This article was paid for by a contributing third party.More Information.

2021 brings big changes to the carbon market landscape

ZE PowerGroup Inc. explores how newly launched emissions trading systems, recently established task forces, upcoming initiatives and the new US President, Joe Biden, and his administration can further the drive towards tackling the climate crisis

This year will see some major changes to the carbon market landscape, as new national trading systems are launched, others are reformed, and the UN battles to complete a set of guidelines for nation-to-nation trading.

A new US president has boosted hopes for more ambitious climate action from the world’s second-largest emitter, though expectations stop short of a federally administered carbon market. Meanwhile, China will bring years of anticipation to an end when it launches its own nationwide emissions trading system (ETS) in February.

European Union ETS reforms

Much attention in 2021 will focus on the EU, where lawmakers will be grappling with ambitious reforms to the world’s flagship carbon market. As well as boosting targets for renewable energy and energy efficiency, the EU is preparing to revamp its carbon dioxide (CO2) market to meet a new target of a 55% cut in emissions from 1990 levels by 2030.

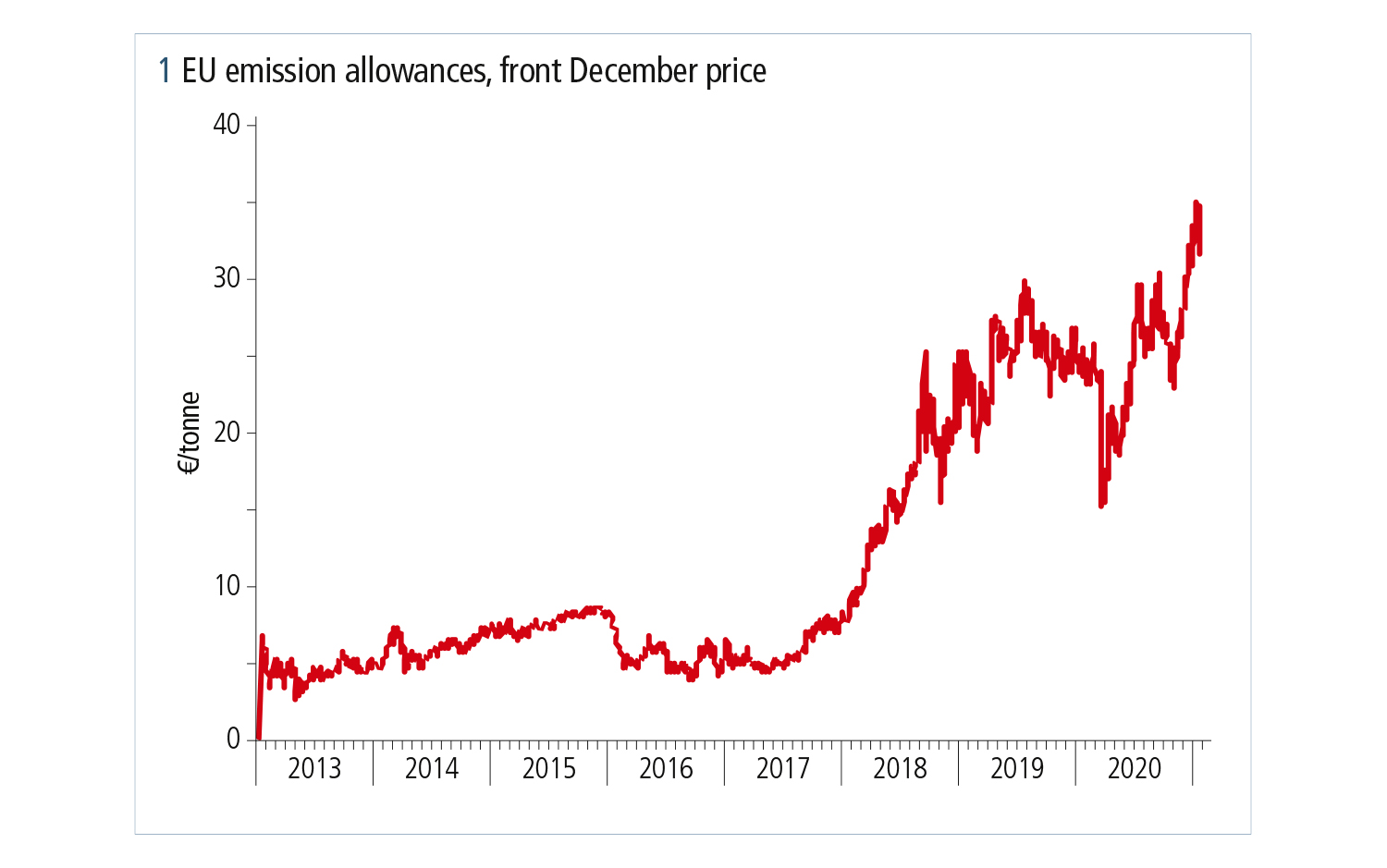

Previous amendments to the market were enacted in 2018 and were scheduled to take effect at the start of the market’s fourth phase, which began on January 1, 2021. These changes included a 40% cut in emissions by 2030 from 1990 levels, which triggered a year-long rally in the market that saw carbon prices treble in 2018.

Since those amendments were approved, however, the bloc has agreed a new climate goal of achieving net zero emissions by 2050. This long-range target requires another adjustment to the interim goal.

The proposed changes will likely include a steeper annual reduction in the overall limit on emissions, the extension of the market to cover maritime and land transport as well as buildings, and changes to a mechanism that reduces the surplus of allowances in the market.

The European Commission (EC) is scheduled to present legislative proposals in the summer. Some changes will likely be enacted sooner than others, experts say, in order to give European industry as much time as possible to adjust to the new emissions limits before 2030 arrives.

The market has already begun pricing in this steep increase in climate ambition. After the first set of Phase 4 reforms saw prices leap from €7 per tonne to €25/tonne in 2018, the next slate of changes has already driven prices from €25/tonne in January 2020 to a peak of €35.42/tonne in early January 2021 (see figure 1).

