Complex short Vix products draw fire as vol plumbs lows

Hedging effects mean popular exchange-traded products vulnerable to big losses if volatility spikes

Need to know

- Market participants are piling into exchange-traded products (ETPs) that are short US volatility in a search for yield, with a lot of interest coming from retail investors.

- Analysts though are worried the complex structure of the products might not be well understood by retail investors, and may cause losses if volatility returns.

- The ETPs are based on indexes referencing the price of futures on the Vix volatility index. The Vix reflects volatility on the S&P 500 index.

- These futures are sensitive to volatility of volatility, so can spike on relatively small S&P moves. The low Vix means high percentage moves, and thus large losses, are more possible.

- If volatility rises, the products hedge by purchasing more volatility, raising concerns of a doom-loop scenario.

- The ETPs have stop-loss features, but the final value may be lower than the levels indicated in the prospectus.

- Issuers have warned the products should be used only as a short-term trading strategy, but there is evidence investors are holding them longer term.

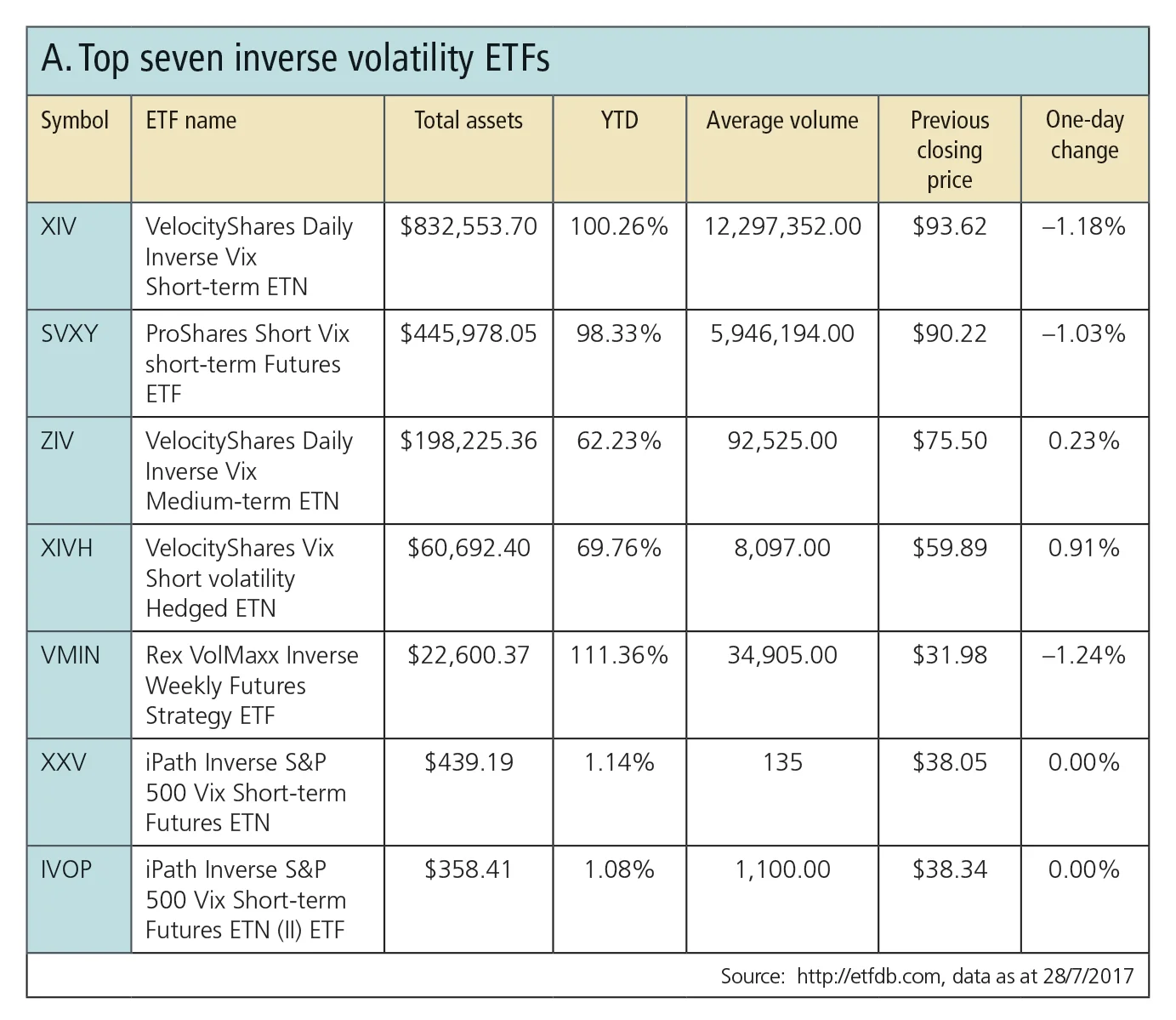

With US stock market volatility creeping lower and lower, investors searching for yield have piled into exchange-traded products (ETPs) that are short volatility. They have performed phenomenally well: three out of the top five short volatility products in terms of assets have almost doubled in value in just a year’s time. As such, investors, particularly retail, have flocked to the product (see Table A).

“We are almost at a record in terms of buyers towards the short side. Normally there is quite a long bias, that is, if you take the long exchange-traded notes (ETNs) minus the short ETNs, the assets under management are still long biased. At the moment we are almost back to near-zero, which is historically very unusual,” says an equity derivatives strategist at BNP Paribas.

But while the products have performed well, traders and analysts on both the buy and sell sides are increasingly worried the products could wreak havoc on unsuspecting investors if volatility returns, given its low current level. Critics say the products are very complex, contain hidden leverage, are being used incorrectly and are positioned in such a way that could lead to a doom-loop scenario, where the rehedging of the products after a volatility spike causes it to rise further.

“There is a lot of crowding, particularly from retail money in the US, into these inverse Vix ETNs, which means the potential for a short squeeze when volatility spikes could be quite substantial,” says one equity strategy head at a European bank.

