This article was paid for by a contributing third party.More Information.

Cliff effect might demand risk calculation agility until Libor cessation

Didier Loiseau, global head of rates, bonds and credit at Murex, examines the problems that originate from the spread calculation technicality stipulated by the new International Swaps and Derivatives Association (Isda) Ibor fallback supplement, which incorporates fallback mechanics in derivatives contracts, specifying how rates will move from Libor to risk-free rates (RFRs) upon cessation – or pre-cessation – of Libor. The general logic is now well known: fallback rates will consist of compounded averages of RFRs plus a transition spread, calculated as the historical median of RFR-Libor fixing spreads

At Risk.net‘s Libor Virtual Week, the UK Financial Conduct Authority’s (FCA’s) head of markets policy, Edwin Schooling Latter, reminded us that, under the supplement, any announcement of Libor discontinuation occurring on a given date would immediately trigger the five-year median spread calculation. This trigger would fix the spread in stone until discontinuation occurs. Therefore, if some of the Libors are subject to such an announcement as early as the end of 2020, as anticipated, the corresponding spreads would be fully determined then.

Between the discontinuation announcement and the actual discontinuation – a period possibly longer than one year – practitioners would need to manage Libor positions with a two-regime set of estimated fixings. The first regime, for all fixings before discontinuation date, would need to be estimated off the usual strip of Libor futures and fixing. The second one, for all fixings beyond any Libor discontinuation date, would need to be estimated off the RFR curve, adding the fixed transition spread to the resulting rate.

However, the Covid‑19 pandemic demonstrated that RFR and Libor rates are significantly decorrelated, which is obvious from their fundamental difference in nature. Hence, depending on the respective movements of those rates, the difference between the two regimes – the ‘cliff effect’ – could be sharp. If it is, practitioners will need to significantly amend their pricing/valuation and risk calculation practices to take the cliff into account until Libor eventually dies.

Trading Libor on the cliff edge – A twofold technical challenge

The cliff effect’s challenge is twofold.

First, accounting for a brutal jump when estimating forward rates is unnatural for many rates analytics libraries. Although it is not the first time discontinuity in forwards must be modelled in curves – for example, central banks meeting jumps in the overnight index swap curve – catering for a single, potentially large jump at a fixed date while using completely different calibration instruments on both sides of the frontier is something rather new.

