This article was paid for by a contributing third party.More Information.

The private markets dilemma faced by asset owners

Demand for private markets has seen continued growth. Shar Kassam, vice-president at Nasdaq, and head of Nasdaq Asset Owner Solutions, explores why market volatility has led to additional considerations for portfolio construction, cashflow and liquidity forecasting, which asset managers will need better tools to overcome

As institutional asset owners seek to maximise portfolio returns, private markets have remained a top destination for new allocations.

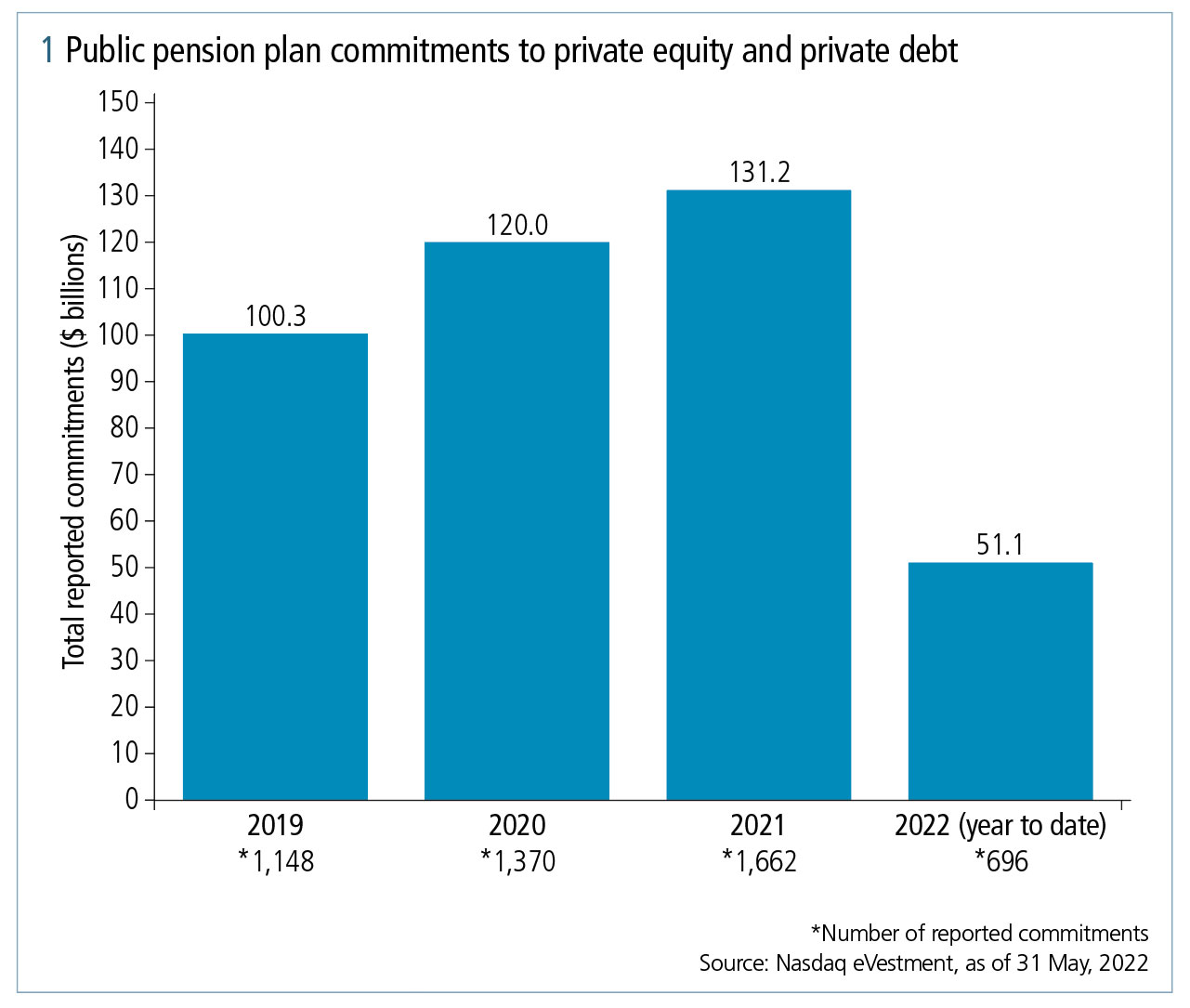

According to data from Nasdaq eVestment, in 2021, public pension plan allocators reported more than $131 billion in commitments to private equity and private debt funds, a 9.4% increase from 2020 (see figure 1). In 2022, allocators have poured over $50 billion into these private funds throughout May.