The products, known as inverse Vix ETPs, are ETNs and exchange-traded funds (ETFs) based on the movement of indexes that track the price of futures referencing the Chicago Board Options Exchange’s Vix index. The Vix is constructed based on the implied volatilities of a wide range of S&P 500 index options and typically used as a measure of expected market volatility.

The short exposure to the futures index is achieved by selling Vix futures of different maturities. The desired level of leverage for these products is then maintained by buying and selling the futures on a regular basis. Put simply, if the futures index keeps falling – as it has for some time (see figure 1) – the products make money.

Popular products such as the VelocityShares Daily Inverse Vix Short-Term ETN, issued by Credit Suisse and known as the XIV, come with a leverage of –1, while others have two-times leverage (see figure 2). But the leverage is in reference to Vix futures, not the Vix index or the underlying S&P 500 index, so it’s sensitive to volatility of volatility. This can move faster than the underlying share index and, given the low levels of current volatility, it’s much easier to see large percentage jumps.

“If you look at May 17, the S&P was down 1.8% and the XIV lost 17%. A 1.8% move seems big right now because volatility is very low, but historically that’s not really that big,” says Taylor Lukof, founder of asset manager ABR Dynamic Funds. “It was a several standard deviations move considering the environment we are in and that caused a 17% loss in XIV.”

Given the futures index can produce big jumps on a relatively small share index move, many describe this as a form of leverage. “It is not leverage in the technical sense; it is more leverage in terms of market exposure. We have seen scenarios where some products have lost more than 15% where the market only lost 2%,” says Vincent Denoiseux, the head of quantitative strategy at Deutsche Asset Management.

The products also need to be rehedged daily, and if volatility jumped the products would become volatility buyers – which some say could force volatility up further, triggering a loop effect.

The products do have a stop-loss trigger, set at 80% of initial value for the XIV, or 40% for two-times leveraged products. But if these triggers were breached, the hedging activity of the dealers looking to close out their positions could push volatility even higher, making the end-of-day value go to zero. As there is no cap on how far volatility can go, ETN-issuing banks could also face losses beyond the initial amount invested in the underlying notes.

Many believe these effects are unlikely to be understood and managed well by the retail investors that are flowing into this market in larger numbers. And despite warnings in the prospectus to not treat the products as buy-to-hold, some say there is evidence that retail investors are doing the opposite.

