Swaps data: Fed’s change of tack on rates fuels volume rise

Cleared dollar rates jump by half year-on-year, as LCH market share tightens

It was a mixed second quarter of 2019. The US Federal Reserve’s protracted signalling of its July rate cut prompted a significant rise in cleared US dollar rate swaps volumes versus the previous quarter and versus the same time last year. Yet cleared volumes in euro-denominated rate swaps are significantly down, as are credit default swaps in all currencies. Yen rate swaps and non-deliverable forwards meanwhile are flat or modestly up.

Little has changed in terms of market share between the big clearing houses. LCH’s SwapClear is slightly up in US dollar rates, while JSCC is slightly up in yen rates. In credit default swaps clearing, LCH’s CDSClear sees its share tick up in euro CDS clearing.

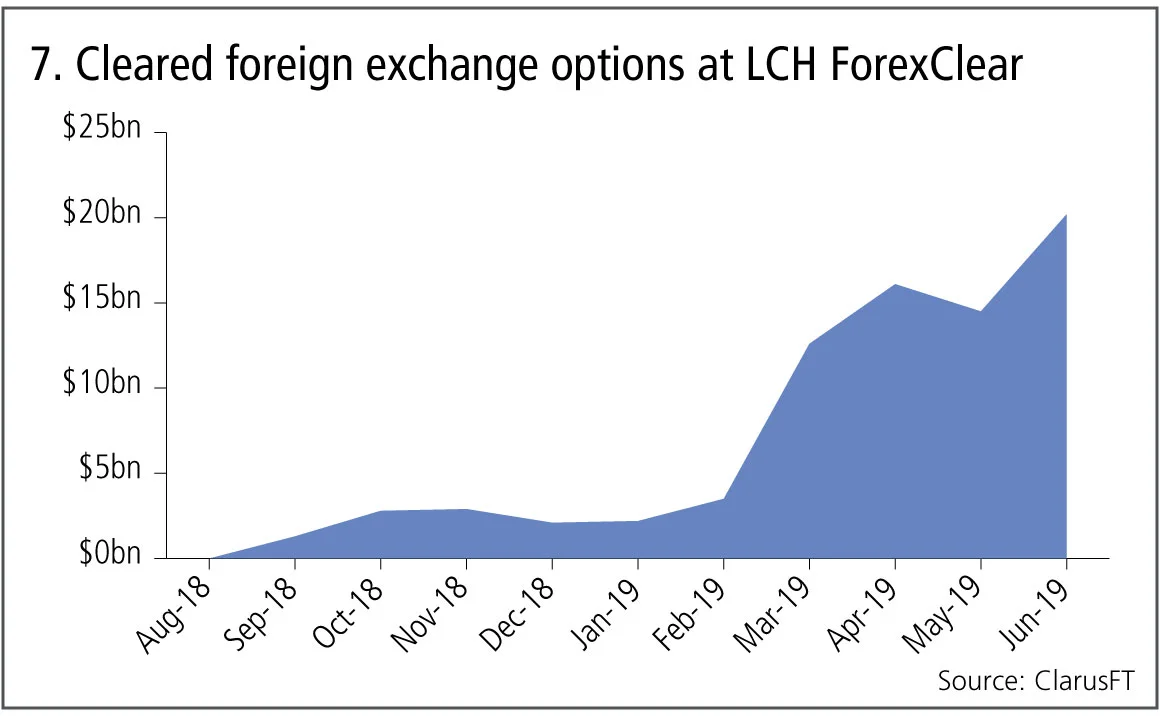

One notable pocket of growth is foreign exchange options clearing, where volumes at LCH ForexClear grew markedly in June. Could this be the first over-the-counter option to move in a big way to clearing? Or will regulators’ decision to split the final ‘big bang’ phase-in of margining for non-cleared derivatives and delay the mandate for smaller swaps counterparties check progress for now?

Some large dealers have historically underpriced their foreign exchange prime brokerage services in order to win more execution business from funds and proprietary trading firms. At least one large bank is repricing its offering to big buy-side users of OTC forex trades, which could be another factor behind the uptick in clearing volumes.

With the costs of trading non-cleared OTC rising significantly for some as a result – and with some banks quietly jettisoning clients in the meantime – the market could yet move to greater use of clearing. LCH should be the main beneficiary, if that happens; if the market instead looks to replicate its currency risk in cash-settled options, however, CME Group could be the happier central counterparty.

