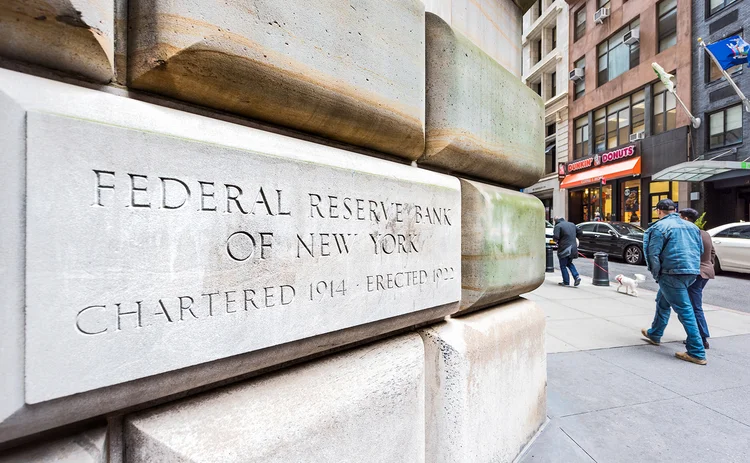

Fed group: SOFR term rate unlikely in 2021

ARRC chair says use case of a forward-looking benchmark would be limited

The development of an official forward-looking version of the secured overnight financing rate by the end of 2021 is in serious doubt after the chair of a key industry group backed by the Federal Reserve tempered expectations for such a benchmark.

Tom Wipf, chair of the Alternative Reference Rates Committee, quashed any notion that a term SOFR – originally pencilled in for June 2021 – would be ready by mid-year and doubted one would be available by year-end.

“We don’t think we’re going to be

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

‘Trump slump’ hedges rise on rate cut fears

One dealer notes fivefold increase in number of clients hedging against possibility of faster rate cuts

Short-term Trump FX trades ‘dead’ as euro rallies

EUR/USD spot rally and vol spike sees mass unwinds of long USD trades

Disappearing dealer gamma spurs wild stock swings

Stock market selloff leaves dealers perilously close to peak short gamma positioning

German defence announcement hits steepener trades

Rapid euro curve flattening following Merz’s comments last week caught out a number of hedge funds, say dealers

Tech firm OneChronos to offer ‘bundled’ equity-FX trading

New auction algorithms will optimise multi-leg trades; roll-out due later this year

SRT markets kick US banks’ caution to the kerb

Market for capital relief trades continues apace despite US banks’ reluctance to offer leverage

Hedge funds flock to US swap spreads on SLR easing talk

‘Trade of the year’ sees investors position for shrinking negative basis as Treasuries predicted to outperform swaps

China programme trading rules to buoy futures market

Futures firms could adjust strategies to avoid HFT classification under new framework