This article was paid for by a contributing third party.More Information.

Automated for the people

Regulatory risk is a key concern for Asia-Pacific non-banking financial firms, particularly in light of a lack of support from regulators, according to research from Asia Risk and Wolters Kluwer. Many organisations are investing in automation to ease this pressure.

The risk management challenges facing today’s non-banking financial market often stem from regulatory change. Organisations within the sector recognise they are moving into a new era as regulators roll out revamped regimes that are intended to increase transparency and limit the impact and spread of future market crises. However, many firms continue to struggle to find solutions that can help them respond to regulatory change. While infrastructural change is clearly necessary in this new market environment, what system elements should organisations focus on to address new rules and standards? And, more to the point, can they develop the necessary tools and processes to not only support essential compliance efforts but also create an offering that can compete in the face of current and future market changes?

As concerns about regulatory risk and dissatisfaction with support from regulators continue to permeate the Asian financial market, many organisations anticipate an increase in infrastructural investment this year, according to a survey conducted by Asia Risk and Wolters Kluwer. The survey of more than 140 market participants was conducted across a range of job functions, as well as organisation types and sizes, across a variety of countries within the Asia-Pacific region. Respondents answered questions about current challenges and concerns in relation to risk management, as well as investment plans in areas such as data management and general technological infrastructure.

The results reveal that market participants face a range of challenges in risk management, and many have concerns about regulatory risk in particular. Organisations in the region have a list of regulation-related concerns, topped by concerns about simply keeping abreast of change. The ability to address rules from multiple jurisdictions via internal systems and processes was also a running theme among participants. It is unsurprising then that investment in automation looks set to be a key trend over the next year, according to the survey. This would allow organisations to create an internal infrastructure that is not only compliant, but also allows organisations to use new requirements implemented since the 2008 financial crisis to boost performance. The results show that some firms already have automated systems and processes in place, but most organisations have plans for investment in this area in 2016. If these firms live up to the investment expectations outlined by the survey respondents, the resulting developments could address the concerns relating to compliance and risk management that are evident throughout the survey results. But will these investment plans come to fruition?

Current challenges

According to the survey, the three greatest challenges facing financial organisations operating in the Asia-Pacific region in 2016 are compliance, operational risk management and financial risk management. The specific results vary based on the country, job function and company type surveyed; however, the results highlight the variety of issues faced by financial market participants throughout the region. For instance, financial risk management is viewed as a major challenge for 73% of Asia-Pacific securities firms, as well as 70% of risk managers across all regions. Operational risk management is seen as highly challenging by finance (60%), risk (70%) and IT professionals (100%), according to the survey, as well as by those respondents currently working at asset management companies, insurance firms and, to a lesser extent, hedge funds. Compliance is considered to be a major challenge by nearly 60% of portfolio managers, but also by 62% of respondents currently employed by asset managers and 60% of those at securities firms across Asia-Pacific.

By investing in technology, organisations can do a lot to address challenges in areas such as compliance and operational and financial risk management. However, the survey shows that current attitudes to technology are middling throughout the market. When those polled were asked to date their organisation’s approach to technology, the most common response was “adequate” (40%), followed by “good” (22%), “excellent” (18%) and finally “poor” (16%).

Among company types, hedge fund employees were most likely to rate their organisational approach as “excellent” (38.5%), otherwise “good” or “adequate” (both 40%). Eighty per cent of those working at securities firms rated their respective organisation’s approach to technology as “poor” (47%) or “adequate” (33%); and nearly 60% of asset managers described their organisation’s approach as “adequate”. The survey found that organisations must develop a better attitude towards technology development in order to create the tools and systems that will allow for better management of risk, especially as new regulations strengthen the requirements around reporting and transparency.

Regulatory woes

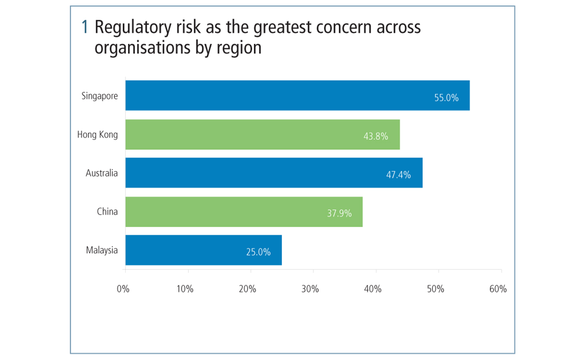

Drilling down into the details of Asian market participants’ current worries, the survey asked respondents to score risk-related concerns on a scale of one to seven. Regulatory risk was rated the number one concern by nearly half of respondents to the survey. Looking at the results by function, regulatory risk is the top concern among portfolio managers, risk managers and compliance professionals. On a geographical basis, a significant proportion of respondents polled across all countries ranked regulatory risk as the number one issue – from 25% in Malaysia to 55% in Singapore (figure 1). While regulatory risk is not the major worry for market participants in every country surveyed, it is clearly an important issue across the Asia-Pacific region.

