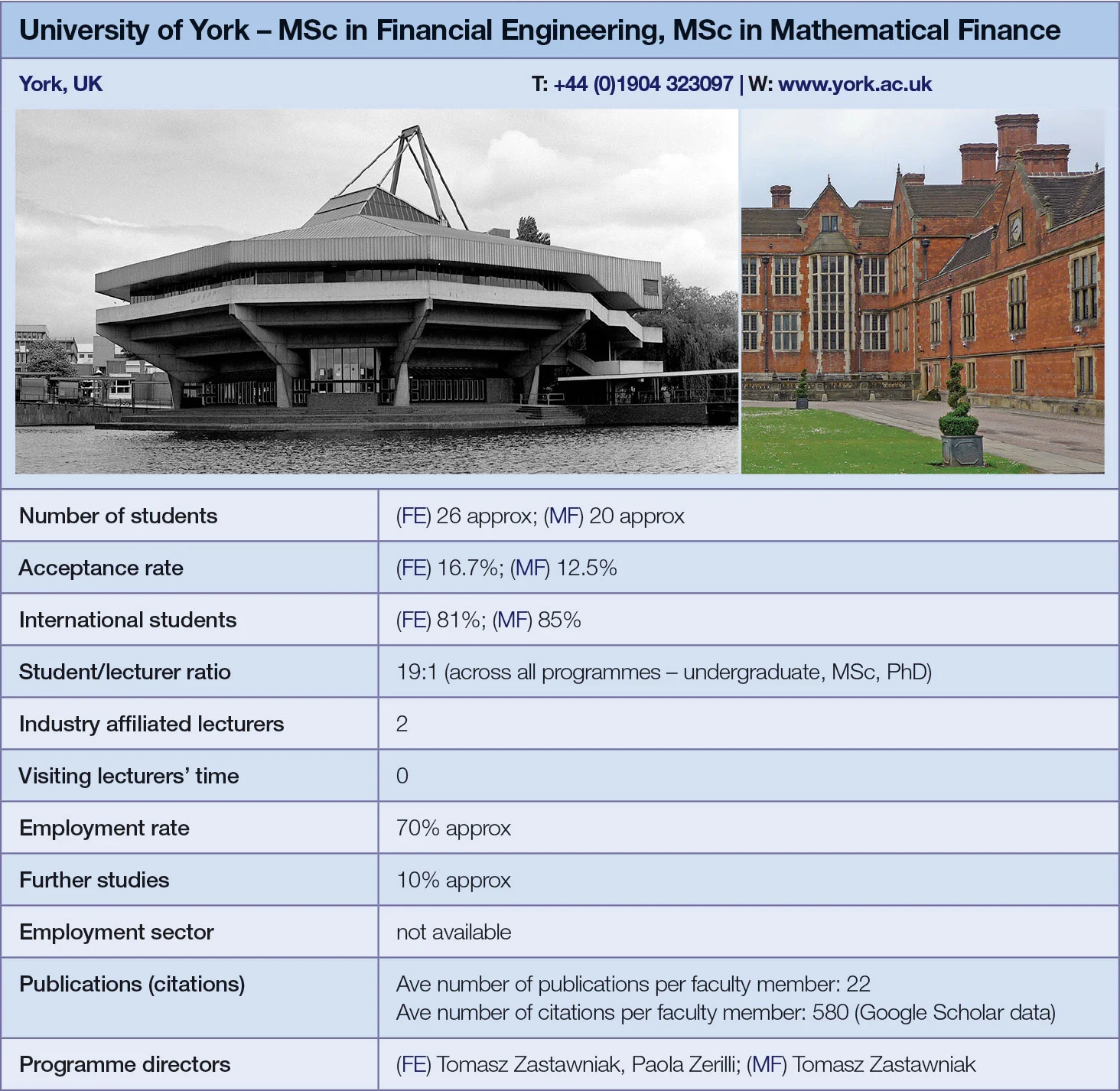

Quant Guide 2017: University of York

York, UK

MSc in Financial Engineering, MSc in Mathematical Finance | metrics table at end of article

The University of York offers two distinct master’s-level programmes: the MSc in mathematical finance focuses on the mathematical foundations of the discipline, while the MSc in financial engineering leans towards the application of technical skills in finance and economics.