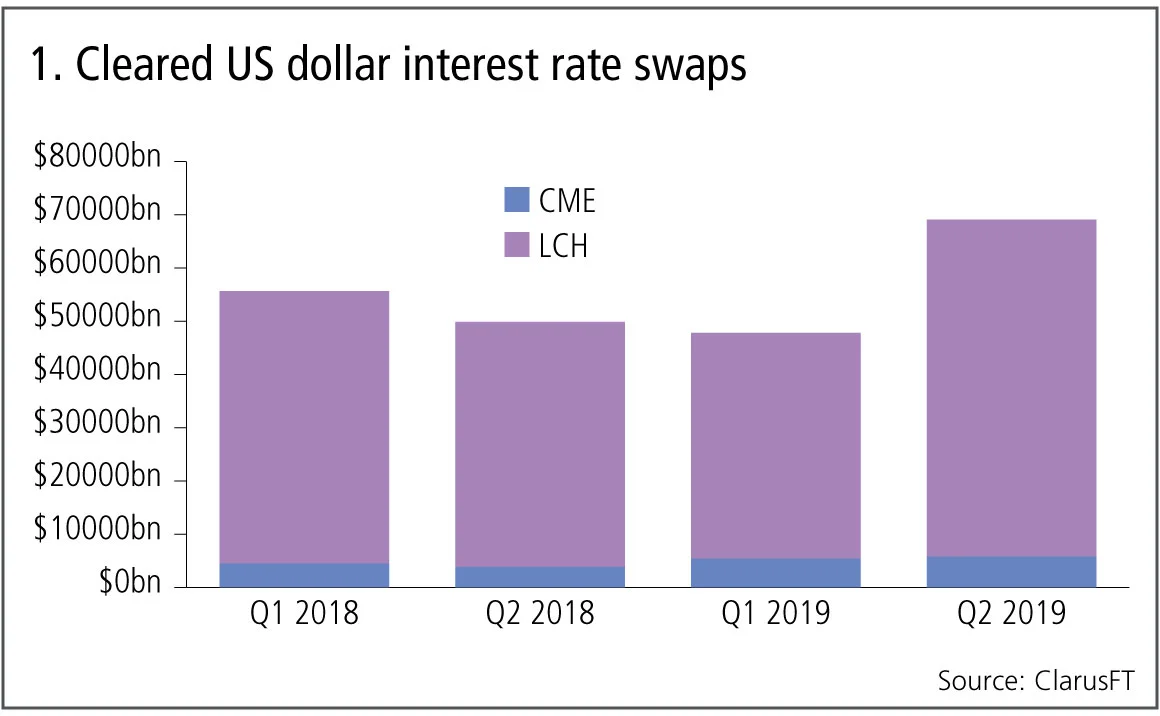

Cleared US dollar swaps

We include all clearable types when tracking US dollar interest rate swap volumes – vanilla fixed versus float, overnight index, basis, zero coupon and variable notional – and use single-sided gross notional volumes.

Figure 1 shows:

- Q2 2019 volumes are 44% higher than Q1 2019, at $69 trillion – 38% higher than a year earlier.

- That’s a very different trend to Q1 2019, which saw volumes fall 14% from a year earlier.

- LCH SwapClear sees its market share increase to 92% in Q2 2019, up from 89% during the prior quarter, with CME down to 8% from 11%.

- In terms of raw volumes LCH SwapClear is up $17 billion from a year earlier, or 38%. CME is up $1.9 billion or 49% from a year earlier.

The Federal Reserve signalling a cut in US interest rates certainly resulted in much higher dollar swap volumes during the quarter, as firms moved to reprice their expectations of a gradually rising path for US rates. However, how the market reacts to Fed chairman Jerome Powell’s verbal intervention dampening hopes of further rate cuts – much to US president Donald Trump’s ire – remains to be seen.