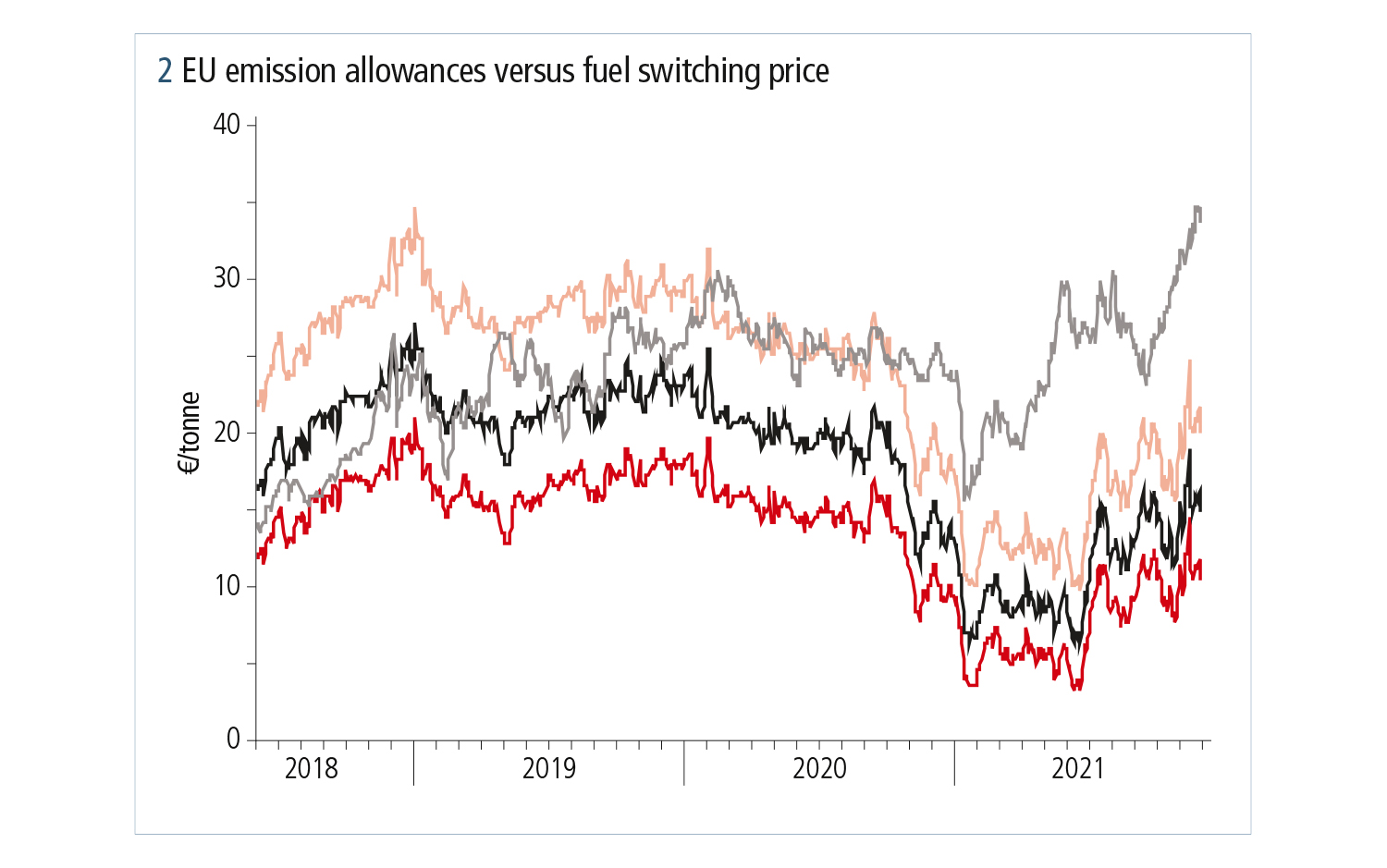

The EU is now entering new territory in pricing: until now, carbon prices have been largely determined by the relative values of coal and natural gas to encourage utilities to switch from coal to gas. But, for most of 2020, carbon stayed above this ‘fuel-switching’ level (see figure 2).

Looking further ahead, the next tranche of emissions reductions will need to come from heavy industry – cement, steel, chemicals, and so on. Natural gas is used as an input to generate energy in these and other industrial processes, and the EU has targeted replacing natural gas with ‘green’ hydrogen – manufactured using renewable energy – as a goal for 2030.

Analysts and the EC both estimate the price of carbon will need to reach around €90/tonne to bring the cost of green hydrogen in line with that of hydrogen made using natural gas. It is this calculation that is seen as the next important goal for the EU ETS.

UK launches domestic market

At the end of last year the UK announced the launch of its own ETS in 2021. The commitment was embedded in the post-Brexit trade deal agreed between London and Brussels on Christmas Eve, which will also see the UK and Europe giving “serious consideration” to linking their respective carbon markets.

According to legislation already passed, the UK ETS will look almost identical to that of the EU: there will be free allocation of allowances to trade-exposed industrial companies, the power sector will be required to buy its allowances at auctions or in the secondary market, and there may be a system to adjust the supply of allowances should a surplus build up.

The UK market will, however, set a floor price for its auctions of £15/tonne in 2021, which may well act as a floor for prices in the open market as California’s auction reserve price has. It is still not clear if there will be a price ceiling.

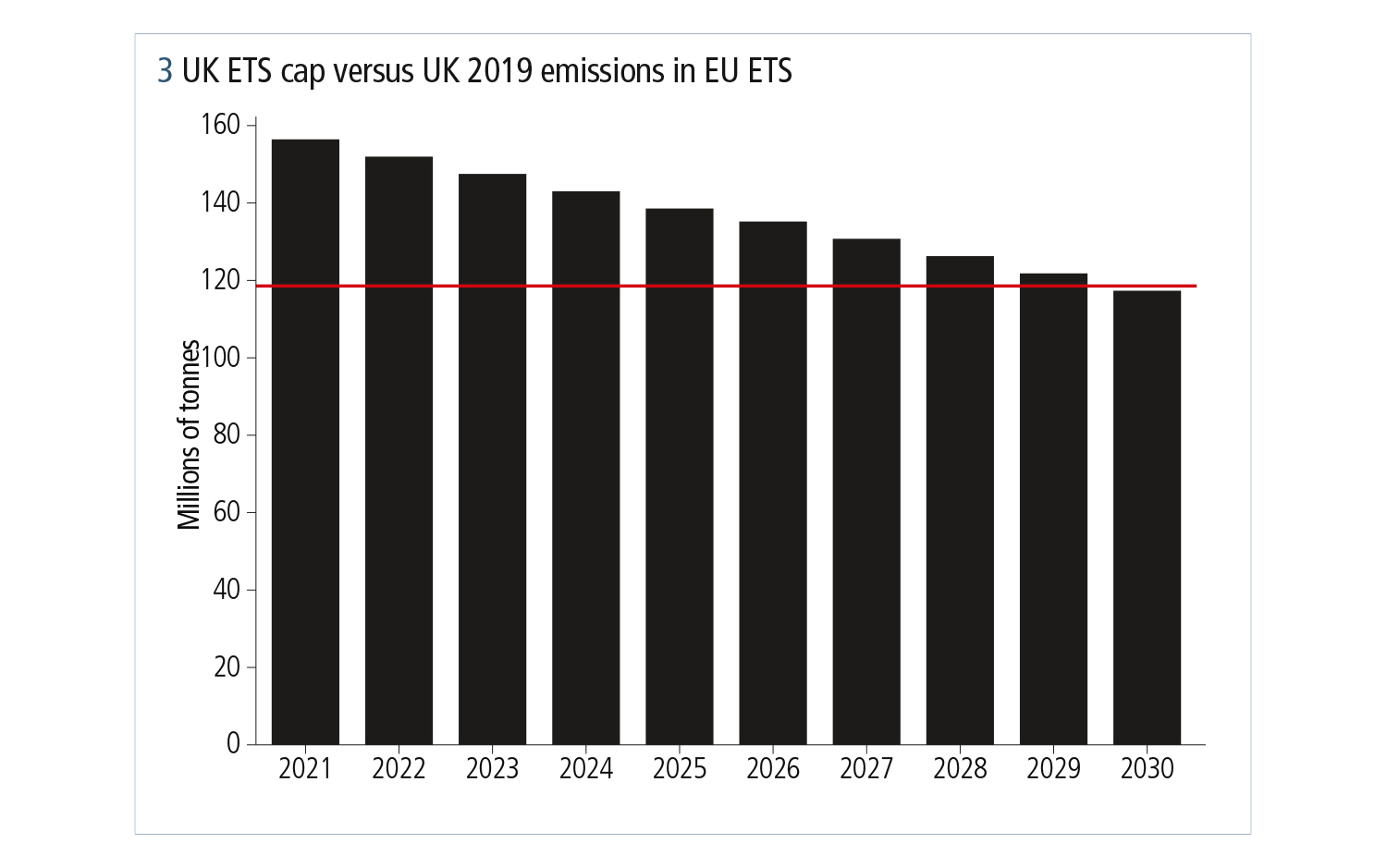

This market will be relatively small at 155 million tonnes per year – around 10% the size of the EU ETS and half the size of California’s system – but the companies that will participate are already familiar with the administration and operation of such a system as they have all been part of the EU carbon market.

Initial analysis suggests the UK market could be oversupplied in its first years. The proposed annual cap on UK emissions from 2021 through to 2029 are higher than the UK’s verified EU ETS emissions for 2019 (see figure 3).

The technical process to establish the UK ETS is not yet complete, and observers expect some allowances to be held back from the market to fill special reserves for new entrants and other purposes.

China launches the world’s largest ETS

In February, more than 2,200 power stations

in China will be handed allowances in the world’s largest carbon market. Lawmakers raced to approve regulations governing the Chinese ETS before the end of 2020, though key elements of the market architecture are yet to become operational. The first phase of the new market will cover around 4.3 billion tonnes per year of CO2 – more than twice the amount emitted under the EU ETS. Later phases will see the market extended to other heavy-industry sectors.

While there will doubtless be fanfare surrounding this launch, the new market is not an ETS in the widely accepted sense. China’s system will start by setting a limit on carbon intensity – CO2 emitted per unit of production – rather than an absolute cap on CO2 emissions. This means total emissions can continue to increase, as long as output also rises.

The rules will establish an efficiency benchmark for coal-fired power plants, and any units that exceed this mark will be able to sell surplus allowances, while those failing to meet the benchmark will need to buy permits.

Trading is unlikely to be very active in the early days of the market – only spot deals will be permitted at the outset, and foreign entities are not currently permitted to participate. Much will depend on how quickly the targets are tightened and whether the rules will permit the development of more sophisticated futures contracts.

While there has been some talk of potentially linking China’s market to other ETSs around the world, it’s highly unlikely that a system that does not put an absolute limit on CO2 emissions can link to other markets that do cap emissions. Analysts say that, once the Chinese ETS has been extended to additional industrial sectors and emissions have peaked – expected to be around 2028 – the government will then put a cap on total CO2 emissions.

A climate-friendly White House

On January 20, Joe Biden was sworn in as president of the US. One of his first acts as the new leader was to rejoin the 2015 Paris Agreement on climate change, the withdrawal from which his predecessor, Donald Trump, announced in June 2017.

President Biden has appointed former senator John Kerry, one of the architects of the Paris Agreement, as his climate envoy and has pledged to work with the international community to drive an increase in global ambition. He has not, however, specified what the US might pledge under its nationally determined contribution (NDC) to the Paris target. This is partly because it’s not yet clear whether he will be able to drive domestic climate policy as quickly. Biden campaigned on a pledge to spend up to $2 trillion on clean energy and infrastructure over the next four years, including railways, sustainable housing and electric vehicles, but he lacks a commanding majority in Congress to support his policies.