In the wake of market dislocations caused by the Covid‑19 pandemic, private debt has been a specific area of focus for institutional investors. Many asset owners are adjusting portfolio allocation targets to make room in their annual pacing plans for commitments to this asset class. As of April 30, 2022, 60 public plans were under allocated against their private debt target allocations, representing $14.1 billion in potential commitments. But, as investors increase their allocations to private markets funds to meet return targets, they need to be prepared for an increase in operational challenges and risks that will be added in turn.

Rising considerations

The challenges of private markets investment and monitoring are increasing. While private funds and their investors have enjoyed the fruits of a bull market, the recent spike in inflation and increasing interest rates are creating market volatility. With this comes even more consideration required in portfolio construction, cashflow and liquidity forecasting and new commitment pacing and due diligence. Asset owners need accurate and timely data across their entire portfolios to do this, which they struggle to achieve because of the characteristics of the private markets.

Once a commitment to a private fund is made, investors face the complex challenge of collecting data on that commitment and integrating it into their existing systems to create a complete portfolio view.

The private markets data dilemma

Part of the challenge for asset owners here is purely a logistical one: gaining access to private markets portfolio data in a timely manner and with a functional format consistent with the wider portfolio. Regardless of the ‘private’ nature of private markets funds, they are still just one part of an asset owner’s broader portfolio. And investors need visibility into the underlying assets of their private markets funds to have a holistic view of their portfolio, to understand their level of risk.

Asset owners need to gather data such as daily cashflow transactions, quarterly investor and fund reporting, and portfolio company performance and valuation metrics. In many cases, institutional investors simply do not have the staffing power to collect, scrub and maintain this data.

Relying on external parties such as custodians is an imperfect solution. Data and calculations will be based in general ledger accounting results, rather than true point-in-time data points that are crucial for accurate exposure, performance and risk analysis.

Legacy technology platforms are similarly limited in their effectiveness. Many asset owners use multiple ‘point solution’ technology platforms that specialise in a single asset class. As a result, these legacy systems assume the individual investment attributes, timing and data elements of each investment are the same for all asset classes. This makes them poor tools for providing accurate and actionable visibility across an asset owner’s full portfolio.

Without the technology to provide an integrated total portfolio view, asset owners are left with the time-consuming task of building bespoke spreadsheet-based models to get the answers they need. Or worse, they’ll forego this necessary analysis.

Meeting portfolio needs with purpose-built solutions

Nasdaq is helping institutional investors overcome the operational challenges of managing and growing a private markets portfolio with its true multi-asset class portfolio analytics solution, Solovis.

As part of the Nasdaq Asset Owner Solutions ecosystem, Solovis uses a flexible data model that can ingest and handle performance metrics and analytics across all asset classes. Users get the flexibility of looking at their total portfolio in one place, with the deeper, purpose-built analysis they need to plan their private markets programmes in an ever-evolving market. This extensive capability ranges from performance and exposure analysis to commitment pacing planning, and cashflow and liquidity modelling.

Solovis also ensures its users get the timely and clean data needed for decision-making, without expending valuable internal resources on manual data work, through its talented and experienced analyst services team.

Asset owners are evolving their portfolios to meet their investment objectives. It’s time their portfolio management tools evolved too.

About the author

Shar Kassam, vice-president, Nasdaq, and head, Nasdaq Asset Owner Solutions

Shar Kassam is responsible for helping institutional investors achieve their investment objectives. She previously served as deputy chief information officer at the Employees Retirement System of Texas, where she managed the investment programme and team. Kassam’s core responsibilities included conducting due diligence for manager recommendations in public equity, private equity and hedge funds, including those that were part of the pension plan’s emerging manager programme.

About Nasdaq asset owner solutions

Nasdaq Asset Owner Solutions is a suite of technology solutions purpose-built for institutional asset owners. Part of Nasdaq, Nasdaq Asset Owner Solutions delivers transparency and decision support throughout the investment lifecycle by uniting eVestment, the industry’s most comprehensive institutional data, with true multi‑asset class portfolio analytics solutions from Solovis.

Sign up today to get Nasdaq’s monthly insights curated for asset owners directly in your inbox

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net