FVC review: Investec targets retirees with protected deposit plan

Investec Structured Products has tailored a new FTSE 100-linked product with capital protection to suit pension planners following the introduction of the UK Pension Schemes Act in April 2015

Investec Structured Products has released a new FTSE 100-linked deposit plan into the UK retail market. The product is available in two versions, both offering full capital protection and a potential digital payment at maturity.

Points for

1. Capital is protected at maturity.

2. Option one: A fixed return of 31.5% is paid if the final index level is above 90% of its initial level.

3. Option two: A fixed return of 24% is paid if the final index level is above 75% of its initial level.

Points against

1. Index averaging may result in the 'final level’ being lower than the one observed on the final investment date.

2. Any index growth above the maximum return is not passed on to the investor.

The plan pays a fixed return for each year of the investment. But instead of the payments being made as income, the return is taken as a percentage of the initial capital invested, leaving a lower amount to be repaid to investors at maturity. The plan is only open to investment via a self-invested personal pension provider.

Option one pays a fixed annual return of 5.25% on each anniversary, equivalent to 31.5% over the six-year term. The remaining 68.5% is paid to investors at maturity, subject to the risk of the issuer. At maturity, if the final level of the index is at or above 90% of its original level, investors will receive the fixed return of 31.5%. This is equivalent to 4.67% annually compounded.

Option one pays a fixed annual return of 5.25% on each anniversary, equivalent to 31.5% over the six-year term. The remaining 68.5% is paid to investors at maturity, subject to the risk of the issuer. At maturity, if the final level of the index is at or above 90% of its original level, investors will receive the fixed return of 31.5%. This is equivalent to 4.67% annually compounded.

Option two pays a fixed annual return of 4% on each anniversary date, equivalent to 24% over the full term. The remaining 76% of investors' capital is paid at maturity. If the final level of the index closes at or above 75% of its initial level, investors will receive a fixed return of 24%. This is equivalent to 3.65% annually compounded.

If the final level of the index fails to reach the required level, then investors will only receive the reduced capital repayment. However, the cumulative fixed payments mean the product is still capital protected when all cashflows are taken into account.

UK pension reforms

On April 6, 2015, the Pension Schemes Act 2015 came into force in the UK, heralding substantial changes to pension laws. Those who have invested in a direct-contribution pension scheme and are at least 55 years old can transfer part or all of their pension pot. Investec's deposit plan is the first retail structured product that looks to capitalise on the new rules, aiming to offer a higher fixed return each year compared to a pension. It also comfortably beats the current six-year risk-free rate of 1.5%.

Up to 25% of an individual's pension pot can be transferred free of tax, which is a maximum of £250,000 now the lifetime allowance has been cut to £1 million. Anything above that will be subject to income tax. The transfer can consist of a lump sum or multiple smaller amounts. The minimum investment for the Investec deposit plan is £3,000.

The product is subject to income tax if the digital payment is made, but the payments that investors receive during the six-year term are exempt owing to the fact that they are taken from initial capital.

Both versions of the plan use daily averaging over the last six months of the term and require the final level of the index to be above a certain figure. Daily index averaging can help to mitigate sudden drops in the underlying asset, especially where a particular index level needs to be achieved, but it can also constrain growth in a rising market.

The type of investor for whom this plan is most suitable is one undertaking pension planning. Investec currently has a credit rating of BBB- from Fitch, which means that while it is deemed to have adequate capacity to meet its financial commitments, this capacity could be strained under adverse financial conditions. A key aspect of the deposit plan is its capital protection, so if preserving capital is the investor's main priority, they should consider whether the level of credit risk is appropriate.

