This article was paid for by a contributing third party.More Information.

Changing derivatives strategies to address the new normal

The events of 2020 have propelled liquidity and collateral management to the top of the priority list for many buy-side organisations. A recent survey by Risk.net and Eurex explored how derivatives strategies are changing in response

Operational complexity intensified across global financial markets during 2020. The outbreak of Covid-19 in December 2019, the ensuing global pandemic and continued Brexit developments have reverberated throughout the markets, prompting participants to rethink their business strategies.

Even as most of the world emerges from the worst of the pandemic, the threat of new variants or another pandemic has triggered a repositioning of key strategies based on the lessons learned over the past year. There is a new awareness of the need to prepare for the unexpected, while also monitoring the impacts of ongoing issues such as major political changes – Brexit, for example – and ongoing regulatory developments.

Eurex and Risk.net polled 89 senior derivatives trading and strategy executives at buy-side organisations in the UK, Europe, the US and Asia during the first quarter of 2021, and found that concerns about operational complexity and market volatility are high in this new environment.

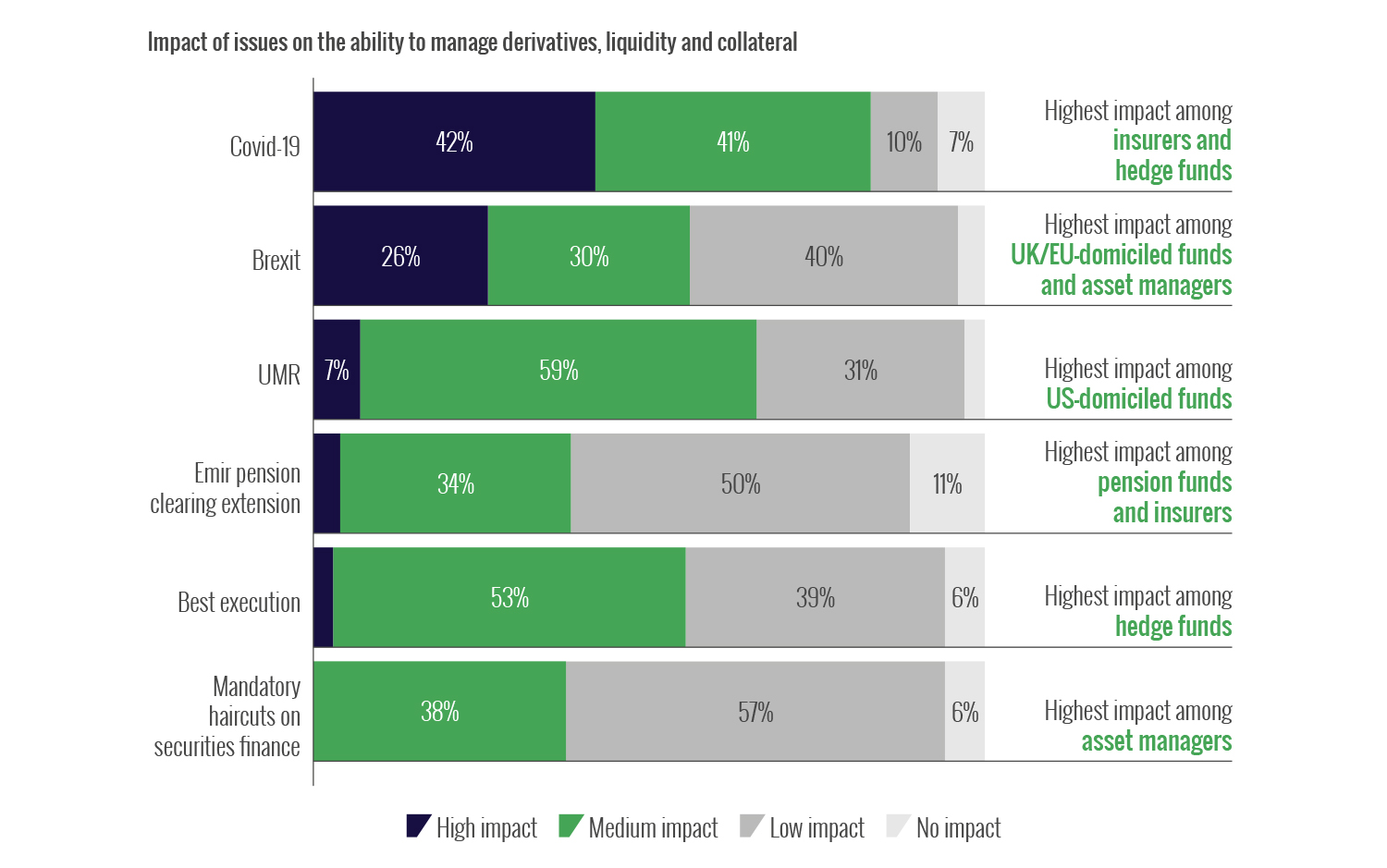

Regulatory developments have also continued to unfold for these market participants in the background of these major events. Survey participants were polled on current regulatory issues such as uncleared margin rules, best execution requirements, pension clearing exemptions under the European Market Infrastructure Regulation and mandatory haircuts on securities finance. A majority indicated that such initiatives had some impact on the ability to manage derivatives, liquidity and collateral last year. This also underlines the growing need for strategic change.

So, while regulation continues to change, Covid-19 and Brexit sharpened this focus during 2020. But such concerns look likely to continue to affect derivatives portfolios, liquidity and collateral management at buy-side firms. Operational complexity and market volatility are seen as the biggest challenges to tackle for the next two years, according to the survey results.

A white paper exploring the full set of survey findings examines how buy-side priorities are being prompted to evolve when it comes to derivatives strategies. It also looks at the steps these firms can – and are – taking to address such change. For many of the firms polled, refining processes and creating efficiencies to improve liquidity and collateral management will be key in coming years.

Collateral and margin management and optimisation capabilities will be prioritised, as will efforts to transfer more derivatives business to central counterparty (CCP) clearing, according to the survey results. There is also a growing acknowledgement of the benefits of direct or sponsored access models across several transaction types among these buy-side organisations.

Market infrastructure providers such as Eurex are supporting clients’ responses to these changes. Relevant initiatives have aimed to boost efficiency and make markets safer and more resilient. The results can be seen in new access models developed in recent years to offer improved execution terms, stronger risk management capabilities and better access to liquidity during unexpected bouts of market volatility.

More work is certainly needed to support wider adoption of such models. For instance, the Risk.net/Eurex survey showed that some concerns remain among buy-side firms around using such models. This is particularly apparent in relation to legal framework complexity and the ability to cope with CCP clearing house margin calls. On the other hand, very few respondents are concerned about agent availability or believe there are “insufficient benefits” to moving to a direct/sponsored access model for CCP-cleared transactions.

To summarise, the survey highlights a clear acknowledgement among buy-side firms that future-proofing derivatives portfolios and managing collateral and liquidity issues should remain high on their agendas. As more buy-side firms adopt new methods such as direct access models, they stand to benefit from improved execution terms, stronger counterparty credit risk management and greater access to liquidity in future crisis situations.

For the full survey findings, download the white paper The changing shape of buy-side derivatives strategy

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net