Sterling

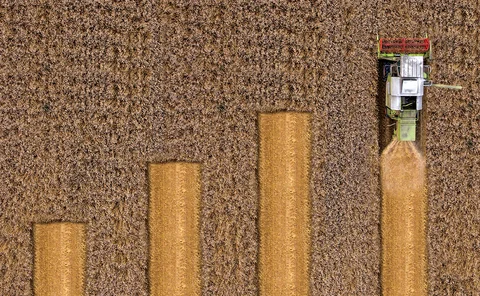

Short-dated sterling swap volumes surge

On April 22, traded volumes were four times the two-year average

Lloyds and Riverside rehitch revolving loan to Sonia

£100m Sonia facility overcame late operational hurdles to be among the first done since the onset of coronavirus

OIS volumes collapse after rates plummet

USD OIS weekly traded notional falls to $502 billion from recent $3.3 trillion peak

Sonia swaps surge not mirrored by futures

Popularity of short sterling futures takes shine off Sonia’s RFR succession

OIS trading in sterling, euro and Aussie dollar soar

Euro overnight index swaps notional volumes hit €192 billion on March 1

Sonia’s share of sterling swaps tipped to hit 80% by year-end

Ahead of Monday’s convention switch, dealers already view Sonia as the primary sterling rate

Who killed FX volatility?

Beyond central bank policy, traders see a range of hidden structural factors at work

Judgement day looms for dealers in swap shift to Sonia

Regulator pushes Q1 deadline for users to adopt risk-free rate as norm for interdealer trades

Lloyds plans £4bn Sonia shift for covered bond extension clause

Consent solicitation aims to flip one-year Libor-linked grace period on fixed instruments to RFR

How pre-trade IM calculation can optimise and reduce collateral drag

With firms under pressure to make their systems compliant with uncleared margin rules (UMR), the increase in margin requirements has put further strain on the availability of high-quality liquid assets. Mohit Gupta, senior product specialist at Cassini…

Competitive differentiation – Reaping the benefits of XVA centralisation

A forum of industry leaders discusses the latest developments in XVA and the strategic, operational and technological challenges of derivatives valuation in today’s environment, including the key considerations for banks looking to move to a standardised…

Sandbar's focus on idiosyncratic factors sets it apart from its peers in equity market‑neutral

With investors sometimes struggling to find hedge funds that deliver uncorrelated, consistent returns, Sandbar Asset Management stands out from its peers. Its success in running an equity market-neutral strategy is a reflection of its founder and chief…

Opening the buy-side liquidity pool

Vikash Rughani, business manager at triReduce and triBalance, outlines a new approach enabling buy- and sell-side participants to optimise the transition of legacy Libor over-the-counter swaps contracts to alternative reference rates

Sterling option volatility spikes on Brexit deal news

Trading reaches crescendo on Friday; insiders warn of further volatility

Deal misfires expose risk of contingent hedging

Banks hike premiums on deal contingent swaps amid Brexit uncertainty

Synthetic Libor mooted as ‘tough legacy’ fix

Recalibration of doomed rate or catch-all legislation under debate as lifeline for lingering contracts

Ice swap rate failure disrupts exotics desks

Dollar version of rate wasn’t published on nine out of 22 working days in August

Looking forward to backward‑looking rates

Interbank offered rates are critical in the world of contracts and derivatives, acting as reference rates in millions of financial contracts and with a total market exposure in the hundreds of trillions of dollars. Bloomberg explores why offering…

Libor transition and implementation – Covering all bases

Sponsored Q&A

FCA urges dealers to quote Sonia swaps on Clobs

Regulator co-ordinates efforts to stream firm prices as part of ramped-up transition plans

Tradeweb reveals package trading for swaps and bonds

New tool offers pricing and trading of sterling swap-bond combo

Dealers dip toe into Sonia swaptions market

NatWest and HSBC print trades, Barclays offers prices