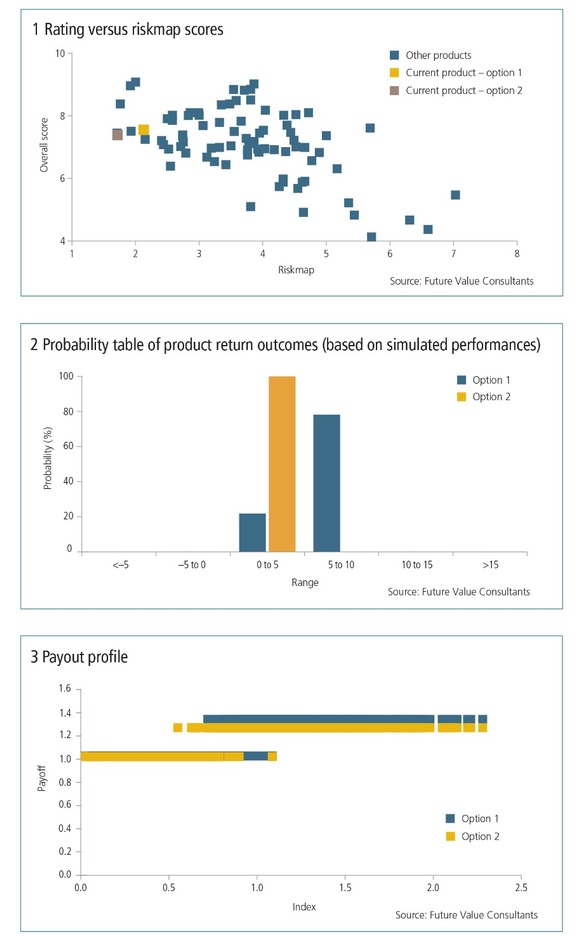

The two options offer different risk-reward profiles. Option one has a 78% chance of receiving its digital payment of 31.5%, according to Future Value Consultants research, while option two has a lower digital payment of 24%, but with a 90% chance of receiving it.

The information in this analysis is taken from sources which Future Value Consultants Limited deems reliable but no guarantee is made that the information is complete or accurate and it should not be relied upon as such. Any opinions in the analyses represent those of Future Value Consultants Limited at the time of writing but are subject to change. All valuations and prices shown are indicative only and do not imply an offer or commitment of any kind. The analysis does not constitute advice or recommendations nor should it be relied upon for any purpose. No liability whatsoever is accepted by Future Value Consultants Limited or Incisive Risk Information Limited for any loss or expense incurred from using this analysis.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Structured products

A guide to home equity investments: the untapped real estate asset class

This report covers the investment opportunity in untapped home equity and the growth of HEIs, and outlines why the current macroeconomic environment presents a unique inflection point for credit-oriented investors to invest in HEIs

Podcast: Claudio Albanese on how bad models survive

Darwin’s theory of natural selection could help quants detect flawed models and strategies

Range accruals under spotlight as Taiwan prepares for FRTB

Taiwanese banks review viability of products offering options on long-dated rates

Structured products gain favour among Chinese enterprises

The Chinese government’s flagship national strategy for the advancement of regional connectivity – the Belt and Road Initiative – continues to encourage the outward expansion of Chinese state-owned enterprises (SOEs). Here, Guotai Junan International…

Structured notes – Transforming risk into opportunities

Global markets have experienced a period of extreme volatility in response to acute concerns over the economic impact of the Covid‑19 pandemic. Numerix explores what this means for traders, issuers, risk managers and investors as the structured products…

Structured products – Transforming risk into opportunities

The structured product market is one of the most dynamic and complex of all, offering a multitude of benefits to investors. But increased regulation, intense competition and heightened volatility have become the new normal in financial markets, creating…

Increased adoption and innovation are driving the structured products market

To help better understand the challenges and opportunities a range of firms face when operating in this business, the current trends and future of structured products, and how the digital evolution is impacting the market, Numerix’s Ilja Faerman, senior…

Structured products – The ART of risk transfer

Exploring the risk thrown up by autocallables has created a new family of structured products, offering diversification to investors while allowing their manufacturers room to extend their portfolios, writes Manvir Nijhar, co-head of equities and equity…