This level of concern among so many market participants is unsurprising given the abundance of new rules and standards issued on a rolling basis by regulators throughout the global financial markets. World leaders at the Group of 20 (G20) summit in Pittsburgh in 2009 pledged to co-operate “to raise capital standards, to implement strong international compensation standards aimed at ending practices that lead to excessive risk-taking, to improve the over-the-counter derivatives market and to create more powerful tools to hold large global firms to account for the risks they take ... to reform the global architecture to meet the needs of the 21st century.”

These pledges have led to the development of a complex web of rules and standards that are now being rolled out on many levels across global financial markets. In addition to regulatory regimes with global reach, such as the Basel III reforms aimed at the international banking sector, market participants in Asia-Pacific must also assess the likely impact on their activities of major initiatives from other regions, such as the US Dodd-Frank Wall Street Reform and Consumer Protection Act or Europe’s Alternative Investment Fund Managers Directive. Asia-Pacific market participants must also adhere to regional developments relating to financial regulation such as the Securities and Futures Act – the Monetary Authority of Singapore’s response to the G20 objectives – which was mentioned by several survey respondents as a key priority for their organisations in 2016.

Lack of support

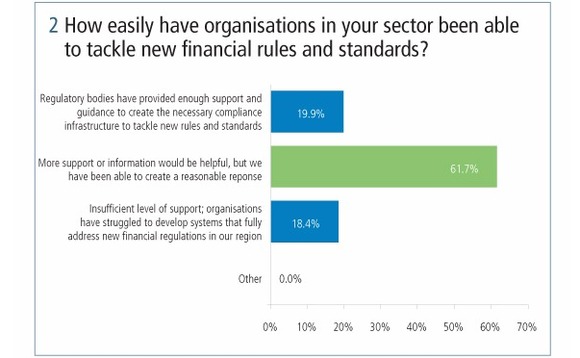

While the current regulatory burden would be difficult to shoulder under the best of circumstances, the survey also uncovered an undercurrent of dissatisfaction with the level of support provided by regulators in the region. According to the results, nearly 20% of respondents deem regulatory support “insufficient”, leaving organisations struggling to develop the necessary systems to address new rules. More than 60% say more support would be “helpful”, with just under 20% of respondents currently satisfied with the level of support provided by regulatory bodies so far (figure 2).

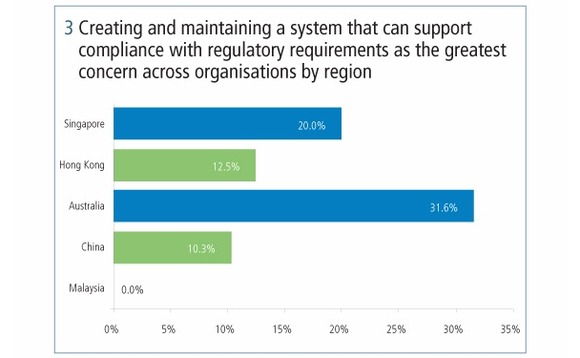

When asked to score specific concerns relating to preparing for new regulations on a scale of one to five, around one-fifth of respondents identified the major issues to be one of the following: understanding rules from other jurisdictions, remaining competitive in spite of regulation and keeping up with regulatory changes. While it was rated the top concern by the fewest number of respondents (17%), the difficulties of developing and maintaining systems that can satisfy regulations on a multi-jurisdictional basis remain a theme among a section of all demographics polled. The survey revealed that respondents in a variety of countries believe creating such systems for compliance purposes could be problematic (figure 3), for example, while around 20% of risk managers, IT managers and portfolio managers were most likely to view this issue as a concern, along with similar numbers of asset management firm and hedge fund employees.

Investment plans

These concerns about changing regulations and the ability of organisations to make the necessary infrastructural preparations in response could explain the high expectations around future investment in automation. More than three-quarters (76%) of respondents work at organisations that plan to invest in automation during 2016.

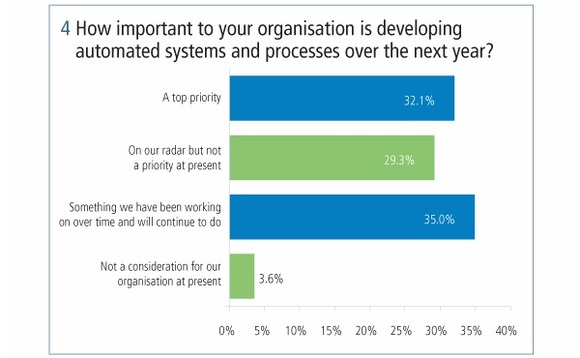

By investing the necessary time and resources, organisations can develop the tools and infrastructure that would allow them to embrace this new regulatory era. But will this happen given the dim view that many employees have of their own organisations’ attitudes to technology? Some firms are already starting down this road and others have plans to do so in 2016, according to the survey. While one-fifth of respondents still operate manually, more than half already have some kind of semi-automated compliance/regulatory system in place. But practically all of those surveyed expect their respective organisations to invest in additional resources that will enhance automation of areas such as risk management, finance and compliance in 2016. Nearly one-third see this as a priority for their organisation, and a similar number say it is “on our radar”, but 35% of organisations polled have already been working on developing automated systems and processes for risk management, finance and compliance purposes (figure 4).

