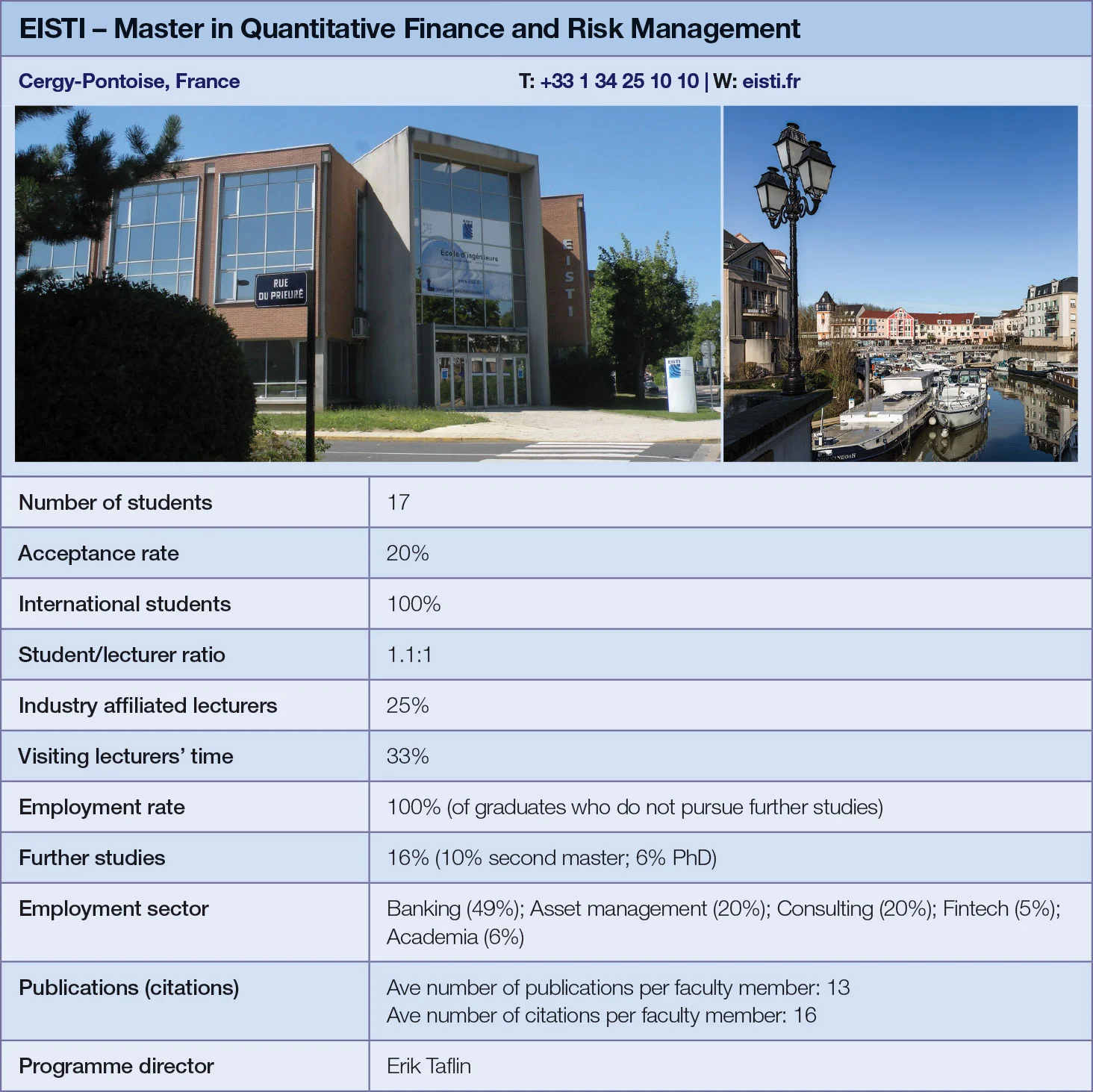

Quant Guide 2017: EISTI

Cergy-Pontoise, France

Master in Quantitative Finance and Risk Management | metrics table at end of article

EISTI, an engineering, mathematics and computing institute outside Paris, offers a one- or two-year programme combining mathematical rigour with a focus on risk management. Students with sufficient knowledge of mathematics can skip the first year. The programme’s small size of around 20 students allows for more individualised attention, although on the flipside they can’t pick and choose their courses.

The programme was established in 2012 in response to the government’s efforts to attract more students from abroad. Official rules stipulate that at least 80% of the programme’s intake must be international; in practice EISTI has consistently admitted cohorts with no French students at all. About a fifth of applicants secure a place.

All lectures are taught in English, by academics and current and former professionals, but there are also regular optional seminars given by practitioners, which are mostly in French.

“EISTI has a long tradition in mathematical finance and it was natural for us to continue in that direction with this programme,” says Erik Taflin, the programme director. “I have seen students, for example, coming from the US who are quite surprised at the level of mathematics.”

French universities have a reputation for their heavy reliance on mathematics and EISTI is no exception, but the programme is less mathematical than some of the more extreme examples in the country. Emphasis is placed on teaching students to calibrate the models learned and apply them to practical situations.

“They juxtaposed the mathematical element with a lot of teachers who have worked in the financial markets,” says Macri. “It provided a very mixed perspective and I think that’s the main thing that attracted me to this school.”

EISTI has responded to changes in the financial industry by introducing new courses, such as those on risk management and insurance. “Companies are interested in students with a slightly different profile than they were before the crisis,” says Taflin. “Before, it was about people who were very good at selling. Now it’s more about people who are good at risk analysis, for which mathematical skills are required.”

Students often practise their programming skills, in courses on the calibration and simulation of models, as well as dedicated modules on C++ and VBA. “It is a must that our students are able to program,” says Taflin. “And when you look at the internships they do, often the students are chosen because, besides a solid theoretical basis, they know how to program.”

Internships are compulsory and last 22 weeks from April of the second year. Students will also write a thesis and this can be completed either before or after the internship.

One alumna, Marie Macri, who graduated in 2014, says she now uses the quantitative skills she gained on the master’s to create standardised portfolio models at Lasalle Investment Management, a fund manager specialising in real estate. She also organises seminars to train her staff in techniques not often used for real estate investments but found in the analysis of other asset classes.

Demand for those types of skills is rising, she says. “When we are looking for new analysts, we’re not necessarily looking for people with real estate backgrounds. We’re looking for people with quantitative and computer skills.”

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director

Quant Finance Master’s Guide 2022

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Princeton, Baruch and Berkeley top for quant master’s degrees

Eight of 10 leading schools for quantitative finance programmes are based in US, latest rankings show

Quant grad conveyor belt stalls as banks retrench

Jobs market is long quant graduates, short vacancies – but hiring freeze shows signs of thawing

Quant Finance Master’s Guide 2021

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked