Stochastic volatility

The stochastic-volatility, jump-diffusion optimal portfolio problem with jumps in returns and volatility

The risk-averse optimal portfolio problem is treated with consumption in continuous time for a stochastic jump-volatility-jump-diffusion (SJVJD) model for both the risky asset and the volatility.

Path-dependent volatility

Julien Guyon on path-dependent volatility models

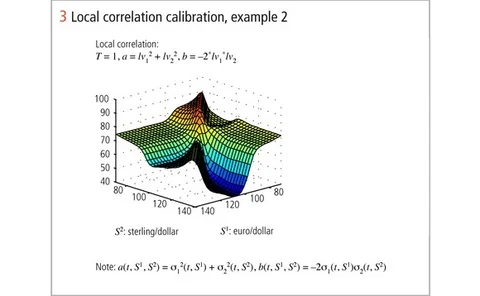

Local correlation families

Local correlation families

Rational shapes of local volatility

Rational shapes of local volatility

Expanded forward volatility

Expanded forward volatility

Cutting edge 2012: From stochastic volatility to shameful scams

From stochastic volatility to shameful scams

Quanto adjustments in the presence of stochastic volatility

It is well known that the quanto adjustment in the drift of the underlying has a significant impact on the prices of quanto options. Alexander Giese points out that an additional quanto adjustment in the underlying’s volatility needs to be considered in…

Quanto adjustments in the presence of stochastic volatility

Quanto adjustments in the presence of stochastic volatility

Stochastic volatility’s orderly smiles

Stochastic volatility’s orderly smiles

Sponsored statement: Ito33

Which model for equity derivatives?

Perturbed Gaussian copula: introducing the skew effect in co-dependence

Gaussian copula models are often used in the industry when single-asset information is quoted but little is known about their joint relation. These models may arise from correlated stochastic Brownian processes with deterministic volatility and…

Being particular about calibration

Following previous work on the calibration of multi-factor local stochastic volatility models to market smiles, Julien Guyon and Pierre Henry-Labordère show how to calibrate exactly any such model. Their approach, based on McKean’s particle method,…

Right Laplace, right time

Right Laplace, right time

Lifetime achievement award: John Hull

Risk awards 2011

A Libor market model with a stochastic basis

A Libor market model with a stochastic basis