The carbon equivalence principle: methods for project finance

A method to price the environmental impact of financial products is proposed

CLICK HERE TO DOWNLOAD THE PDF

The carbon equivalence principle states that all financial products shall contain a term sheet of the equivalent carbon flows from greenhouse gases that the financial products cause or enable. This reveals that all existing financial products may already be environment-related. Chris Kenyon, Andrea Macrina and Mourad Berrahoui focus on project finance and show how the costs and risks associated with carbon footprints can be priced. Using a flexible linear

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Cutting Edge

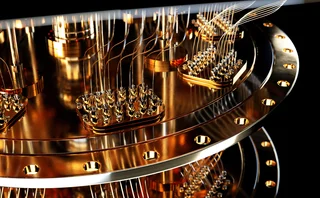

Quantum two-sample test for investment strategies

Quantum algorithms display high discriminatory power in the classification of probability distributions

Market-making in spot precious metals

A market-making framework is extended to account for metal markets’ liquidity constraints

Choosing trading strategies using importance sampling

The sampling technique is more efficient than A-B testing at comparing decision rules

A comparison of FX fixing methodologies

FX fixing outcomes are mostly driven by length of calculation window

Quantum cognition machine learning: financial forecasting

A new paradigm for training machine learning algorithms based on quantum cognition is presented

Backtesting correlated quantities

A technique to decorrelate samples and reach higher discriminatory power is presented

A hard exit threshold strategy for market-makers

A closed-form solution to derive optimal stop-loss and profit-taking levels is presented

Pricing share buy-backs: an alternative to optimal control

A new method applies optimised heuristic strategies to maximise share buy-back contracts’ value