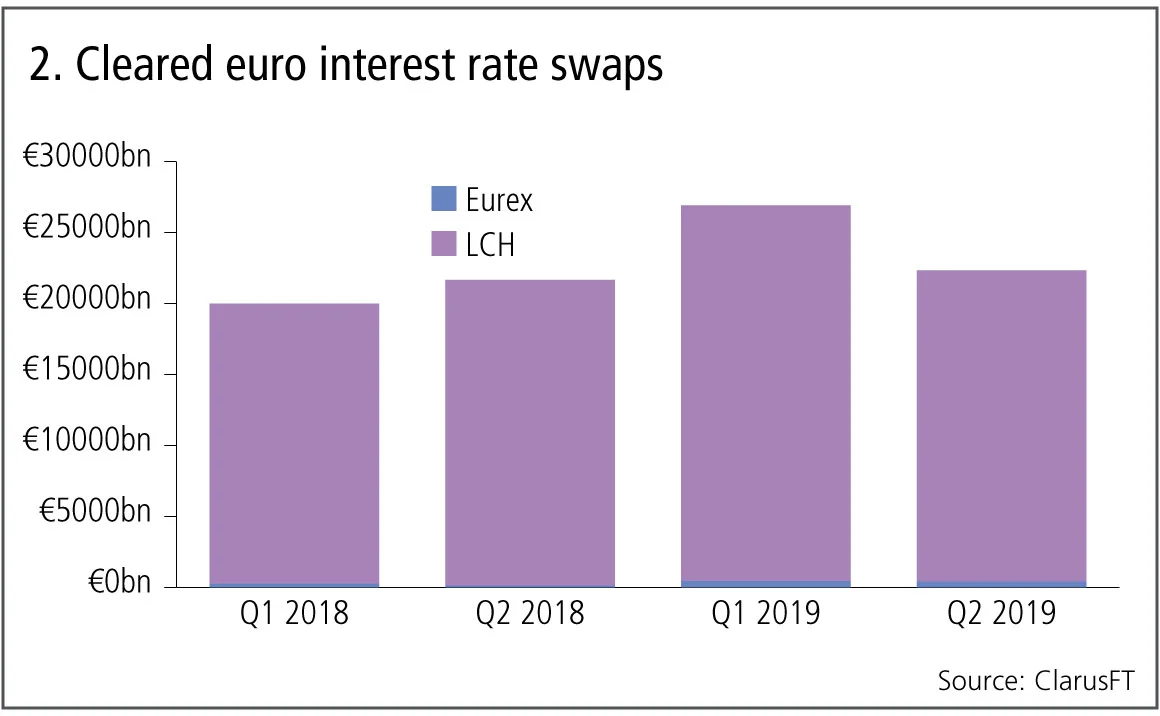

Cleared euro swaps

Figure 2 shows activity in the second-largest product, cleared euro interest rate swaps, across all clearable instrument types.

Figure 2 shows:

- At €22 trillion ($24.6 trillion), Q2 2019 volumes are 17% lower than Q1 2019, and 3% higher than a year earlier.

- Market share split is little changed from Q1 2019: LCH SwapClear has a 98.1% share, Eurex 1.9%.

- In terms of raw volumes, LCH SwapClear is up 2% or €386 billion from a year earlier, while Eurex is up 209% or €286 billion from a year earlier.

So, LCH SwapClear continues its dominance in euro swaps clearing – but Eurex is continuing to grow at a much faster rate, from a much lower base.