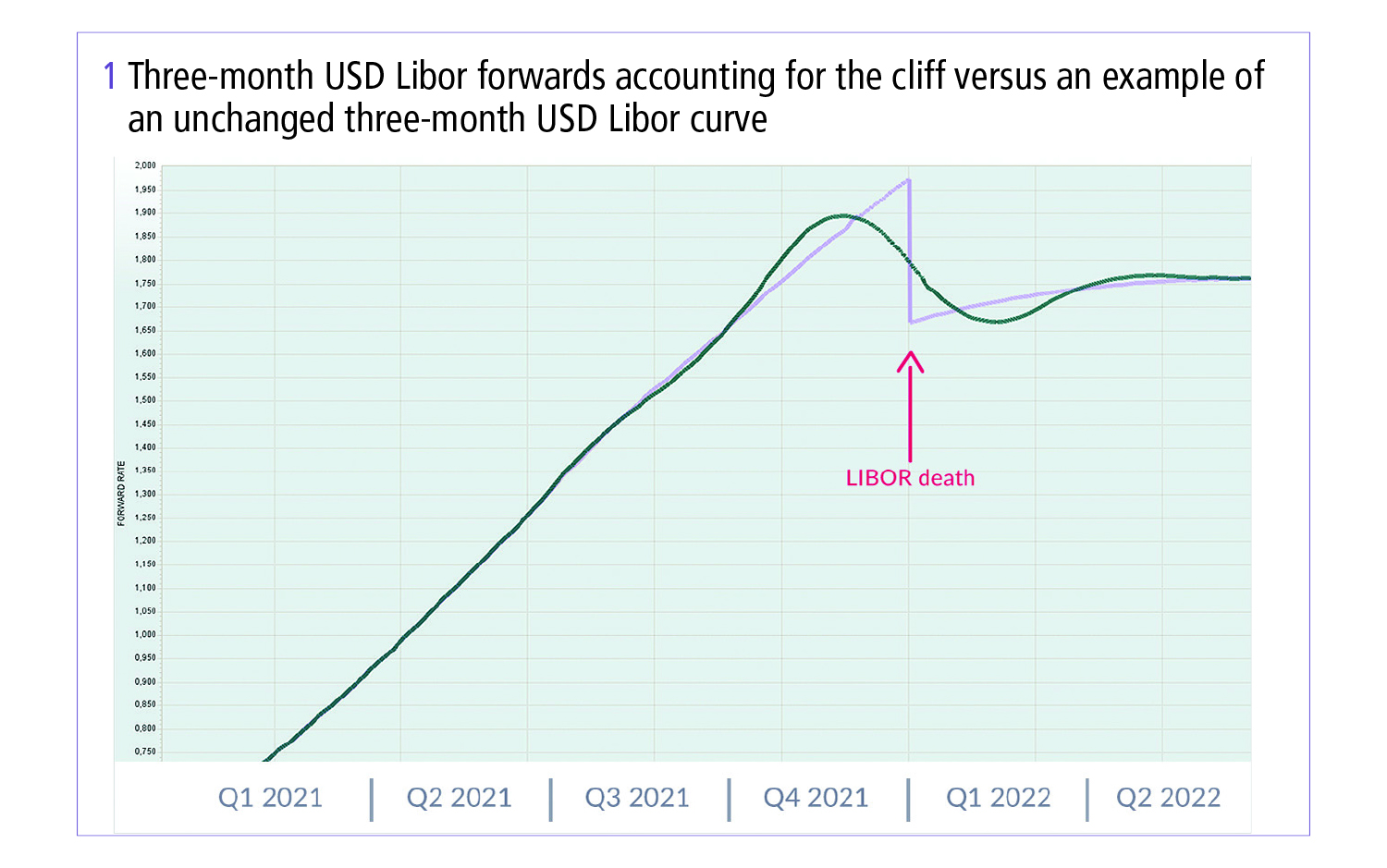

Most rate curve libraries would naturally smooth out rates across the frontier, which would mitigate the brutal nature of the jump. If the magnitude of the cliff is high, trying to force the jump could result in undesirable forward oscillations around the discontinuation date. An adaptation of rate curves libraries is therefore necessary to accommodate such a feature (see figure 1).

The second challenge is the necessity to amend risk calculations. For traders, that means accounting for the double regime forward curve when calculating sensitivities and hedge ratios, so they hedge the short-term fixings with, for example, Libor futures, and long-term fixings with RFR instruments – with a clear cut-off at the discontinuation date. This is yet another challenge that may not be the same as previous ones from a technical perspective and will certainly be an area of focus.

In any case, appropriate modelling of this jump requires significant adaptations of analytics libraries from pricing/valuation and risk perspectives. Should the cliff effect materialise in the coming months, these changes would need to be implemented in a very short amount of time – and would only remain for a limited period.

Trading desks can be enabled to mark the final Libor fixing

Another important factor to consider is how forward Libors can be controlled between the last full Libor instrument and the discontinuation date.

