Credit data: ‘dirty diesel’ woes weigh on autoparts firms

Auto supplier default risks have jumped, as environmental concerns hit prospects for diesel vehicles, says David Carruthers of Credit Benchmark

Prospects for the diesel car do not look good. Attempts to rehabilitate the fuel continue, but appear to be running out of time. New emissions tests reportedly show that even new diesel vehicles are pumping out too much nitrogen oxide, and a court in Germany – Europe’s largest car market – recently ruled that cities can ban diesel cars in an attempt to control pollution.

It’s just one of the stresses facing autoparts companies – along with the rise of viable electric cars, the introduction of self-driving software, changes to manufacturing processes and the arrival of more innovative designs.

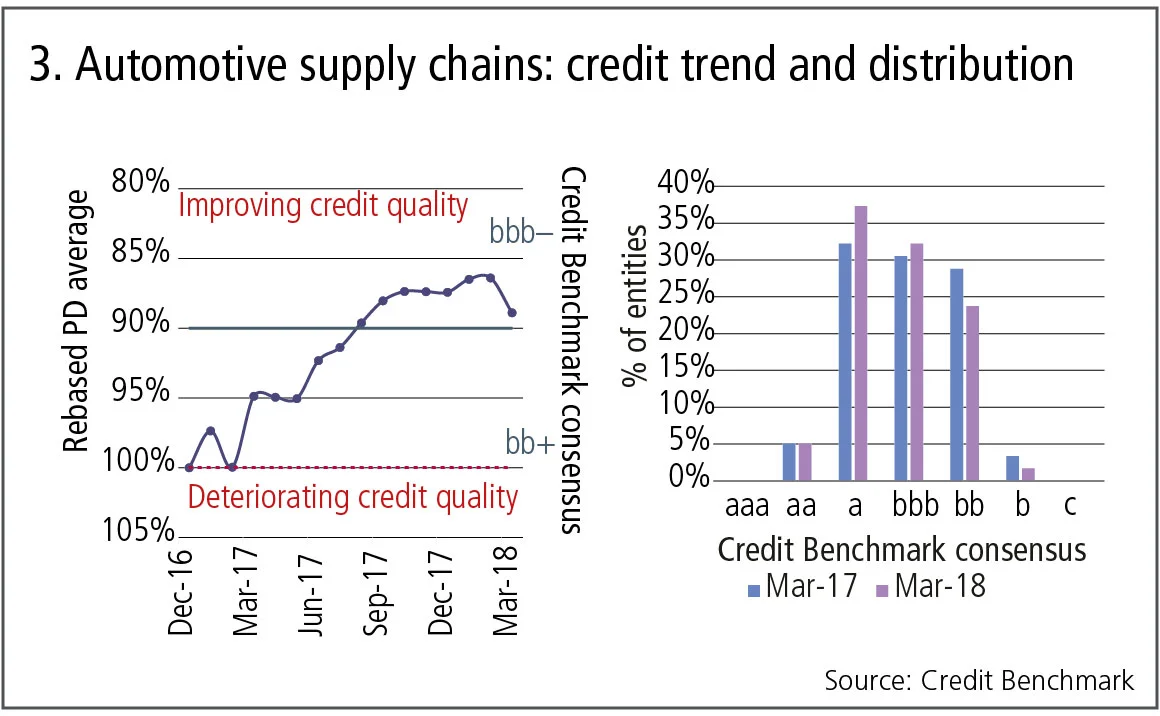

Those challenges appear to have halted a year-long improvement in credit quality for the autoparts sector. Starting in February 2017, banks’ estimates of default risk for 60 of these firms had charted an almost unbroken decline. Over this period, the consensus credit rating derived from these estimates moved from high yield to investment grade – a transition that occurred in August 2017, reflecting broad expectations of improved prospects for the sector.

That trend stopped in February 2018. Following the German court ruling on diesel bans, credit quality for the sector has dipped 3%, having risen 10% over the preceding 12 months.

Elsewhere this month, in the context of the US decision to pull out of the Iranian nuclear deal, we look at sovereign credit risk across the Middle East. We also discuss the recent history of Nasdaq and NYSE earnings surprises across the credit risk spectrum, and review recent research by the Bank of England, which uses Credit Benchmark data to analyse the relationship between default risk and credit default swap (CDS) prices.

Global credit industry trends

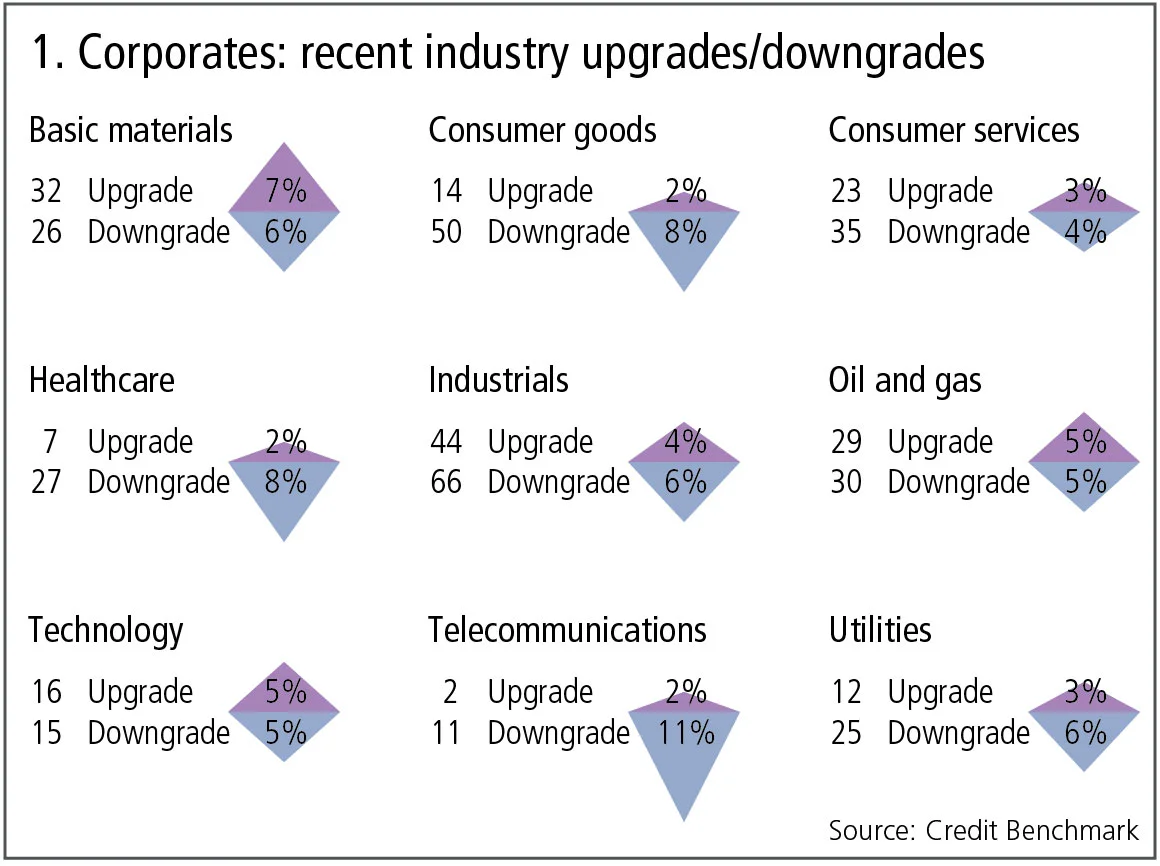

Figure 1 shows industry migration trends for the most recent published data.

Figure 1 shows:

- In global corporates, consensus downgrades outnumber upgrades. Downgrades dominate upgrades in six out of nine industries. One industry is dominated by upgrades and two are balanced.

- Overall, 4% of the global corporates obligors have improved and 6% show a deterioration. Compared with the previous month, the imbalance has switched in favour downgrades.

- Basic materials continue to favour upgrades, following their trend over the last six months.

- Consumer goods and consumer services return to downgrades outweighing upgrades after a month of favouring upgrades.

- Healthcare, industrials, telecommunications and utilities have maintained their recent pattern of downgrades outnumbering upgrades.

- Technology and oil and gas have returned to balance after a period of upgrades outweighing downgrades.

Sovereign credit risk in the Middle East

The recent spike in the oil price is partly driven by Middle East tensions. US withdrawal from the Iran nuclear deal has been one factor, and forms part of the complex political realignment occurring across the Middle East as Saudi Arabia and Iran vie for regional leadership. This rivalry is reflected in plans for alternative gas pipelines; the Russian-backed Iranian pipeline would run through Iran, Iraq, Syria and Lebanon. This highlights the strategic importance of Syria in Middle Eastern politics and shows the clear polarisation that is now emerging.

This polarisation has seen strong electoral performance by Shia candidates in Lebanon and Iraq. While US policy in the region clearly favours Israel, the new realities of Middle Eastern politics have had the surprising result of closer alignment between Saudi Arabia and Israel. And surging oil prices are good news for Saudi Arabia ahead of the enormous – $2 trillion – Saudi Aramco flotation planned for later this year.

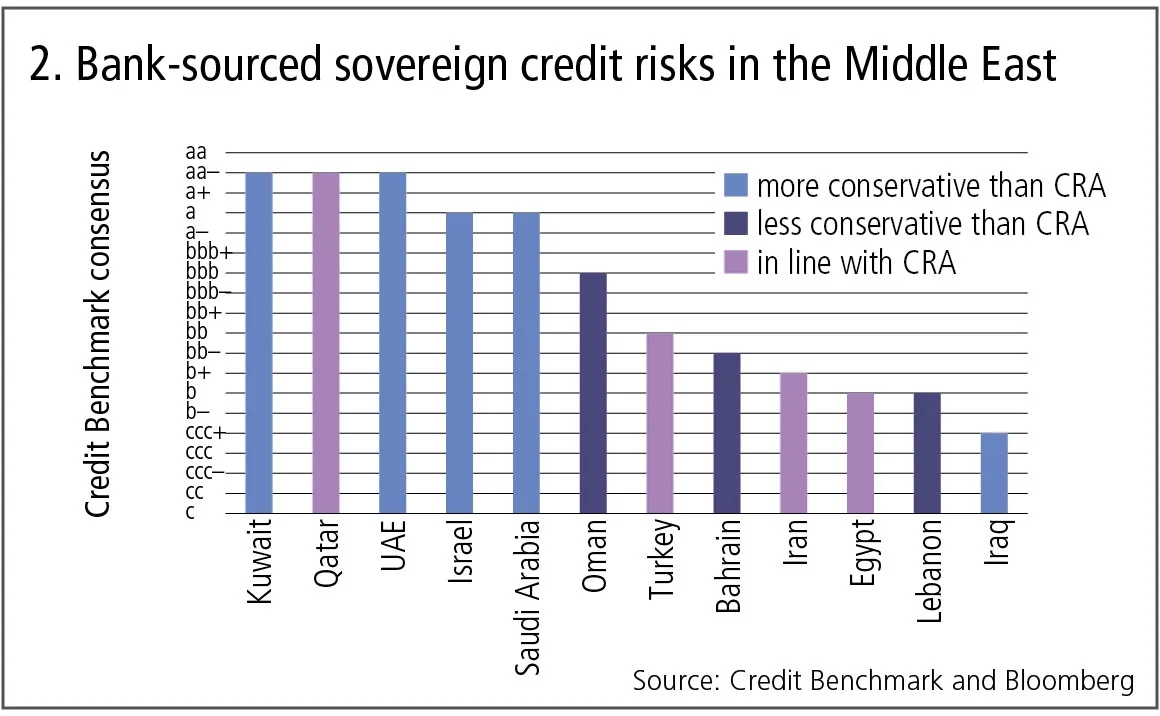

Figure 2 shows bank-sourced sovereign credit risks across the region; it also shows where the bank-sourced credit consensus is significantly more conservative or less conservative compared with the main rating agencies.

