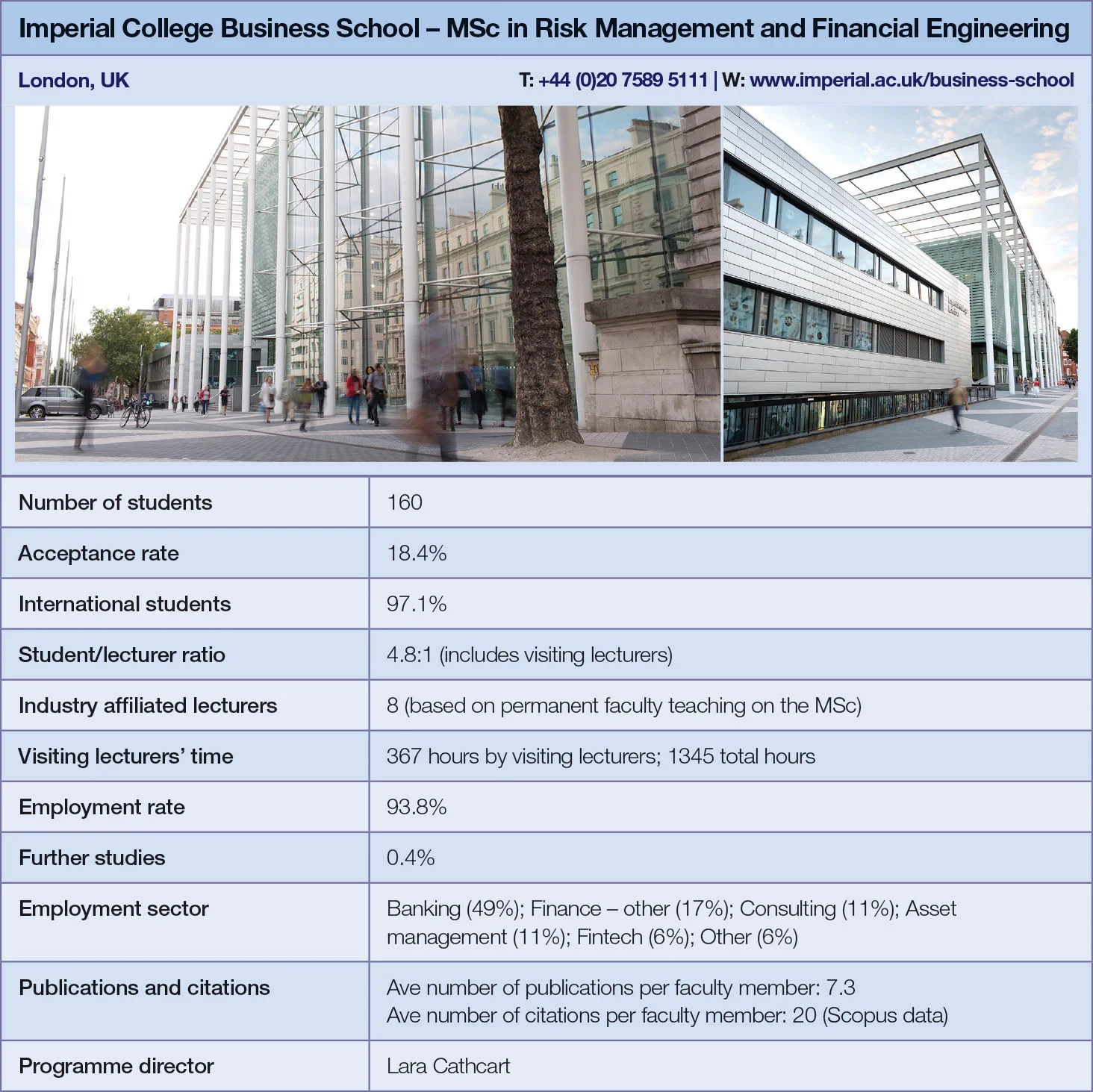

Quant Guide 2017: Imperial College Business School

London, UK

MSc in Risk Management and Financial Engineering | metrics table at end of article

The story of Isella Rigoulet illustrates many of the themes currently shaping careers in quant finance: the blending of technical and practical skills; the need to bridge those two worlds; adaptability; and the rise of regulation.

A 2013 graduate, Rigoulet had been attracted to Imperial College Business School’s programme by its flexibility. Finance and risk theory are taught in the programme’s core modules, with a range of elective modules allowing students to specialise in technical disciplines or lean towards specific fields of application.

After graduating, she worked in operational risk at BNP Paribas, but is now a senior auditor in the corporates and markets division at Commerzbank – a role in which the technical and practical combine on a daily basis. “The thing about audit is that you need to be able to understand the business quickly in order to challenge people on what they’re doing. You need a technical background for that,” Rigoulet says.

The master’s in risk management and financial engineering was introduced as a part-time Msc in the 2005–06 academic year, before becoming available as a full-time programme a year later.

“We use applied modules to merge mathematics with finance. We teach a lot of the theory through our core modules, and our electives are more practical – we often get practitioners in to help deliver them,” says Lara Cathcart, director of finance programmes at Imperial College Business School.

Students can choose a quant-heavy route by opting for technical electives – advanced financial statistics, for example, or advanced options theory – or can instead lean towards corporate and general finance, where electives focus on private equity, wealth management and other sectors. Of the 160 students currently enrolled (making this the biggest European programme included in the guide), a little more than half are following the quant path, and modules have been added to allow greater technical specialisation.

“There’s been an increased interest in areas like financial analytics, and we responded to that demand by adding in new elective modules to give students an opportunity to get more expertise in that area,” says Cathcart.

The course also tries to reflect events in the outside world – modules on data science, fintech and algorithmic trading are evidence of that. Regulation is another focus.

“There’s a big push for more understanding of regulation,” says Cathcart. “We introduced an elective on that – banks, regulation and monetary policy. Our advisory board are mostly practitioners and regulation has been high on their list.”

Commerzbank’s Rigoulet says this was the right call: “The regulatory aspect is such a big focus right now. There’s such scrutiny of banks that you can’t not talk about it. So many job opportunities are arising as a result – compliance departments are becoming very big and important.”

Practitioners actively collaborate with the business school. Last year, students from the risk management master’s joined peers from another Imperial programme to compete against their rivals from European universities in a live risk simulation run by consulting firm Avantage Reply, the Professional Risk Managers’ International Association (PRMIA) and Royal Bank of Scotland. As part of the challenge, students had to save a struggling bank from resolution.

In 2017, students also took part in the PRMIA risk management challenge.

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director

Quant Finance Master’s Guide 2022

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Princeton, Baruch and Berkeley top for quant master’s degrees

Eight of 10 leading schools for quantitative finance programmes are based in US, latest rankings show

Quant grad conveyor belt stalls as banks retrench

Jobs market is long quant graduates, short vacancies – but hiring freeze shows signs of thawing

Quant Finance Master’s Guide 2021

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked