This article was paid for by a contributing third party.More Information.

Assessing climate risk in bond portfolios

Running climate stress tests on bond portfolios is a nascent exercise for many asset managers. MSCI looks at what to consider when optimising bond portfolios for climate exposures

Corporate interest in climate change is soaring, and many financial firms and institutional investors, including asset and portfolio managers, now have internal targets for achieving net-zero emissions. Many of these are in line with the Paris Agreement on climate change and global efforts to limit warming to 2º Celsius or lower. There are now 220 firms with $57 trillion in assets under management signed up to the Net Zero Asset Managers initiative, with the goal of being net zero and supporting investing aligned to achieving net zero by 2050 or sooner.

As companies plan their strategies for achieving these goals, asset managers are grappling to understand the impact climate-related choices, actions and policies will have on their portfolios over the coming years. They are also trying to understand how best to transition their portfolios to mitigate climate risk and benefit from opportunities around climate investing.

When it comes to bond portfolios, running climate stress tests is a relatively new exercise for many asset managers. It’s one that requires very granular climate data and sophisticated risk models. At this year’s Buy-side Risk Global, MSCI spearheaded some group discussion on the topic. To prompt the dialogue, participants were invited to run climate scenarios on a hypothetical bond portfolio.

The task was to determine what the impact would be on the portfolio if global temperatures rose to 1.5ºC above pre-industrial levels by 2100. They were then asked to optimise the portfolio to create a version of it that was less severely impacted by the climate stress test.

The scenarios were built using MSCI’s work in recent years in the field of risk factor models, optimisation capabilities and climate value-at-risk (VAR). In combination, they considered both risks and opportunities coming from climate change.

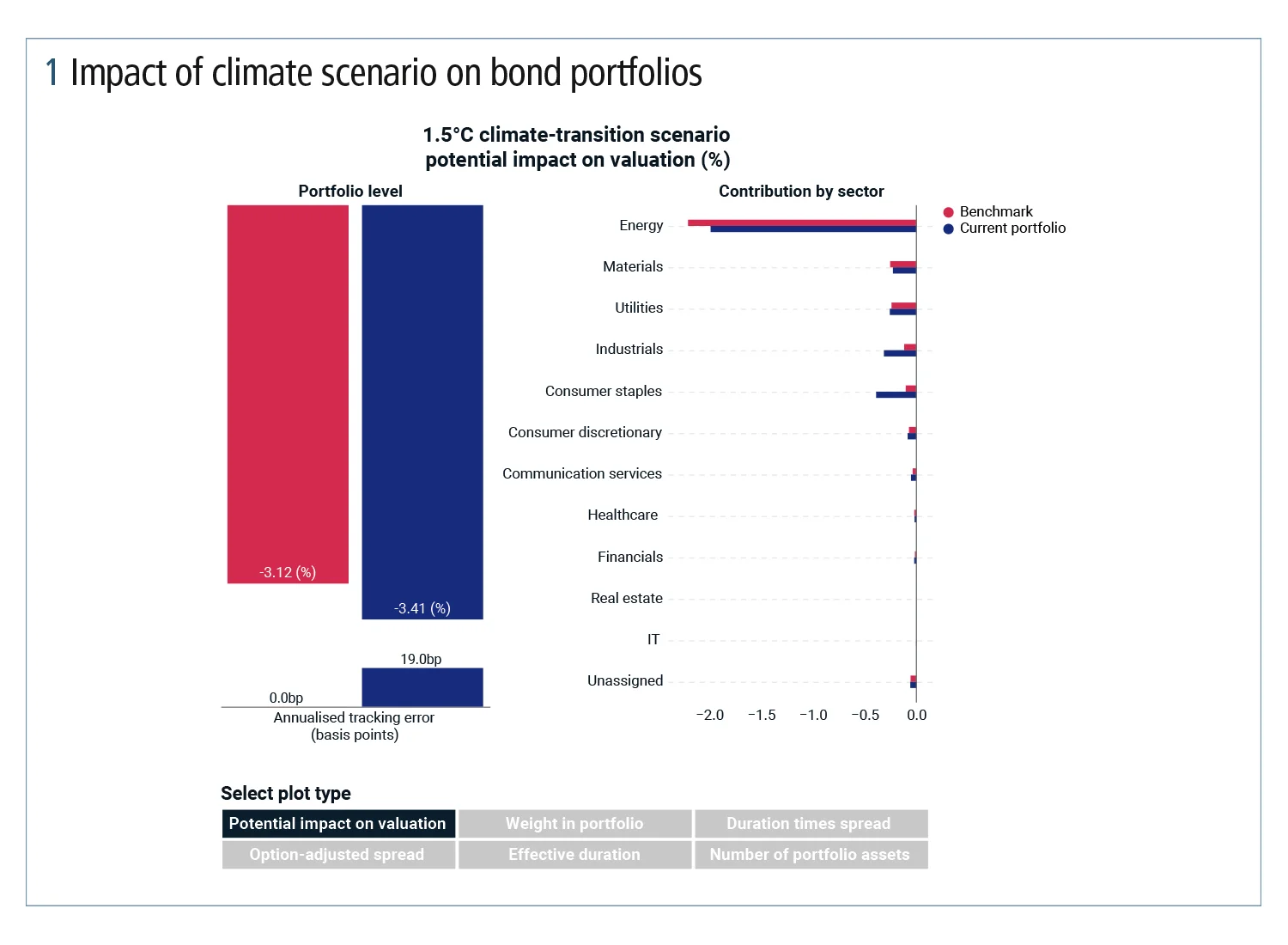

The hypothetical client bond portfolio had the MSCI US Dollar Investment Grade Corporate Bond index as its underlying benchmark. After running the 1.5ºC climate scenario, it could be seen that both the client’s portfolio and the benchmark registered losses (see figure 1). While the benchmark fell by 3.12%, the client’s portfolio fared worse with a loss of 3.41%.

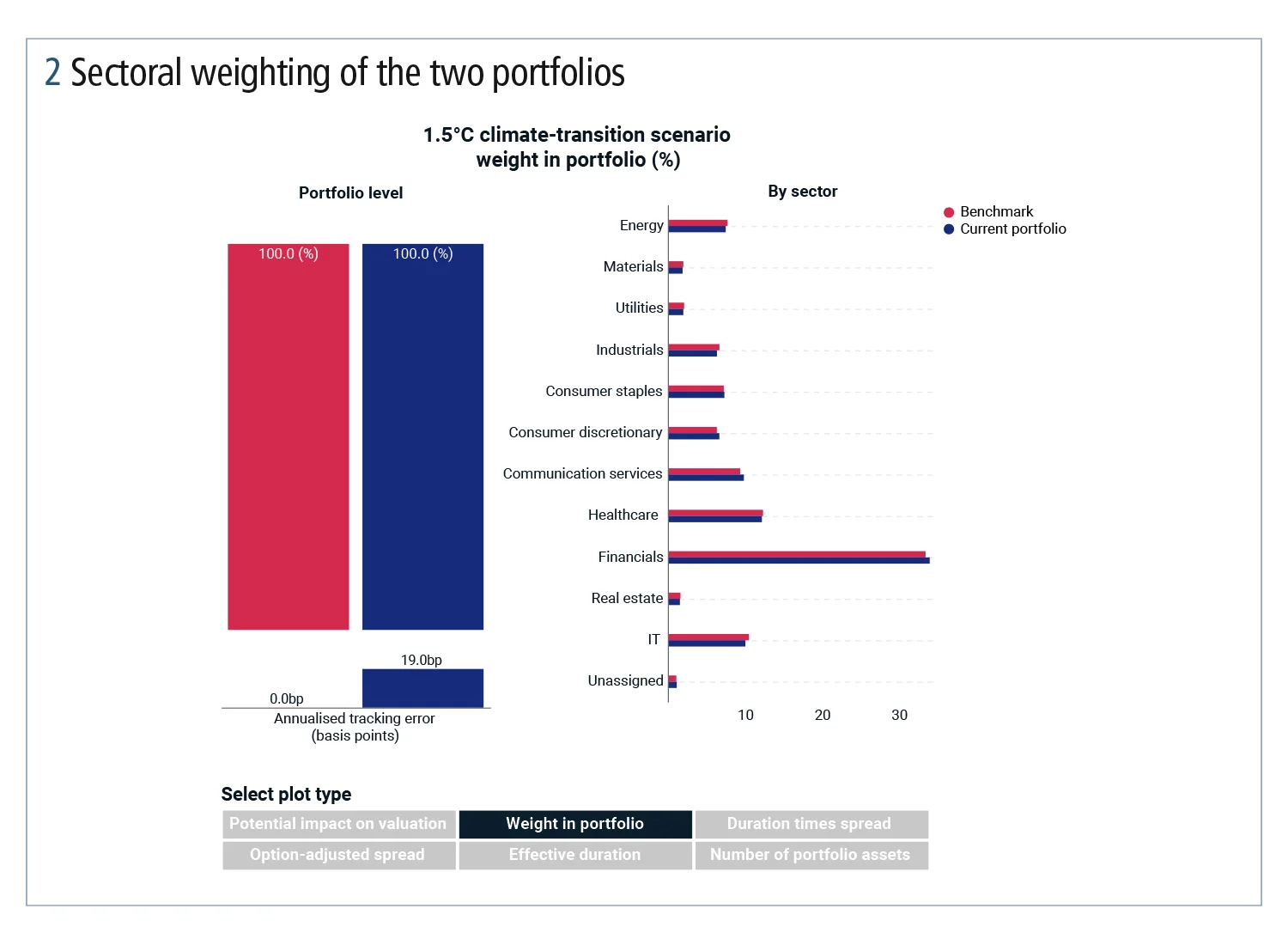

The sectoral weightings of the client portfolio matched that of the benchmark closely (see figure 2). Looking at figures 1 and 2, it can be clearly seen that the energy sector, even though it had an allocation of only around 7.5%, was responsible for most of the climate risk. The contribution of the industrials and consumer staples sectors to climate risk was also disproportionately higher than their weighting in the portfolio.

Once the effect of the climate scenario had been seen on the portfolio, the next exercise was to see if the portfolio returns could be improved. Using MSCI’s portfolio construction application, further analysis was run, taking into account some hypothetical constraints around issuer concentration and maximum tracking error to the benchmark.

The results showed the optimised portfolio had significantly lower climate risk – the performance went from -3.41 to +0.21 (see figure 3). The largest gain came from the energy sector, in which risk had been reduced considerably. Further gains came from the industrial sector, which moved from being a negative to positive contributor to the portfolio.

“What we saw was that we could almost eliminate the drawdown coming from the energy sector, and we went from negative to positive for the industrial sectors,” said Laszlo Hollo, vice-president, risk management research at MSCI.