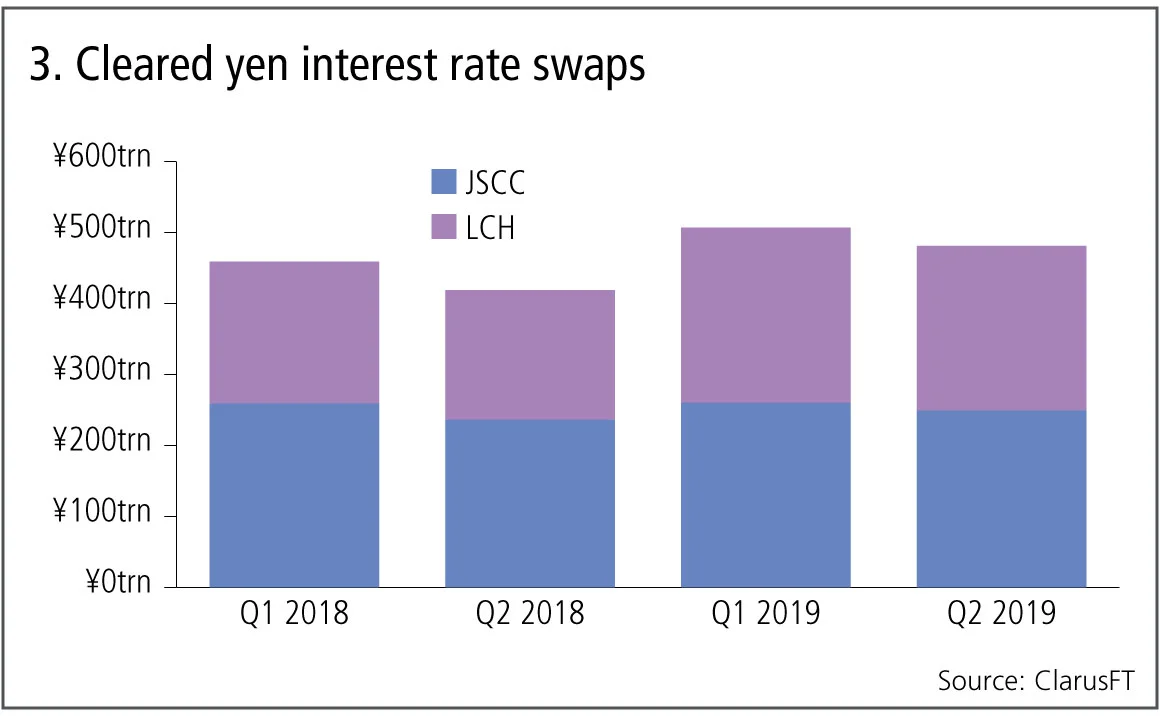

Cleared yen swaps

Figure 3 shows:

- At ¥481 trillion ($4.5 trillion), Q2 2019 volumes are 5% lower than Q1 2019, but 15% higher than a year earlier.

- JSCC market share sits at 52% and LCH’s at 48% in Q2 2019 – a gain of 1% in JSCC’s in favour compared with Q1 2019. A 52:48 split sounds like unfinished business.

- In terms of raw volumes, JSCC is up 5% or ¥13 trillion from a year earlier; LCH is up 26% or ¥49 trillion.

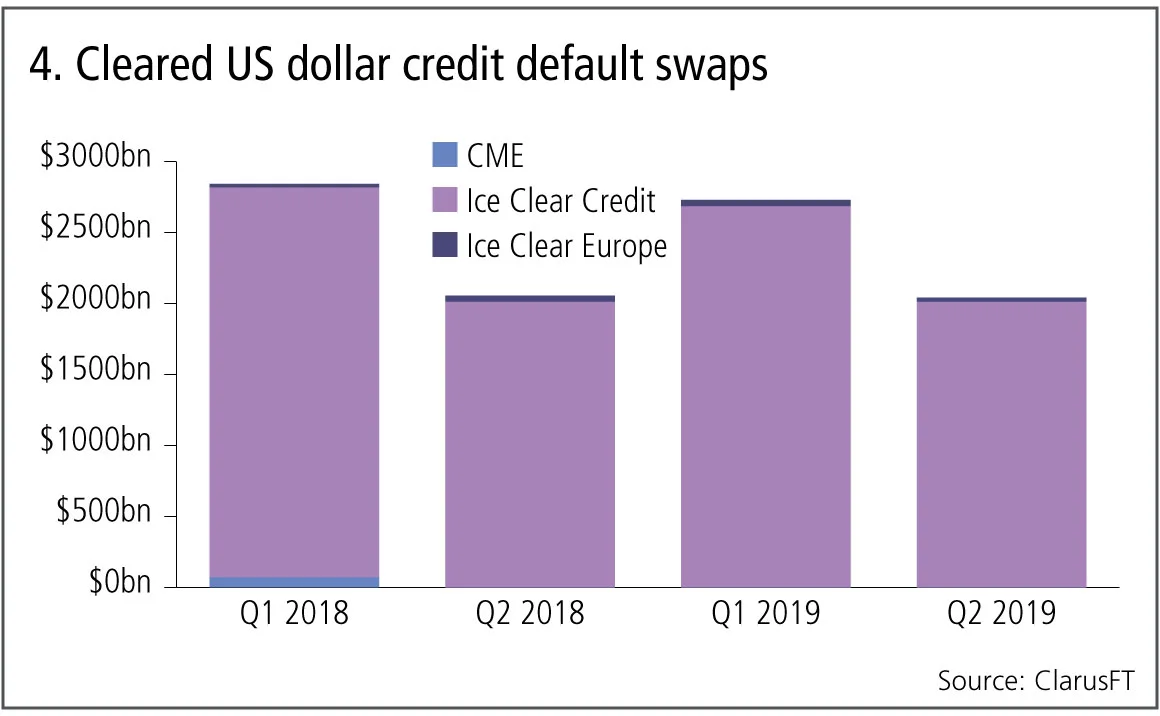

Cleared US dollar credit default swaps

Next, let’s take a look at volumes in cleared dollar-denominated credit default swaps.

