Korea to start mandatory clearing in October 2013

Legislative hold-up means Korea OTC derivatives clearing will be delayed

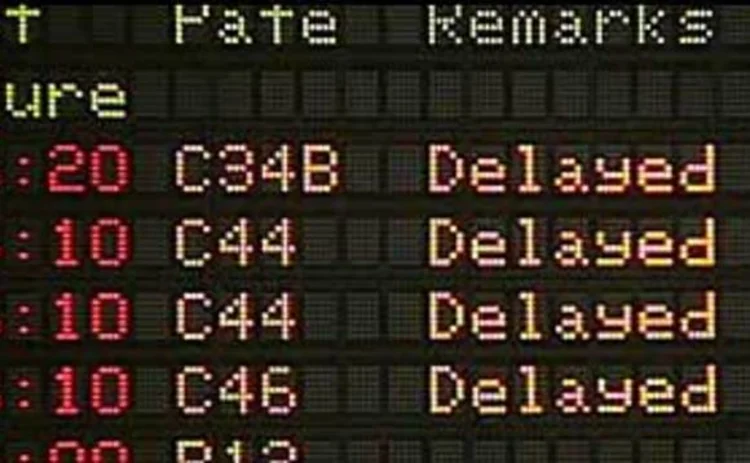

Korean legislators failed to pass the over-the-counter clearing bill on Thursday, dashing hopes that clearing in Korea could be kick-started, with mandatory clearing now slated to commence in October next year.

The Korean OTC clearing bill passed the first legislative committee stage last week, but was resisted at the second stage by opposition party members distracted by the upcoming presidential election and requesting further time to discuss the provisions, says Jae-Joon Lim, director of business development in the derivatives market division at the Korea Exchange (KRX) in Seoul.

Korea tried to pass a package of amendments to its Capital Market Act to allow the establishment of Korean investment banks, alternative trading systems and OTC clearing. However, only OTC clearing made it to the second stage.

Last month, KRX told Asia Risk that it would struggle to meet the end-2012 deadline originally agreed by the Group of 20 to clear standardised OTC derivatives, but Lim says he is hopeful the bill might be passed this week to allow the Korean clearing house to push on with its plans.

"Unfortunately, the bill was rejected but government officials say the bill will be passed. It is not a question of whether it will be passed or not, it is just a matter of time. I expect it will now be passed in February [at the next committee meeting]," he says.

Voluntary clearing in Korea is now slated to start in April next year, with mandatory clearing set for October. Lim says 79 banks and securities companies are expected to sign up to KRX's clearing service, which will start clearing won interest rate swaps to be followed at a later date by non-deliverable forwards and credit default swaps.

Client clearing will also commence in tandem with the start of mandatory clearing of interest rate swaps but only for financial institutions that are unable to access the clearing house directly.

Minimum capital requirements will be 300 billion won ($276 million) for proprietary clearing members and 500 billion won for full members that also offer client clearing services.

KRX also has plans next year to apply to be a derivatives clearing organisation under the Commodity Futures Trading Commission's rules in order to be able to clear derivatives where one or more counterparties are US entities.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Clearing

Derivatives funding: smart solutions for a complex environment

Eurex’s cleared repo and GC Pooling offerings are helping market participants overcome challenges in the funding, financing and collateral markets

Taming the systemic risk Hydra: 10 years of mandatory clearing

Regulators, clearers and market participants reflect on a decade of the clearing requirement

Switching CCP – How and why?

As uncertainty surrounding Brexit continues and the impacts of Covid-19-driven market volatility are analysed, it is essential for banks and their end-users to understand their clearing options, and how they can achieve greater capital and cross…

BNP leads a comeback for Europe’s clearers

Brexit, leverage ratio tweaks and concentration fears could help European banks compete with US FCMs

Clearing conundrum – Forging a solution for the bilateral market

Central clearing has had a beneficial effect on the over‑the‑counter derivatives market, but for some products the road to a cleared model has not been smooth. Capital, operational and margin costs of the non-cleared market have increased, while…

Clearing conundrum – Forging a solution for the bilateral market

Sponsored webinar: LCH

Asia clearing surge raises concerns over eligible collateral

Scarcity of high-quality liquid assets gives rise to liquidity risk worries, say banks

Buy side: central clearing 'a mess' as sell-side dialogue hits 'fever pitch'

Asset managers want to see futurisation of swaps get off the ground in Europe