Non-linear risk

The inverse Vix products exist essentially to capture the premium in the term structure of the Vix futures curve. Longer-term points on the curve are assumed to be more expensive than shorter term. So the product is designed to sell the Vix futures contract that matures in two months’ time and buying back the contracts with a one-month maturity daily. “That’s the premium it’s trying to capture, by selling high at the two-month point and hopefully buying it back lower, if the one-month point is lower, because generally, you would expect there to be less volatility over a shorter time horizon,” says Kirtan Bains, an executive director in the index structuring team at Nomura in London.

For inverse Vix ETNs with leverage of –1, the fund would have to be 100% short the front-month Vix futures contract, which is a month away, and roll part of that exposure to the second month’s contracts on a daily basis and finish the cycle 100% short the second month contracts. The leverage also needs to be maintained by rebalancing – or buying and selling Vix futures – typically at the end of every trading day.

Each ETP provides a return related to the daily performance of its underlying index, which is based on the performance of a portfolio of Vix futures contracts, such as the S&P short-term futures index (see figure 1).

One key problem is that the impact of rebalancing the inverse Vix ETPs is not linear because of the so-called short-gamma exposure. In other words, a spike in volatility causes the value of the underlying ETPs to rise, and so the sensitivity of the futures to volatility also increases. To rebalance its position, the product would then need to buy volatility in a rising market, locking in losses and potentially pushing up volatility further.

“The Vix ETPs need to buy volatility as it rises, hence can amplify an adverse move – that is, a volatility spike – through their trading behaviour,” says Nitin Saksena, head of US equity derivatives research at Bank of America Merrill Lynch (BAML).

Pravit Chintawongvanich, head of derivatives strategy at Macro Risk Advisors, says this could kick off even larger moves.

“If you had enough of a market move – which I don’t think you need a huge one from these low volatility levels – I think their buying pressures could distort things and maybe make the Vix go up by a lot more than it would otherwise,” he says.

This relationship means the relationship between moves in the value of the ETP products compared with the S&P 500 underlying distorts at higher levels of volatility. Some see it as a sort of leveraged exposure to S&P 500 moves.

“They don’t have any official leverage because you are short one times the Vix futures, but the convexity, the volatility of volatility can go up so fast, the Vix can move far faster than the S&P ever could,” says the equity derivatives strategist at BNP Paribas.

“If you have an S&P drop of 10%, then the XIV really starts to accelerate on the downside. And it is not in a linear fashion, and that will only be exacerbated by the heavy positioning people have in these things at the moment,” he adds.

With increased capital requirements meaning banks are unable to hold as much risk, and thus play the traditional shock-absorber role in fast-moving markets as in the past, a situation like this could also see gapping in volatility levels.

“The price discovery can be extremely painful. The main point is the gap risk. So it is not a continuous market. It can be 25 and the next minute it is 30,” says a risk manager at one US bank.

The inverse ETNs do come with stop-loss provisions to protect the issuers. So typically, if there is an 80% spike in the underlying Vix futures, it could shut down the ETNs and the investors would receive 20% of their investment back.

But that’s not guaranteed. The problem is that if a product triggers intraday, its final value is not determined until the end of the day. During that time, the product would need to buy more volatility to wind down its position – potentially pushing volatility up further and reducing the final value of the product, potentially to zero.

For the second largest inverse volatility ETF by assets – the ProShares Short Vix Short-Term Futures ETF, known as the SVXY – this stop-out number is not known for certain, as it would depend on when its broker requests a margin call. However, analysis by Macro Risk Advisors shows that a 60% move in the underlying could cause the product to stop out.

Mean reverting volatility

Given the extremely low levels of volatility, some say large percentage moves are not as unlikely as they used to be. For instance, if the Vix were to move from its current closing value as of July 27 of 10.11 to 18.20, that would be an 80% move.

“Eighty per cent sounds like an extraordinary move, and there hasn’t been a move like that in recent history,” says Josh Thimons, a managing director at asset manager Pimco. “However, with the Vix at 10%, it is not out of the question if there were some exogenous shock that volatility could move from 10% to 18% in a given day, which could potentially trigger shutting down some of the short Vix ETFs.”

Some argue that eventually, volatility would have to rise and revert to more long-term average levels, which is a key property of the risk measure.

