Swaps data: forex options – candidate for a clearing mandate?

Volume stats reveal a large vanilla market and much smaller trade in barriers

Foreign exchange options have so far been less affected than other products by changes to the structure of over-the-counter derivatives markets. There is no clearing mandate. This is a result of insistence from regulators that any clearing service should cover the potentially huge settlement risks that arise in physically settled options, when the trade notional in different currencies have to be exchanged. The need to solve that challenge has held back the launch of voluntary services.

As a result, there is also no requirement to use swap execution facilities (Sefs) in the US; only products that are subject to mandatory clearing can be considered for a Sef mandate.

But next year the picture is set to change, with both CME Group and LCH working on forex options clearing services. Trading in the product has also been switching steadily to electronic platforms.

The market is a potential candidate for both a clearing and execution mandate at some point in the not-too-distant future. So, how does it look today?

Vanilla forex options

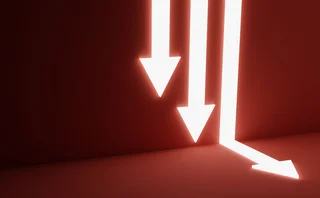

Data from swap data repositories in the US is used here to aggregate trade counts for vanilla forex options, which are traded by US firms in five major currency pairs in each of the past four months.

Figure 1 shows:

- Each month, around 27,000 trades are reported in these five major pairs.

- An average of 1,350 each day.

- USD/JPY has the most trades, averaging 11,400 per month.

- EUR/USD is next, averaging 7,100 trades per month.

- USD/CAD follows with 3,350 trades per month.

- AUD/USD and GBP/USD are 2,700 and 2,300 respectively.

Gross notional

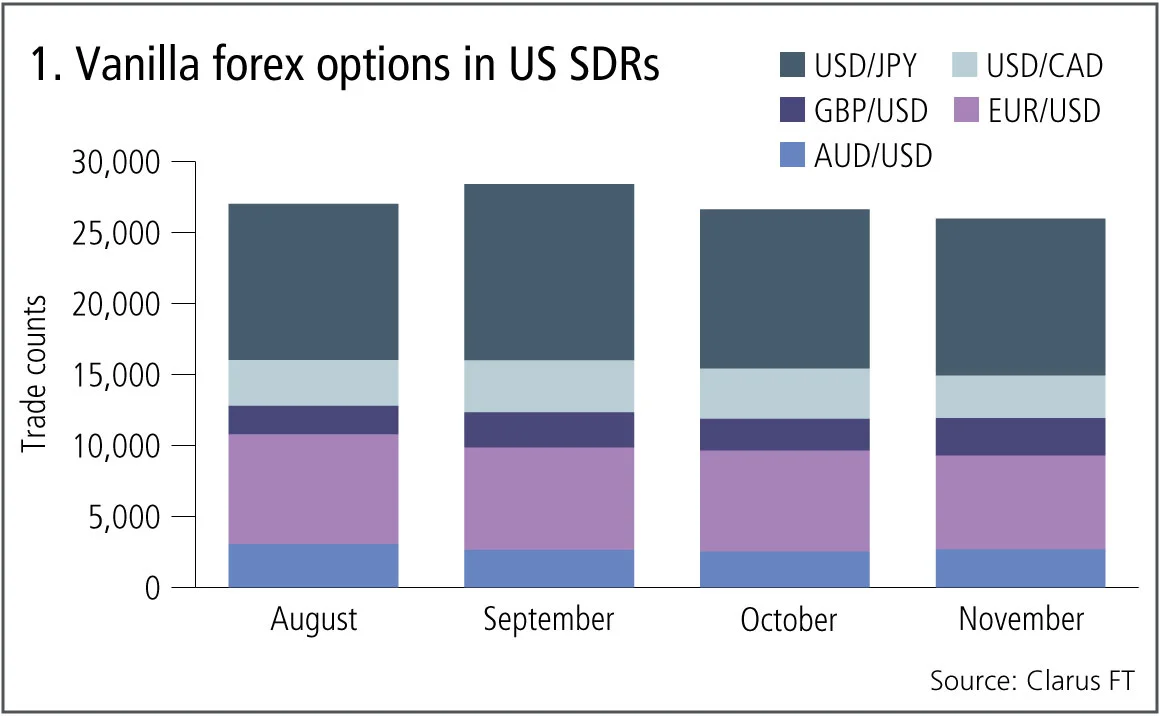

Let’s look at the same trades in gross notional terms.

Figure 2 shows:

- An average of $725 billion is traded each month in these currency pairs.

- EUR/USD is the largest, with $300 billion per month, or $15 billion per day.

- USD/JPY is next, with $240 billion.

- GBP/USD follows with $75 billion.

- USD/CAD and AUD/USD have $67 billion and $46 -billion, -respectively.

