BrokerTec

RJ O’Brien plots expansion into US Treasury clearing

Chairman and CEO says futures house plans to capitalise on SEC’s new mandate for interdealer trades

Duffie: SEC plan heralds all-to-all Treasuries trading

Former Fed adviser welcomes long-advocated Treasuries clearing mandate

Page 19901: the benchmark that time forgot

CFTC probe into swap price rigging revives the ghosts of Libor manipulation

People moves: CRO role for SG’s Ricke, Barclays continues hiring spree, new SwapClear head, and more

Latest job changes across the industry

UBS unleashes Orca for rates clients

Machine learning algo trawls liquidity pools to slash US Treasury trading costs

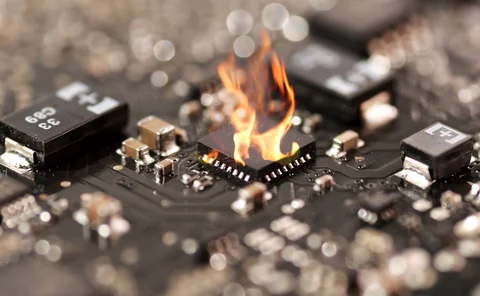

BrokerTec outage serves as ‘systemic risk’ wake-up call

January 11 shutdown of dominant US Treasury market platform worries participants

Jump: inside the secretive e-trading giant

Execs at the Chicago prop firm wish the whole world was a Clob, but as bilateral volumes rise, they’ve decided to go with the flow

Brexit OTC mutation, chaperones and SA-CCR

The week on Risk.net, October 6–12, 2018

Direct streaming gains foothold in US Treasuries market

Cost savings drive dealers away from Clob model into alternative venues

New DTCC fee structure could lure non-bank traders

US regulator approves proposal targeted at government securities business

DTCC set to cut US Treasury clearing fees

Revised fee structure could prompt more firms to participate in clearing

Size-discovery protocols are not on the efficient frontier

Practice improves allocations but more can be done, says Darrell Duffie

BrokerTec dominance ‘unhealthy’, says Nasdaq’s Shay

More clearing needed to improve US Treasury competition

Non-banks eye EGBs as primary dealers retreat

Primary dealers warn of further exits as principal trading firms wait in the wings

HFT firm Teza said to be eyeing prop trading retreat

Big US Treasury trader has seen hedge fund add $1.5bn this year

Voltaire Capital and the prop shop that changed its spots

London-based start-up joins liquidity contest via buyout of Chicago HFT firm

Non-banks push direct liquidity streams in US Treasuries

Dealers could save millions in broker fees and transaction costs, non-banks claim

SEC's White urges rules rethink for US Treasury venues

Current regime gives platforms easier ride on transparency

Icap launches repo settlement facility to reduce counterparty risk

Daily news headlines

BGC hires head of fixed-income e-commerce

Andrew Stone has been appointed head of fixed-income products for e-commerce at London-based interdealer broker BGC.

TradeBlade adds to management team

Tullett Prebon have announced three new senior additions to the management team of TradeBlade, the interdealer broker’s electronic platform.