Figure 4 shows:

- Q2 2019 volumes are 25% lower than Q1 2019 at $2 trillion, and 1% or $13 billion lower than a year earlier.

- Ice Clear Credit dominates with a 99% market share.

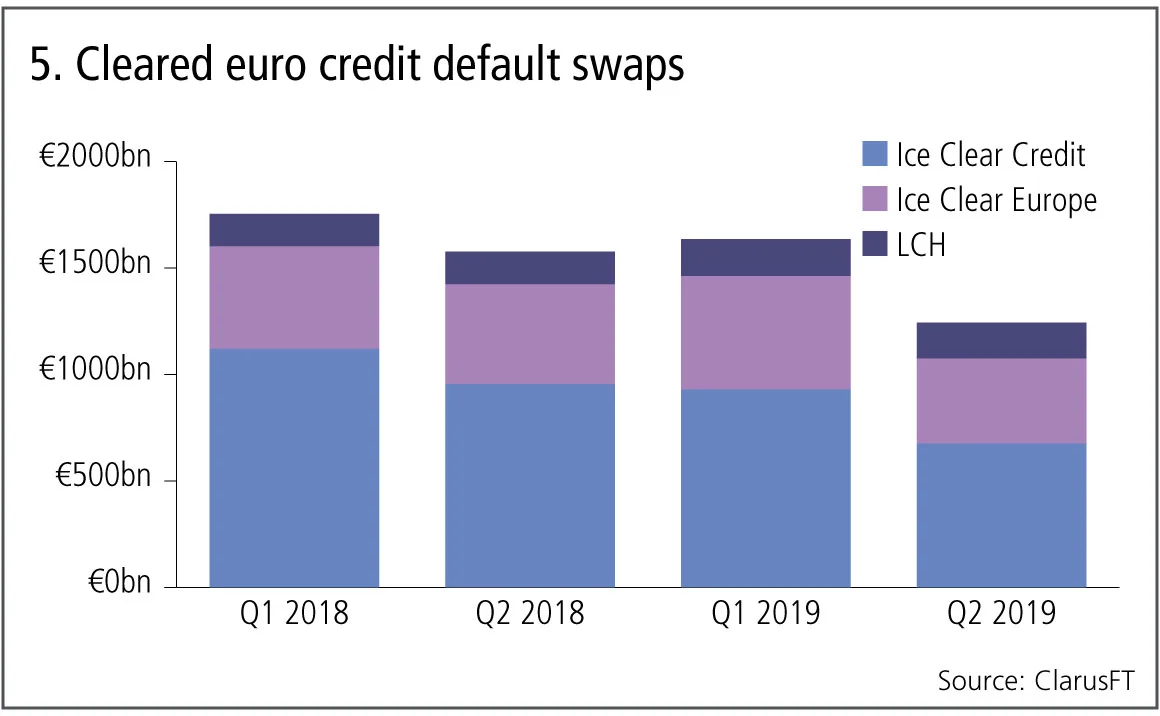

Cleared euro credit default swaps

Next, the volume of credit indexes and single names in euros.

Figure 5 shows:

- Q2 2019 volumes are 24% lower than Q1 2019 at €1.25 trillion, and 21% lower than a year earlier.

- Ice Clear Credit with 54.3%, Ice Clear Europe 32% and LCH CDSClear with 13.7% market share in Q2 2019, which compares with 56.8%, 32.6% and 10.6% in Q1 2019, respectively.

- Ice Clear Credit’s volumes are down 29% from a year earlier, Ice Clear Europe down 15% and LCH CDSClear up 10%.

Cleared credit derivatives volumes denominated in euro mirror the drop in US dollars for the most recent quarter, and show a much larger drop year-on-year, with only LCH CDSClear increasing its volumes and share.