- The average trade size of EUR/USD forex options is $40 million, while for USD/JPY it is half that at $20 million.

Swap execution facilities

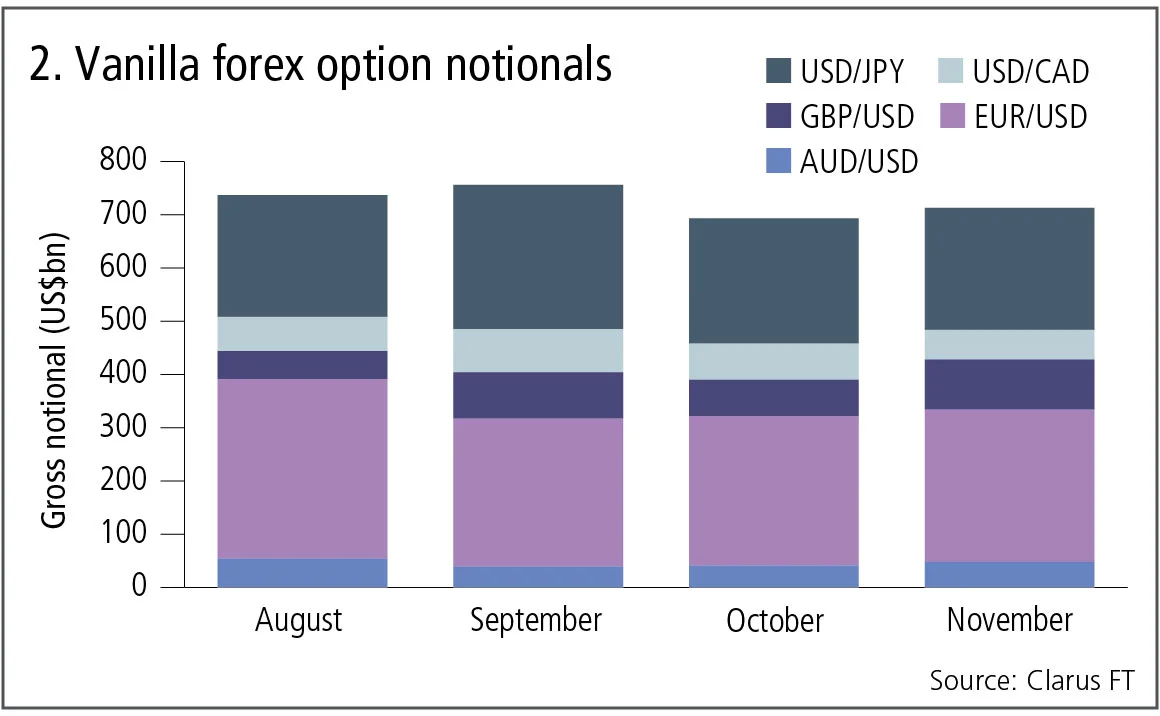

While it is not mandatory to trade forex options on swap execution facilities, some trading takes place voluntarily.

Figure 3 shows:

- About 70% of volume by trade count is off-Sef and 30% on-Sef.

- In gross notional terms, it is 63% off-Sef, and 37% on-Sef.

The vast majority of on-Sef volumes takes place on dealer-to-dealer Sefs run by BGC, GFI, Tradition and TP Icap.

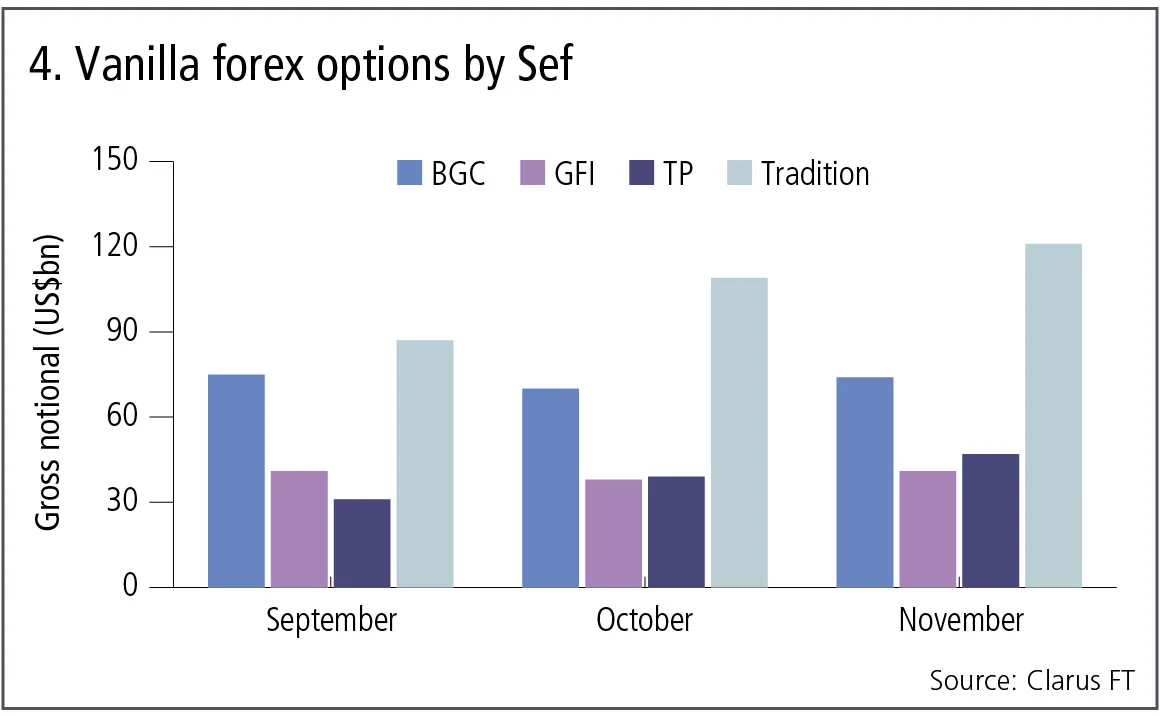

Figure 4 shows:

- Tradition is the largest each month, with a 40% market share.BGC is next, with a 28% share.

- GFI follows with a 16% share.

- TP Icap has 15%.

- November 2017 was the highest-volume month.

Barrier forex options

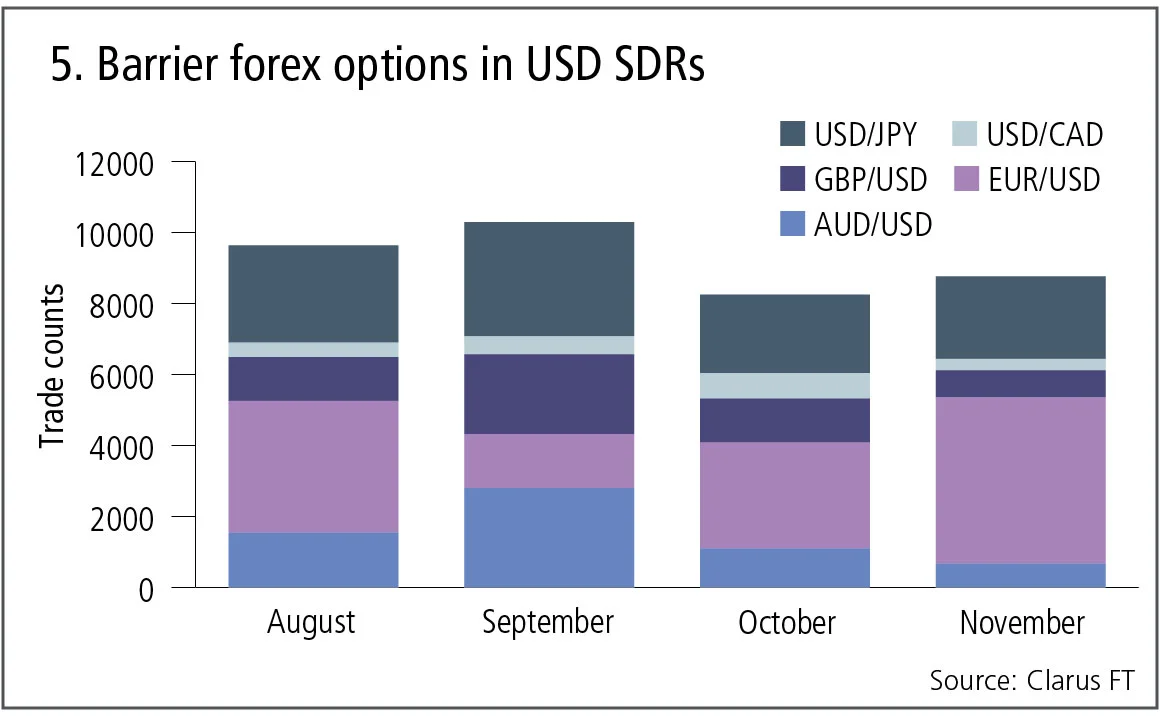

Forex options with a barrier level that triggers the option to kick in or knock out are another common product. Repository data is used here to generate trade counts for the same five currency pairs.

Figure 5 shows:

- Each month, around 9,000 trades are reported in these five major currency pairs – so, one-third the levels for vanilla options.

- EUR/USD has the most trades, averaging 3,200 per month.

- USD/JPY is next, averaging 2,600 trades per month.

- AUD/USD follows with 1,500 trades per month.

- GBP/USD and USD/CAD are at 1,350 and 500 respectively.