Figure 2 shows:

- Saudi Arabia has a Credit Benchmark consensus of a, generally in line with or slightly below the main rating agencies. If oil price rises are sustained, there will be a positive impact on Saudi reserve values.

- Iran does not have a traditional credit agency rating, but bank-sourced data shows a historically stable CBC of b+. The Iranian economy will inevitably suffer from renewed US sanctions, so this is likely to deteriorate.

- Banks are more conservative than the agencies for most of the highest-quality sovereigns in the Middle East, such as Kuwait, Israel and the United Arab Emirates.

- Banks are more positive than the agencies on Bahrain, Lebanon and Oman.

- Iraq is understandably at the bottom of the bank and agency ranking, but the good news is that banks – while conservative – have at least started to do business there again. Some commentators see the latest election result as the start of a “frontier market” recovery. Lasting peace in Syria may seem remote but Iraq’s credit recovery shows how banks quickly return at the first opportunity.

The automotive supply chain

The global auto industry is entering a major transformation. Sales continue to grow at 2–3% a year, but environmental concerns and new technologies mean a prolonged period of uncertainty and realignment for manufacturers and their suppliers.

The environmental drivers include the phasing-out of diesel and the spread of low-emission legislation; technological changes include the advent of viable long-distance electric cars and the introduction of self-driving software.

In addition, the influence of new computer systems, manufacturing processes and innovative designs are putting constant pressure on autoparts companies to evolve and innovate. To manage the new resource requirements, the sector has embarked on a series of mergers and acquisitions.

Figure 3 shows recent credit trends for more than 60 global autoparts companies.

Figure 3 shows:

- The automotive supply chain moved from high yield to investment grade in August 2017, part of a steady improvement between February 2017 and February 2018.

- Since March 2017, credit quality has risen by nearly 10%. However, data for March 2018 shows a 3% deterioration.

- Between March 2017 and March 2018, the credit distribution has improved from bb to bbb and from bbb to a.

US equity earnings surprises

It is unusual for finance research to compare credit risk with equity valuations, but for some companies at critical stages of their credit cycle there may be significant links between equity prices and balance sheet strength.

This section shows the latest results from an expanded analysis of US equity market earnings surprises grouped by credit category, adjusted for the credit distribution of the underlying universe.