These results indicate that organisations may not feel that current systems are up to par when it comes to the new requirements that are being implemented across the global financial markets. While it is unlikely that new or improved systems will alleviate the concerns about the lack of regulatory support identified in the survey, increased automation should address participants’ worries about the ability of their organisations to satisfy rules in multiple jurisdictions. Managing multi-jurisdictional risks manually would be an incredibly complex undertaking, greatly increasing operational risk for organisations. Automation, on the other hand, allows firms to ensure compliance with a range of regimes with much greater efficiency and accuracy.

These results indicate that organisations may not feel that current systems are up to par when it comes to the new requirements that are being implemented across the global financial markets. While it is unlikely that new or improved systems will alleviate the concerns about the lack of regulatory support identified in the survey, increased automation should address participants’ worries about the ability of their organisations to satisfy rules in multiple jurisdictions. Managing multi-jurisdictional risks manually would be an incredibly complex undertaking, greatly increasing operational risk for organisations. Automation, on the other hand, allows firms to ensure compliance with a range of regimes with much greater efficiency and accuracy.

Data management challenges

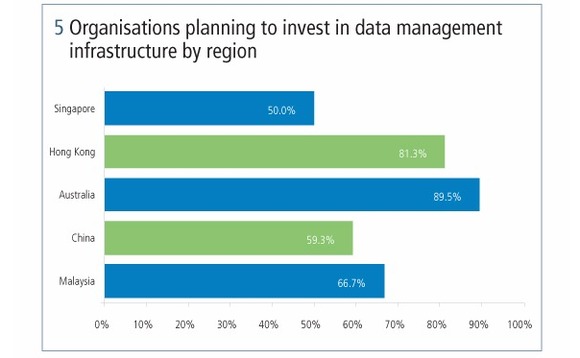

Data management is an infrastructural area that is likely to benefit from an investment boost in 2016, according to the survey. Nearly half of respondents across all regions see this as a major challenge in the current regulatory environment, and 66% expect their organisation to invest in data management infrastructure in 2016. This issue is particularly pronounced in Australia and Hong Kong, where data management was earmarked for investment by 90% and 81% of survey participants respectively (figure 5).

Insurance firms see data management issues as a major challenge (75%), as do asset managers (50%) and banks (58%). However, when it comes to future investment, only 33% of insurance firms have plans to invest in this area in 2016, compared with 67% of asset managers and 64% of banks. Among the various occupations polled, data management was generally seen as a major challenge, but the urgency of this issue varied – 75% of compliance professionals and 67% of IT managers highlighted data management when asked about challenges, compared with 40% in both the treasury and finance job function categories. A similar percentage of respondents from compliance (71%) and the same percentage from IT (67%) say their organisations plan to invest in data management over the next year, indicating that these firms are aware of and are eager to act on employees’ concerns about data management infrastructure.

Insurance firms see data management issues as a major challenge (75%), as do asset managers (50%) and banks (58%). However, when it comes to future investment, only 33% of insurance firms have plans to invest in this area in 2016, compared with 67% of asset managers and 64% of banks. Among the various occupations polled, data management was generally seen as a major challenge, but the urgency of this issue varied – 75% of compliance professionals and 67% of IT managers highlighted data management when asked about challenges, compared with 40% in both the treasury and finance job function categories. A similar percentage of respondents from compliance (71%) and the same percentage from IT (67%) say their organisations plan to invest in data management over the next year, indicating that these firms are aware of and are eager to act on employees’ concerns about data management infrastructure.

Again, regulation is almost certainly a key driver behind the emphasis on data management throughout Asia-Pacific that can be seen in the survey results. Organisations are aware of the need to manage the increasing flow of data that is now necessary under new rules and standards introduced by regional regulators following the global financial crisis that began in 2008. By placing more emphasis on transparency and introducing more rules relating to reporting and record-keeping as a result, regulators have placed the onus on financial firms to gather, collate and manage increasing amounts of data. The granularity and frequency of reporting has increased under rules such as the Basel Committee on Banking Supervision’s Principles for effective risk data aggregation and risk reporting (BCBS 239), which require organisations to prove that reported data is both accurate and complete.

Organisations that wish to move beyond merely ticking the boxes when it comes to compliance can use automation to optimise their data management systems and processes, increasing efficiency and adding further depth to their analytical capabilities. Nearly all respondents to the survey say automation is either very important (68%) or quite important (30%) to their respective organisation’s data management systems and processes, showing that it will play a key role in 2016 and beyond.

The focus on infrastructural development shown in the survey is a promising sign for the market. Regulatory risk remains a key concern that causes confusion for many market participants, particularly in light of the perceived lack of support from regulators identified by the survey. It is possible to use technology to address these challenges, however, and organisations in Asia-Pacific are already looking towards such solutions. Investment plans show that many firms recognise the need for infrastructural change and have the capabilities to develop the necessary tools to monitor and respond to regulatory change. It remains to be seen, however, if the investment plans outlined by respondents to the survey will bear fruit in 2016, resulting in a welcome boost to operational and financial risk management strategies throughout the market.

Read/download the article in PDF format

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net