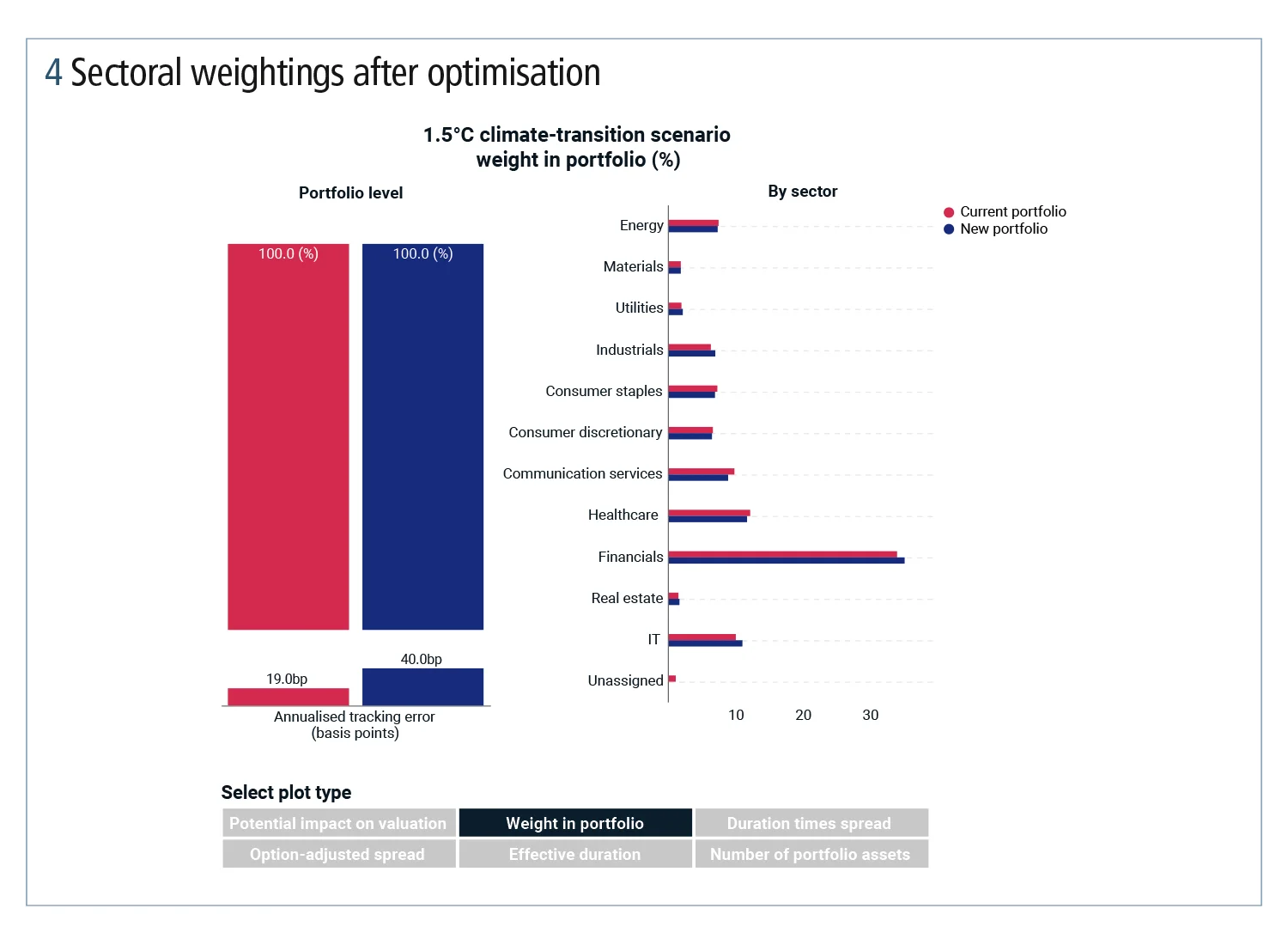

All this was achieved while keeping very similar weightings to the benchmark (see figure 4). The large improvement on the energy side came from increasing weight being given to issuers with lower climate risk, such as Enbridge and Orsted. Enbridge was given a 5% weighting – the maximum allowed by the scenario.

“The weights in the underlying benchmark and the client portfolio aren’t that different, but the model is selecting companies that are going to perform relatively well under the climate scenario. So substitution within sectors is how the model does it,” Hollo added.

The enhanced performance from the industrials was achieved by taking into account technological opportunities in that sector. “The climate VAR model factors in opportunities from climate policies, looking at things like patents,” said Juan Sampieri, vice-president, portfolio management research at MSCI. “This really shows there is an investment opportunity from the positive contribution of some industrials to climate change. The race is on to benefit from that.”

The tracking error moved from 19 basis points versus the benchmark to 40bp. “This shows that, with only a bit of elevated tracking error, climate risk under the 1.5°C scenario could be significantly reduced,” he added.

Overall, the results show it is possible to adjust a portfolio for climate risk without deviating too much from the original strategy of the underlying benchmark.

“You can be true to the existing investment strategy of your portfolio in terms of its risk and return profile while optimising it for climate,” said Thomas Moser, executive director, product management at MSCI. “In other words, you can incorporate climate as an additional constraint but keep the investment strategy of your portfolio intact.”

As the scenario analysis highlighted, focusing on the top 10, or even biggest three issuers in each sector, and swapping them out if they are high risk, can have a surprisingly big impact on the portfolio.

The MSCI workshop also considered a portfolio based on the MSCI US Dollar High-Yield Corporate Bond index. This portfolio started with a tracking error to the benchmark of 37bp. After running the 1.5ºC scenario, the portfolio registered a 13.44% loss. After the optimisation exercise, that loss shrank to just -2.45%.

“This was really achieved by stripping out some of the firms in the US energy sector and some other fairly dirty companies,” said Jack Turner, investment manager at 7iM.

Increased use of climate stress-testing

With the impact of climate change events and policy being increasingly felt by businesses each year, it’s becoming imperative that portfolio managers and investors not only understand the impact of various climate scenarios on their portfolios but are able to tilt them accordingly to retain or even improve performance.

Many firms are beginning to think about this and have already set up working groups. For those that haven’t, the time to move is now, said Moser. “I think, if there is a call to action coming out of the work we’ve done so far, it is that firms need to address this as soon as possible and to set up the working groups that will help inform their strategy and actions on climate investing.”

Main takeaways

- As climate risk can be positive as well as negative, analysis needs to be run not only on the likely risks to high emitters in the portfolio but also on the opportunities for low-carbon companies and those exposed to clean technologies

- Even within high-risk sectors such as energy, there is huge variance in risk. Swapping out high-risk for low-risk energy stock can make a huge difference to the portfolio

- Concentrating on the top three to five issuers in terms of climate risk can make a huge difference

- Swapping out high-risk industrials for those with potential upside – for example, clean tech companies, firms with patents for new green technologies, etc. – could skew an underperforming portfolio towards outperforming

- The sectoral weighting of a portfolio/strategy can be adhered to very closely while still optimising the portfolio for climate performance

- It is possible to treat climate as an additional constraint while keeping the risk and return profile of a portfolio intact

- The tracking error only needs to increase by a small amount to achieve a portfolio that’s optimised for climate

- There’s an investment opportunity from the positive contribution of some industrials to climate change and the race is on to benefit from that.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net