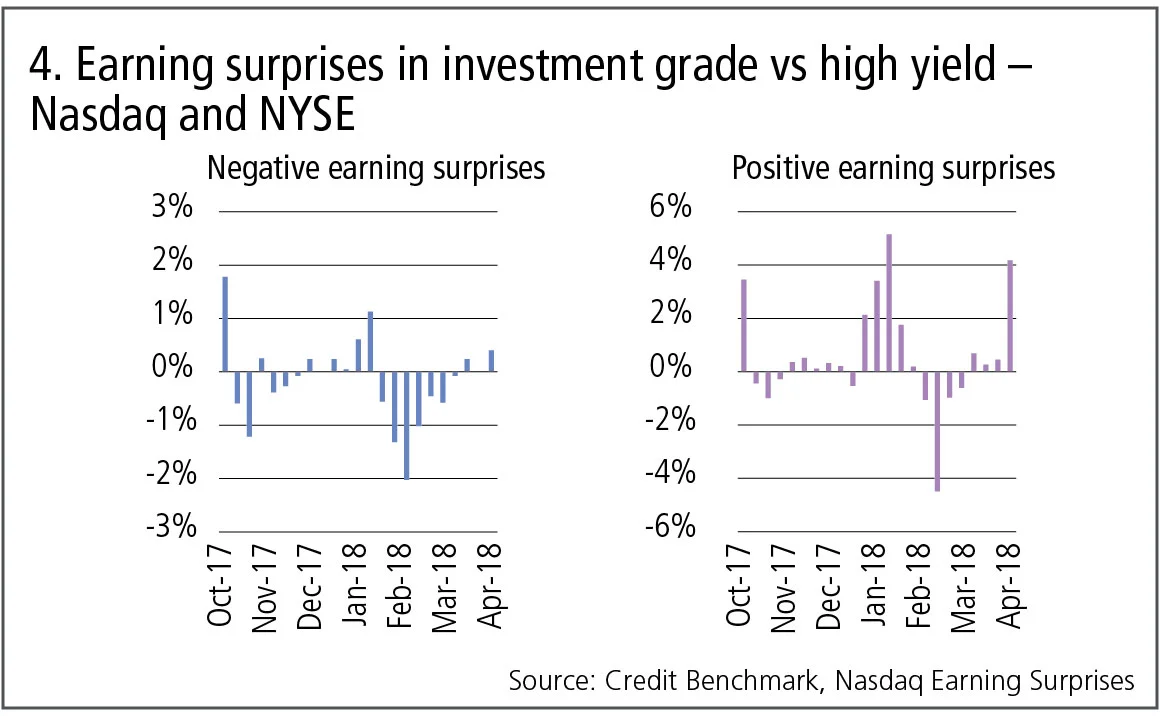

Figure 4 compares the percentage of investment-grade and high-yield Nasdaq and NYSE entities with weekly positive and negative earnings surprises over a period of six months.

Figure 4 shows:

- The relationship between credit risk and earnings surprise shows specific patterns over the past six months.

- High-yield entities showed relatively more negative surprises than investment-grade companies over the past six months. In addition, positive surprises were relatively more common in investment-grade companies.

- The time series of positive or negative earnings surprises in the investment-grade and high-yield categories exhibit moderately positive autocorrelation: if there are relatively more investment-grade positive surprises in a given month, then it is likely that the same will be observed in the following month. The level of positive autocorrelation is 0.4 for negative earnings surprises and 0.5 for positive earnings surprises.

- This autocorrelation appears in Figure 4 as clusters in time of positive and negative surprises.

Bank of England: increased appetite for risk taking

Over the past few years, the Bank of England has been one of the pioneers in research into the credit and liquidity risk premium. In a speech given in April 2018, Bank of England executive director Alex Brazier compared CDS prices and bank-sourced credit risk data. This showed that the appetite for risk-taking has increased since early 2016, as investors seem to be willing to take the same risk for less compensation. The premium for interest rate and credit risk is squeezed, which suggests investors are highly confident about the interest rate outlook and corporate prospects generally.