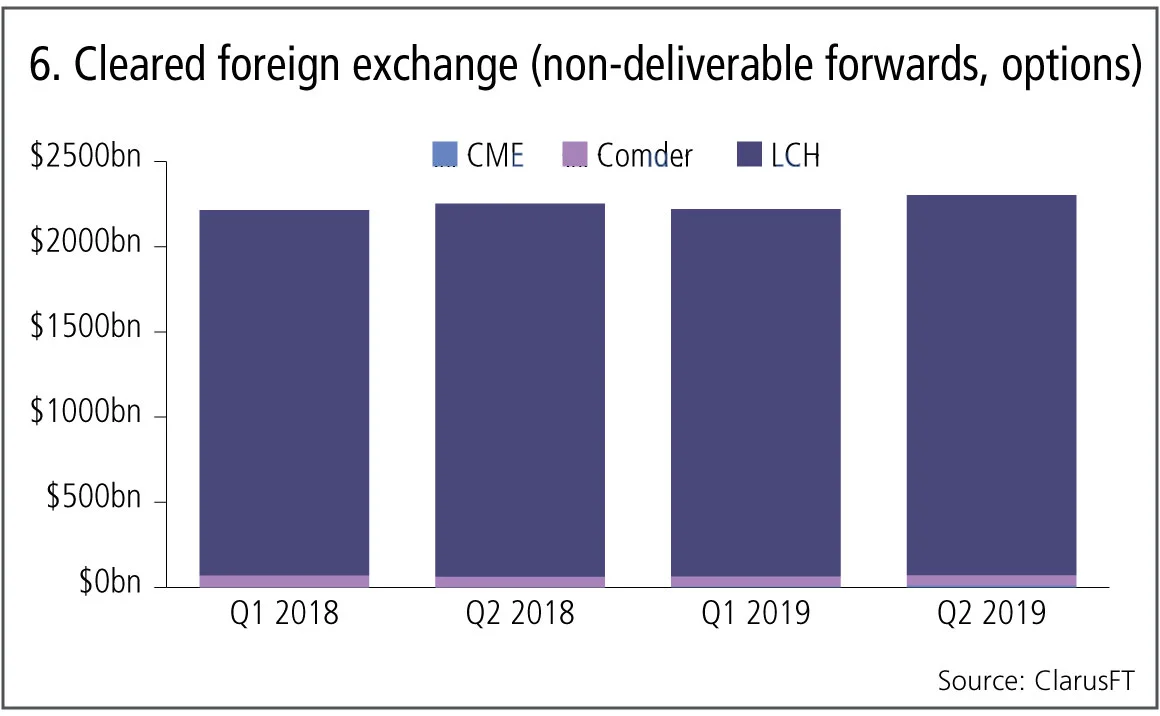

Cleared non-deliverable forwards

Finally, let’s take a look at cleared non-deliverable forwards.

Figure 6 shows:

- Q2 19 volumes are 2% higher than a year earlier at $2.3 trillion.

- LCH ForexClear with 97% share in the quarter, with Comder on 2.6% and CME with 0.5%.

Cleared non-deliverable forwards volumes no longer show their long-running trend of high growth, pre-2018. We may have to wait for non-cleared margin rules phase 4, 5 and 6 for a return to that.

However, delving further into the LCH ForexClear numbers, we do see growth in forex options clearing, with $20 billion gross notional in June 2019, up from $14.5 billion in May 2019.

Amir Khwaja is chief executive of Clarus Financial Technology

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

An AI-first approach to model risk management

Firms must define their AI risk appetite before trying to manage or model it, says Christophe Rougeaux

Op risk data: At Trafigura, a $1 billion miss in Mongolia

Also: Insurance cartels, Santander settlement and TSB’s “woeful” customer treatment. Data by ORX News

UST repo clearing: considerations for ‘done-away’ implementation

Citi’s Mariam Rafi sets out the drivers for sponsored and agent clearing of Treasury repo and reverse repo

Op risk data: Macquarie mauled by securities mismarks

Also: Danske’s costliest branch, tedious times for TD, and WhatsApp won’t stop. Data by ORX News

Climate stress tests are cold comfort for banks

Flaws in regulators’ methodology for gauging financial impact of climate change undermine transition efforts, argues modelling expert

Op risk data: Shady loans robbing Reliance of $1.1bn

Also: H20’s less-than-liquid holdings, Ripple ripped for $125m, and more WhatsApp slaps expected. Data by ORX News

FX algo users change tack to navigate market doldrums

BestX data finds traders ditching TWAP in favour of more opportunistic execution styles

Op risk data: Payday lender Skytrail sees $1.4bn disappear

Also: Cartel claims cost European bond dealers dearly, plus oil price gouging and crypto cover-ups. Data by ORX News