Graduates in each typically follow different career tracks, says Tomasz Zastawniak, co-director of the financial engineering programme: “Our financial engineers apply more successfully for people-facing roles – they’re much better prepared for that, whereas maths finance graduates are more focused on technical skills and they often work as quant developers rather than dealing directly with clients.”

In both cases, however, expectations from employers have changed, and the programmes have tried to respond. “When I started in this business in the 2000s, the industry was happy to employ a physicist and give them in-house training, but now the expectation is for people to have a strong academic background in the field. On top of academic qualifications, many of our students aim to do a CFA – the combination of both seems to help them land a good job,” he says.

The MSc in mathematical finance is a combination of four core modules and three electives, a group project and a dissertation. Every student enrolled in this programme is obliged to complete a course on mathematical methods in finance; discrete time modelling and derivative securities; stochastic calculus and Black-Scholes theory; and modelling of bonds, term structure and interest rate derivatives.

“The programme is mathematically rigorous and our aim is to provide people with the skills to quickly accommodate new developments in the field in the future. We’re not as concentrated on the technical number-crunching aspects, we’re more focused on the theoretical background,” says Zastawniak.

Just over a year ago the programme was expanded to include new modules – an elective on computational finance and a new course on credit risk.

In May 2017, a compulsory group project was added to the curriculum. The plan was to reduce the dissertation size and complement it with more practical work. The project is aimed at mimicking real-life scenarios to give students an opportunity to apply their knowledge in practice.

Since 2009, the programme has also been available for distance learning. It runs alongside the campus-based programme, offering regular one-to-one online meetings with a tutor and supervisory sessions. It usually takes between 18 and 36 months to complete the online programme.

For mathematical finance students who wish to refresh their knowledge of mathematics before starting the programme, there is a pre-sessional course, which is delivered online and takes up to two months to complete. Its syllabus covers sets and functions, convergence, calculus and probability.

The programme has released a series of text books based on lecture notes. “There’s been a void in the book market for master’s students and we’ve made a deal with Cambridge University Press,” says Zastawniak. So far, the collaboration has resulted in the publishing of eight books.

The separate MSc in financial engineering is offered in conjunction with York’s economics department.

“It’s much softer on the technical side – we require less in terms of mathematical background, but more in terms of finance and economics,” says Zastawniak.

This programme consists of four core modules in the first term focusing on econometrics, time series, mathematical methods in finance and continuous-time finance and derivatives. In the second term, students cover financial engineering, topics in financial econometrics, stochastic calculus and Black-Scholes theory. The number of electives available to students varies, as optional modules are assigned various credit weightings, which means some of the modules count for two. Among the optional courses available are modules on C++ programming, credit risk and risk management.

The two programmes have commonalities. All new electives, apart from the group project, are available across both degrees. There is a strong focus on programming skills, and students do a lot of academic work using C++ and MatLab.

Students can get practical experience by participating in the management of a student-run investment fund, which was established via a donation.

Click here for links to the other universities and an explanation of how to read the metrics tables

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Quantitative finance

Quant Finance Master’s Guide 2025

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch maintains top spot in 2025 Quant Master’s Guide

Sorbonne reclaims top spot among European schools, even as US salaries decouple

Quant Finance Master’s Guide 2023

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Baruch topples Princeton in Risk.net’s quant master’s rankings

US schools cement top five dominance as graduate salaries soar

Is it worth doing a quant master’s degree?

UBS’s Gordon Lee – veteran quant and grad student supervisor – asks the hard question

Starting salaries jump for top quant grads

Quant Guide 2022: Goldman’s move to pay postgrads more is pushing up incomes, says programme director

Quant Finance Master’s Guide 2022

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Princeton, Baruch and Berkeley top for quant master’s degrees

Eight of 10 leading schools for quantitative finance programmes are based in US, latest rankings show