Gross notional

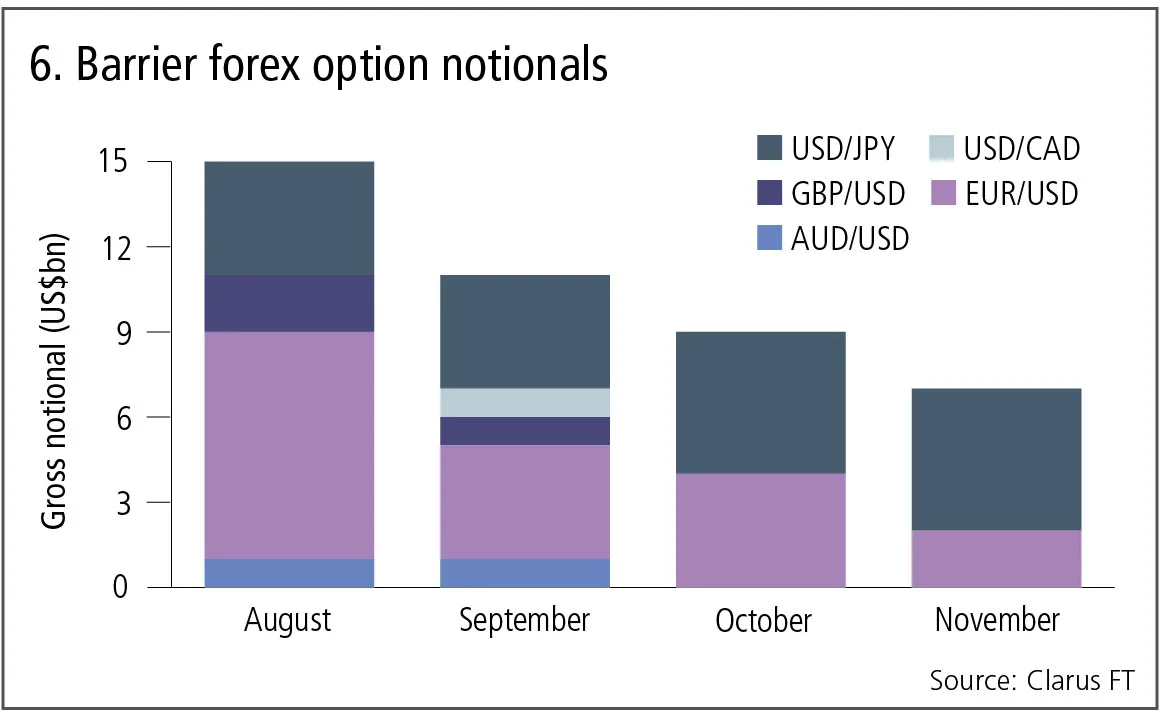

Again, the shares change when the market is looked at in gross notional terms.

Figure 6 shows:

- An average of $11 billion is traded each month in these currency pairs.

- That is just 1.5% of the $725 billion in vanilla options.

- EUR/USD is the largest, with $4 billion per month.

- USD/JPY is similar, also with $4 billion.

- The chart shows lower month-on-month volume.

- So, while in trade-count terms barriers are equal to 30% of the vanilla options market, in gross notional terms they are far less significant at 1.5%.

The average trade size of EUR/USD barrier trades reported to US swap data repositories is $1.4 million, significantly lower than the $40 million average for vanilla options. Such small notionals are not indicative of client activity.

Amir Khwaja is chief executive of Clarus Financial Technology.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Comment

Op risk data: At Trafigura, a $1 billion miss in Mongolia

Also: Insurance cartels, Santander settlement and TSB’s “woeful” customer treatment. Data by ORX News

UST repo clearing: considerations for ‘done-away’ implementation

Citi’s Mariam Rafi sets out the drivers for sponsored and agent clearing of Treasury repo and reverse repo

Op risk data: Macquarie mauled by securities mismarks

Also: Danske’s costliest branch, tedious times for TD, and WhatsApp won’t stop. Data by ORX News

Climate stress tests are cold comfort for banks

Flaws in regulators’ methodology for gauging financial impact of climate change undermine transition efforts, argues modelling expert

Op risk data: Shady loans robbing Reliance of $1.1bn

Also: H20’s less-than-liquid holdings, Ripple ripped for $125m, and more WhatsApp slaps expected. Data by ORX News

FX algo users change tack to navigate market doldrums

BestX data finds traders ditching TWAP in favour of more opportunistic execution styles

Op risk data: Payday lender Skytrail sees $1.4bn disappear

Also: Cartel claims cost European bond dealers dearly, plus oil price gouging and crypto cover-ups. Data by ORX News

For US Treasury troubles, treat the cause not the symptom

Regulatory alarm about hidden risk in the Treasury futures market misses the point, fund association execs write