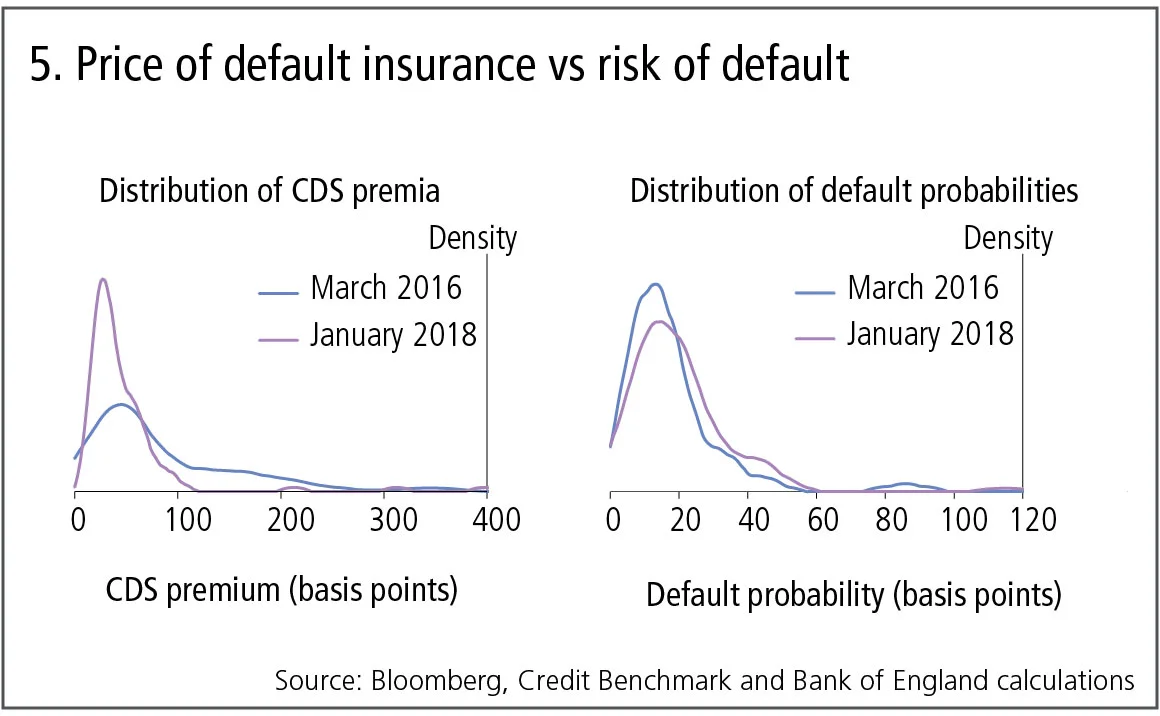

Figure 5 plots start- and end-date frequency distributions for the price of default insurance and default risk.

Figure 5 shows:

- The left-hand chart shows that the average annual cost of insuring against investment-grade corporate default decreased from 85 basis points in March 2016 to 50bp in January 2018.

- The premium was more than 150bp for almost 20% companies at the beginning of 2016, while today there are almost no such cases.

- The right-hand chart shows that one-year default probabilities derived from bank-sourced through-the-cycle credit risk estimates have been broadly stable, suggesting that the change in the CDS price distribution reflects a major reduction in the interest and credit risk and/or liquidity premium over this period.

About this data

The Credit Benchmark dataset is based on internally modelled credit ratings from a pool of contributor banks. These are mapped into a standardised 21-bucket ratings scale, so downgrades and upgrades can be tracked on a monthly basis. Obligors are only included where ratings have been contributed by at least three different banks, yielding a total dataset of almost 19,000 names, which is growing by 5% per month.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

Op risk data: Santander in car crash of motor-finance fail

Also: Macquarie fined for fake metals trade flaws, Metro makes AML misses, and Invesco red-faced over greenwashing. Data by ORX News

‘It’s not EU’: Do government bond spreads spell eurozone break-up?

Divergence between EGB yields is in the EU’s make-up; only a shared risk architecture can reunite them

Why there is no fence in effective regulatory relationships

A chief risk officer and former bank supervisor says regulators and regulated are on the same side

An AI-first approach to model risk management

Firms must define their AI risk appetite before trying to manage or model it, says Christophe Rougeaux

Op risk data: At Trafigura, a $1 billion miss in Mongolia

Also: Insurance cartels, Santander settlement and TSB’s “woeful” customer treatment. Data by ORX News

UST repo clearing: considerations for ‘done-away’ implementation

Citi’s Mariam Rafi sets out the drivers for sponsored and agent clearing of Treasury repo and reverse repo

Op risk data: Macquarie mauled by securities mismarks

Also: Danske’s costliest branch, tedious times for TD, and WhatsApp won’t stop. Data by ORX News

Climate stress tests are cold comfort for banks

Flaws in regulators’ methodology for gauging financial impact of climate change undermine transition efforts, argues modelling expert