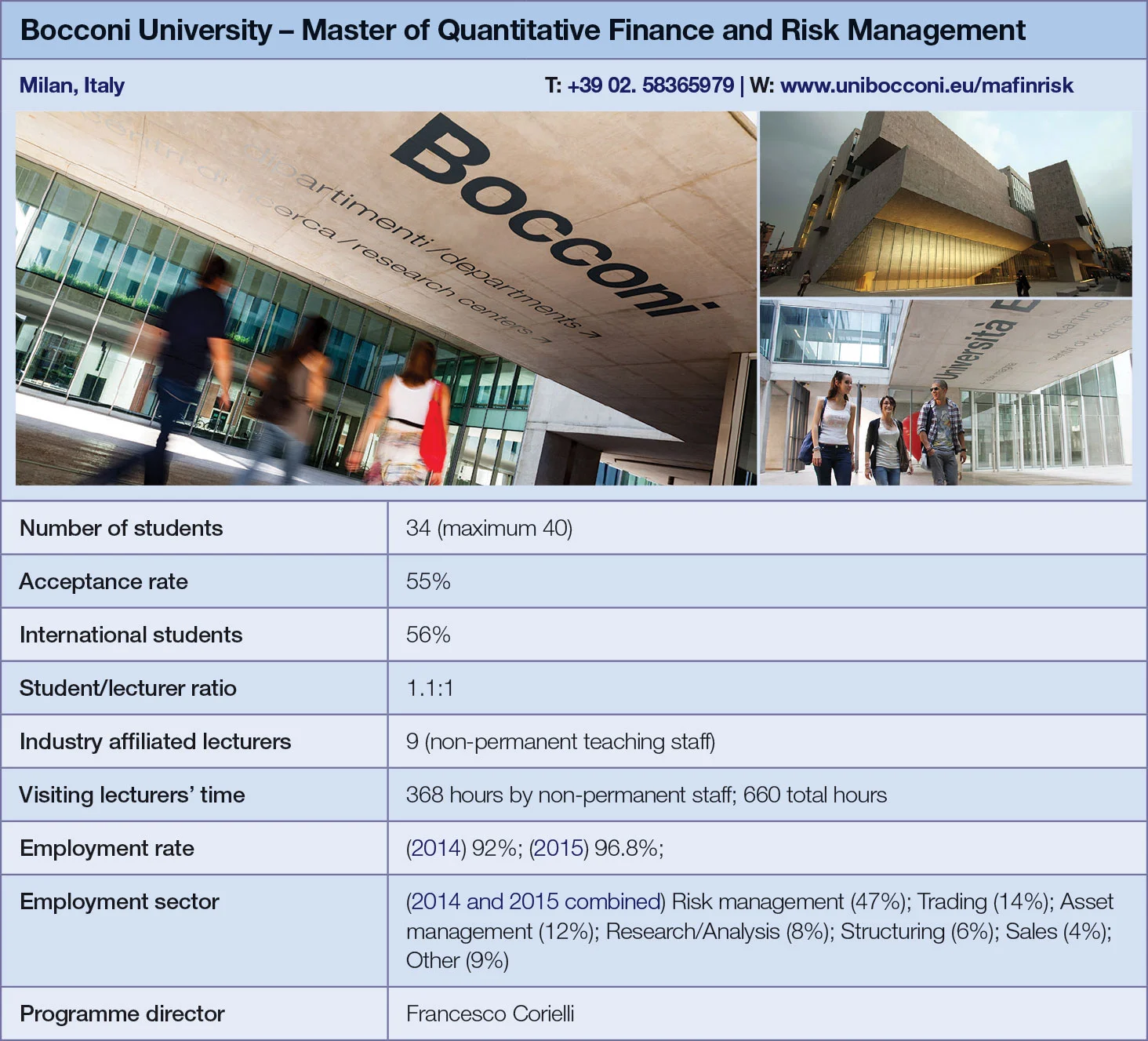

Quant Guide 2017: Bocconi University

Milan, Italy

Master of Quantitative Finance and Risk Management | metrics table at end of article

Students on this English-language master’s at Bocconi University can learn directly from senior professionals at some of the world’s best-known banks. Teaching staff in the 2016–17 academic year included: Fabrizio Anfuso, who leads collateral modelling at Credit Suisse; Pietro Virgili, head of risk analysis and pricing models at Intesa Sanpaolo; Andrea Fabbri, in charge of Italian institutional clients in the capital markets business at BNP Paribas; and a well-known figure in quantitative finance, Massimo Morini, who heads up interest rate and credit models at Banca IMI.

Practitioners mostly teach optional modules; students pick six from a list of about 10 courses – for example, derivatives credit risk management, term structure modelling, and market and counterparty risk management. Twelve mandatory courses are taught mainly by academics and include econometrics, stochastic calculus and time series analysis. From next academic year, R, a programming language, will feature more prominently in the econometrics module.

At the end of the 10-month programme – also known as Mafinrisk – students write a short thesis. If, as is often the case, the student is doing an internship or has already been hired, the thesis should summarise the main features of the placement or the job, exploring in particular the links with what was learnt on the programme.

Alternatively, the thesis can expand on a topic covered during the programme. “This is usually a very focused applied work whose aim is to implement as realistically as possible some of the tools developed during the master’s,” says programme director Francesco Corielli.

In addition to industry practitioners, current teaching staff on the master’s includes Marcello Minenna from Italy’s markets regulator Consob, and lecturers from other universities. Applicants to the programme require the equivalent of a bachelor’s degree in economics, finance, business or management or a quantitative subject such as mathematics, statistics, physics or engineering.

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director

Quant Finance Master’s Guide 2022

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Princeton, Baruch and Berkeley top for quant master’s degrees

Eight of 10 leading schools for quantitative finance programmes are based in US, latest rankings show

Quant grad conveyor belt stalls as banks retrench

Jobs market is long quant graduates, short vacancies – but hiring freeze shows signs of thawing

Quant Finance Master’s Guide 2021

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked