will they use the disclosures?

Regulators want to fix AT1s. Investors want restraint

Tweaking the instrument that regulators love to hate may be the only way to prevent its abolition

Fed’s Basel III rollback gives clearing units a capital break

Client-cleared trades will be exempt from CVA charges and G-Sib surcharge calculations, says Barr

DTCC ‘will prevail’ in UST clearing, says CME’s Duffy

CME boss says LCH-FMX cross-margining deal could face obstacles, and acknowledges difficulties at BrokerTec

The standoff over separate account margining

CFTC issues sixth extension of no-action relief as long-awaited final rule stalls

Banks fret over vendor contracts as Dora deadline looms

Thousands of vendor contracts will need repapering to comply with EU’s new digital resilience rules

EU banks lose relief on model test after FRTB delay

Deferment of new trading book regime to January 2025 eats into transition period for “erratic” P&L attribution test