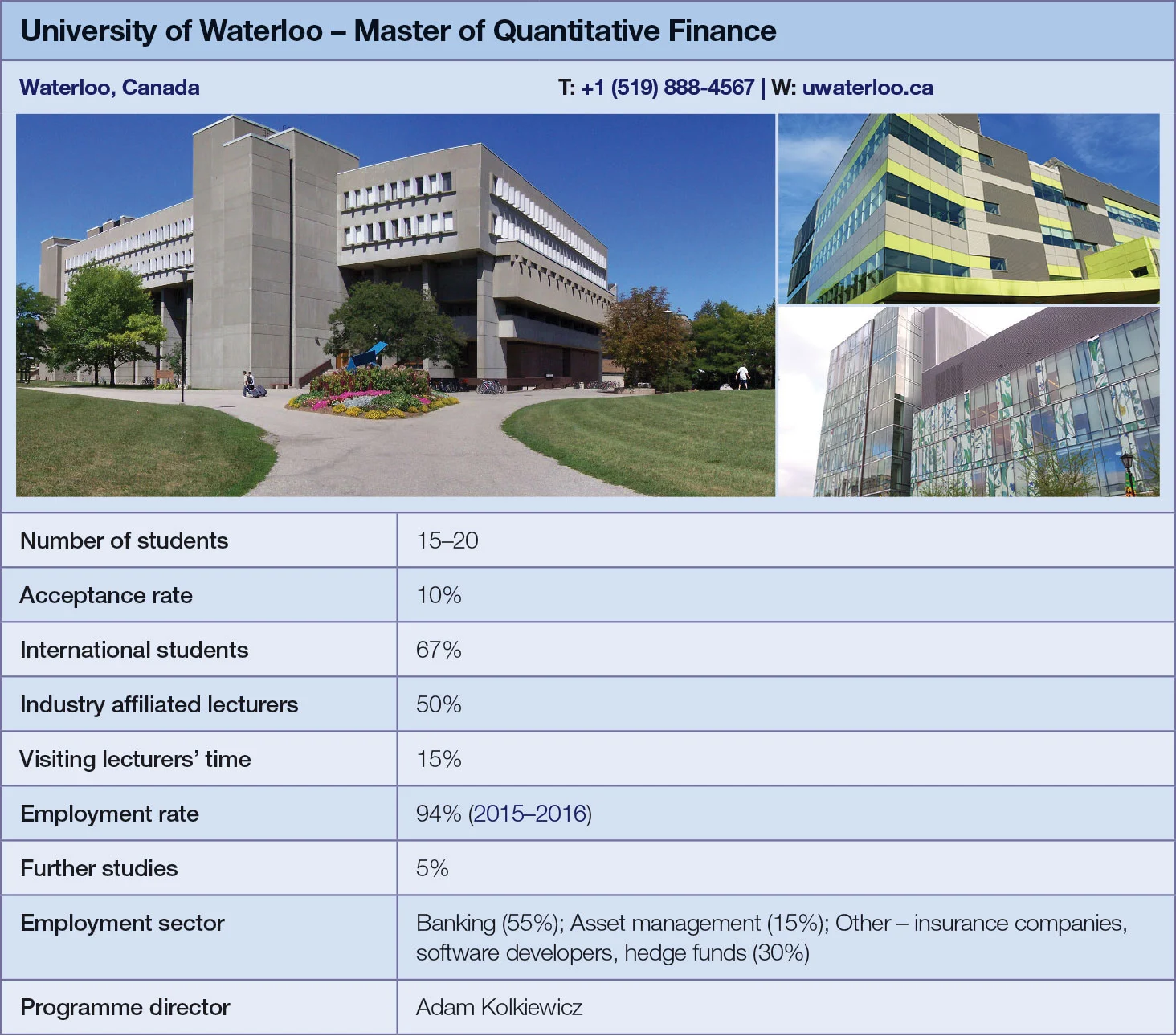

Quant Guide 2017: University of Waterloo

Waterloo, Canada

Master of Quantitative Finance | metrics table at end of article

Waterloo offers a technically rigorous and research-oriented programme that aspiring quants can use as a launch pad to further studies in the field. Launched in 1995 by renowned researcher Phelim Boyle, a pioneer of Monte Carlo methods in options pricing, the 16-month-long degree is highly selective – typically admitting just 15 to 20 students a year.

Students choose a thesis or non-thesis option on enrolment: the former is tailored to those interested in pursuing a PhD and includes six taught courses, whereas the latter emulates the structure of a typical master’s, including eight required courses, one elective and an independent research paper.

The admissions requirements reflect the technically demanding nature of the programme. Prospective students must pass both an entrance exam and an interview conducted by a panel of faculty staff. They must also have completed three undergraduate courses in calculus, two in algebra and one in real analysis, as well as advanced courses in statistics and probability. A working knowledge of computer programming languages R, MatLab and C++ is also mandatory – though the course includes a series of workshops designed to familiarise students with the various programming environments used by the modern quant.

Enrollees typically originate from undergraduate studies in actuarial science, mathematics, statistics, engineering, physics, computer science and economics.

A strong emphasis is placed on theory. The faculty is made up of active researchers whose areas of interest are reflected in the annual syllabus. The first and second terms each include a module on probability theory, while the second term also includes a course on estimation and hypothesis testing. Programme director Adam Kolkiewicz says the course prioritises mathematical and statistical modelling rather than trading.

Unlike in some other programmes, such as that offered by the University of Toronto, internships are not compulsory – although many students take still them. Internship destinations include Bank of Montreal, CIBC, Scotiabank, TD Securities and RBC.

Yet the real-world applications of quantitative methods are by no means absent from the programme. Students are equipped with a practical understanding of the industry through a first-term module on the foundations of finance and a fourth-term component on current topics. The programme advisory board, which includes alumni in senior positions at firms including TD Securities and IBM, ensures it stays up to date with evolving industry trends. Kolkiewicz says the industry demand at present is for graduates adept at risk management and statistics.

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director

Quant Finance Master’s Guide 2022

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Princeton, Baruch and Berkeley top for quant master’s degrees

Eight of 10 leading schools for quantitative finance programmes are based in US, latest rankings show