The Senate is evenly divided between Democrats and Republicans, with vice-president Kamala Harris holding the casting vote in the event of any tied ballots. This may embolden the Biden administration to take more concrete steps at a federal level.

Biden’s more aggressive climate pledges reflect continuing ambition among individual states as well. The country’s oldest cap-and-trade system, the eastern Regional Greenhouse Gas Initiative (RGGI), covers emissions from power generation in 10 northeastern states, and expanded to include Virginia at the start of 2021. The state of Pennsylvania is now considering whether to apply to join as well.

Some RGGI member states are also widening the coverage of their carbon markets to include transportation fuels from 2023. The Transport and Climate Initiative will require fuel distributors to buy and surrender allowances covering the emissions from petrol and diesel they sell.

At the same time, efforts continue in the western states of Washington and Oregon to introduce legislation establishing carbon markets. Oregon governor Kate Brown issued an executive order in 2020 requiring state agencies to set up an ETS, which has drawn legal challenges from industry.

In neighbouring Washington, governor Jay Inslee is also set to propose cap-and-trade measures this year, together with a clean fuel standard. Like his counterpart in Oregon, governor Islee faces stiff opposition.

The UN Framework Convention on Climate Change and the Paris Agreement Article 6

Looming over all of the carbon market developments in 2021 will be the UN-sponsored negotiations over the future of international carbon trading.

The Paris Agreement sets a framework for emissions trading among nations to help achieve net zero emissions by 2050.

Under the Paris Agreement, more than 190 countries are required to submit NDCs or self-binding commitments to achieve emissions cuts. These NDCs may take the form of ETSs, carbon taxes or simply policies to cut emissions.

Policy analysts suggest most NDCs are not yet ambitious enough to help achieve the Paris Agreement’s goal and that they will need to be improved. Countries are expected to submit updated commitments at November’s UN Climate Change Conference in Glasgow. However, one major component of the Paris Agreement remains unresolved. Since 2016, negotiators have been hard at work to flesh out the details of Article 6 of the agreement, which governs international emissions trading.

There remain differences of opinion as to how countries should account for transactions of emissions reductions among themselves, what kinds of technologies would be eligible to earn carbon credits and whether more than 10,000 projects that were approved under the Paris Agreement’s predecessor, the Kyoto Protocol, should continue to be eligible under the new regime.

Successive summits since 2016 have failed to reach a binding agreement on some critical technical details of Article 6, and the postponement of last year’s summit has only added to the sense of urgency underpinning the talks.

While Article 6 remains the largest element of the Paris Agreement not to be agreed, there are other equally important technical and political decisions concerning financial flows to developing nations – to assist with low-carbon development and adaptation to the impacts of climate change – that must be resolved.

The rise of the voluntary market

One of the more high-profile issues in 2020 was the future of the voluntary carbon market. For the past two years, pressure has been building on companies outside the scope of mandatory emissions limits – usually commercial and financial entities – to take concrete action on their own supply chain emissions.

Voluntary offsets are generated by clean-technology projects that reduce emissions compared with a business-as-usual baseline. Examples include replacing fossil fuel-fired power stations with renewables, reducing deforestation or planting new forests to absorb CO2. The resulting savings are expressed in tonnes of CO2 reduced or avoided, and certificates are issued that can be retired to offset emissions generated elsewhere.

Multinational entities such as Marks & Spencer, Microsoft and even corporations participating in carbon markets such as BP and Shell have been increasingly looking to neutralise the climate impact of their entire operations, including raw materials and supply and distribution chains. Most have turned to carbon offsetting as the most efficient way to compensate for their carbon footprints.

In 2020 a number of task forces were launched to discuss how to better organise this unregulated marketplace and to increase the transparency, quality and integrity of offsets. The leading initiative – the Task Force on Scaling Voluntary Carbon Markets, led by Bill Winters, chief executive of Standard Chartered, and Mark Carney, former governor of the Bank of England – will present its final report early in 2021.

The task force is likely to recommend the development of core carbon price indexes and reference contracts, open marketplaces for trade in offsets, registries to hold and transfer the offsets, and systems to protect the market’s integrity. Already there are efforts under way to develop transparent trading venues for offsets and to establish contracts for representative offset standards. But 2021 is likely to see these increase exponentially.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net