“There is an assumption that volatility is mean reverting. It is, by definition. We are in a very low-volatility regime now. There is an assumption of the fact that volatility can never go up again. At some point the risk will emerge, whether that is central bank-led or geopolitical-led or North Korea launching a nuclear missile – god forbid, who knows? When that day comes the assumption on volatility and liquidity, in my opinion, [will be] misguided,” says a senior equity derivatives source at the US bank.

However, the strange dynamics that afflicted the volatility markets after last June’s Brexit shows that predictions on what will happen may not pan out as expected.

There are risks in there for ETN issuers as well. As there is no upper limit for where volatility can rise to, dealers unwinding the short positions on a product that had triggered can be left on the hook for more than what investors paid via the note.

“Let’s say volatility goes from 10 to 21, that means the short futures have lost 110% of their initial value. The ETN issuer can get 100% from investors, that is, all of the money invested in the ETN. Where will the other 10 come from? Well, the ETN provider would have to take that hit,” says Nomura’s Bains.

Don’t buy to hold

Due to the complexity of the underlying fund structure, inverse Vix ETNs are typically marketed as a short-term trading strategy.

For the XIV – the largest inverse volatility ETN by assets, issued by Credit Suisse AG – page 14 of the prospectus states in bold that “because of the large and sudden price movement associated with futures on the Vix Index, and the daily objective of the ETNs … [they] are intended specifically for short-term trading. You should monitor the performance of your ETNs as frequently as possible, even intraday”.

The prospectus also makes it clear that the ETNs are meant to provide daily exposure to the underlying as opposed to long-term exposure, and that the performance of the product is related to the underlying Vix futures and not the Vix index itself. In addition, it states the relationship between the level of the Vix Index and the underlying Vix futures will begin to break down as the length of an investor’s holding period increases, even within a single day.

The shares outstanding are not declining, meaning people invested are letting their positions run and are not monetising the very strong year-to-date returns

Nitin Saksena, Bank of America Merrill Lynch

Despite the warning, some say there is evidence for investors holding their securities over longer terms. “The shares outstanding are not declining, meaning people invested are letting their positions run and are not monetising the very strong year-to-date returns,” Saksena at BAML says.

Some believe retail investors would even struggle to understand the products in the short term. “The issue is you are likely to have two different effects: the level effect, so the level of the Vix itself; and then there may be a curve effect, so how the futures term structure will be distorted in the market. It is a complex topic, unlikely to understood by direct retail clients,” says Deutsche Asset Management’s Denoiseux.

Hedge funds and day traders that commonly trade these products may have systematic hedging strategies to mitigate losses or might combine this product with other strategies. For instance, some have looked at relative value strategies, such as variance swaps, to obtain a short position on volatility by trading realised versus implied volatility.

Investment management firm ABR Dynamics Funds, on the other hand, has developed an index that has exposure to a mix of short Vix futures and US Treasuries, which have historically been anti-correlated to reduce the impact of a volatility spike.

“We are using the front two months of the Vix futures in that index, and what we’re looking to do is capture most of the upside of shorting volatility while mitigating the downside. We have managed to essentially cut the drawdown in half from being short volatility,” says Lukof at ABR.

But for those investors not sophisticated enough to hedge, a volatility spike could mean big trouble. “Folks that are using it to buy and hold and think they can make easy money are the ones that get clobbered when volatility does spike,” says Tom Balcom, founder of 1650 Wealth Management.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

Credit traders await resolution on delayed swaps index

Market participants confident CDX Financials fix will overcome regulatory obstacles

BofA sets its sights on US synthetic risk transfer market

New trading initiative has already notched at least three transactions

BNPP ups efforts to weed out skew sniffers

French bank deploys skew sensitivity algo to help identify predatory behaviour

BlackRock exec pushes for FX swaps Clob

FX head Chaudhry says all-to-all venue could boost TCA, price discovery and spur algo trading

FXGO eyes platform upgrades with new fee model

Bloomberg’s brokerage charges will fund upcoming automation and TCA projects

EU bonds favoured over swaps as hedge for European debt

Hedge funds are increasingly using the bonds to hedge Bunds and OATs as swap correlations decline

Canada benchmark shaken by T+1 hedge fund influx

Shortened settlement cycle swept hedge fund trades into Corra, making the rate more volatile

Basis swaps surge amid US repo concerns

Fed funds-versus-SOFR swap volumes nearly quadruple as declining Fed reserves impact funding rates