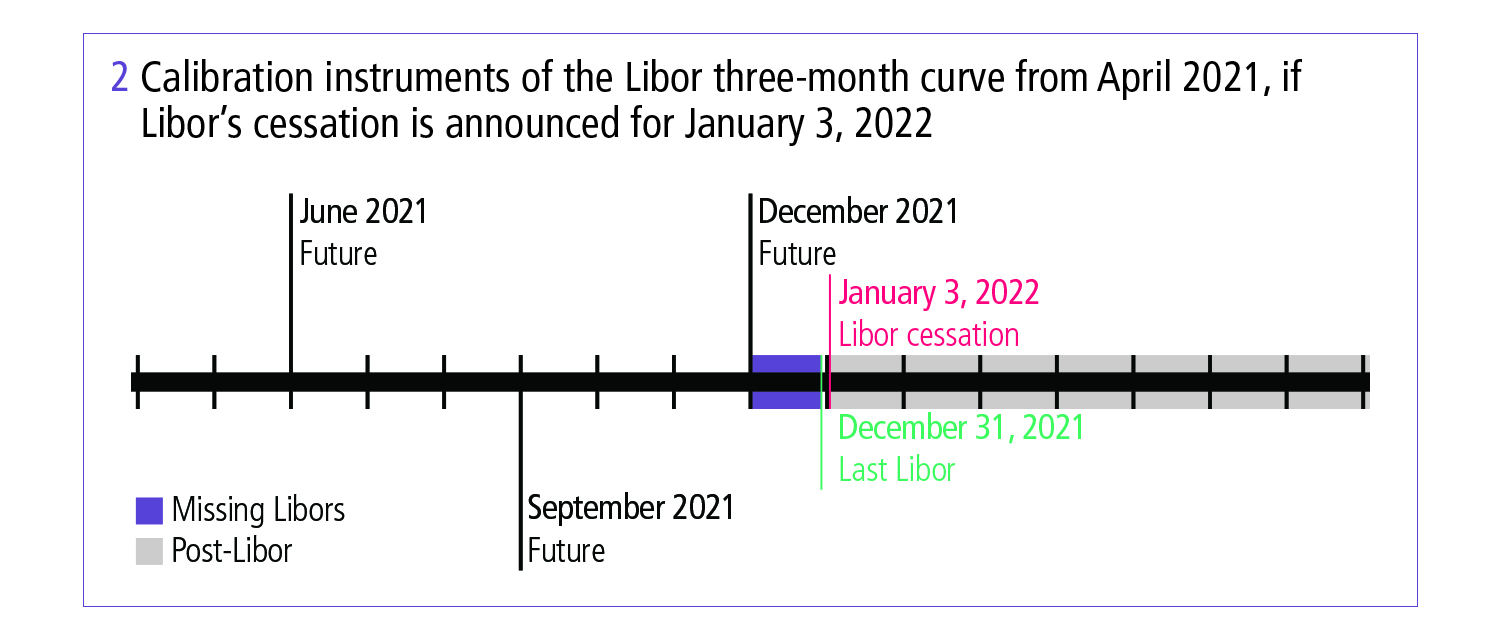

Let’s take the example of the three-month USD Libor curve. Typically, the short term of the curve will be made of future quotes. Assuming Libor ceases on January 3, 2022, the last instrument of the Libor three-month curve is going to be the December 2021 future. This instrument will mark the December 15, 2021 Libor level, but what about three-month Libor levels between this date and January 3, 2022?

These ‘missing’ Libors cannot be calibrated or interpolated from Libor instruments – such as swaps – maturing after the transition date. Their levels will be impacted and polluted by the presence of the secured overnight financing rate (SOFR) + spread fixings on fixing dates after the transition.

Alternatively, relying on flat interpolation between December 15, 2021 and January 3, 2022 would likely be an approximation too rough for many practitioners.

The best solution, therefore, is to enable trading desks to actively mark the very final Libor. In the example presented in figure 2, this is the Libor fixing on December 31, 2021. By interpolation, it also gives full control on the missing Libors – Libor fixings falling strictly between December 15 and December 31, 2021.

Close monitoring going forward is essential

While it is evident the technical challenge is significant, it must be considered that it will only materialise if the level of the cliff is high enough. Indeed, it will keep evolving according to the SOFR curve, the Libor curve and the expected transition spread. Practitioners will need to carefully monitor market levels to know which way to go.

The FCA’s announcements following the release of the new Isda protocol later this year also require close monitoring – only then will market participants need to make a call on whether and how to model the cliff in their pricing, valuation and risk calculations.

Contact info@murex.com for more information about Murex’s packaged solution to manage cliff effects, mark the final Libor and navigate other aspects of the Libor transition.

Libor Risk – Quarterly report Q3 2020

Read more

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net