Margin

OTC derivatives clearing: no turning back

Clearing advocates have plenty of reasons to feel optimistic about the future

Ion expands into OTC markets with Clarus deal

Tech titan adds real-time swaps margin analytics to its post-trade services for listed derivatives

IM phases five and six collide as buy side delays readiness

More than 1,000 segregated accounts for uncleared margin may still need to be opened post-deadline

Client margin down 33% at Credit Suisse’s swaps unit in Q2

Drop in IM could signal clients jumping ship in the aftermath of Archegos blowout

GameStop frenzy triggered $2 billion margin breach at OCC

Total initial margin held by the OCC's default fund stood at $114.4 billion in Q1

Sunil Cutinho on CME’s crisis performance

Maverick clearing house boss dismisses the need for anti-procyclicality tools imposed by regulators

Futures aim to put a dent in FX swaps supremacy

Advent of margin rules sharpens appeal of exchange-traded instruments for buy-siders

BNP inks back-office clearing deal with FIS

Vendors jostle to offer collateral management services amid negative rates and shrinking returns for FCMs

NSCC caught $600m short during meme-stock frenzy

Worst-case losses would have wiped out the CCP’s available liquid resources on one day in Q1

Deep XVAs and the promise of super-fast pricing

Intelligent robots can value complex derivatives in minutes rather than hours

NSCC hit by $1.06bn margin breach

In total, the DTCC division reported 96 margin breaches at end-March 2021

Banks invest in futures utility to guard against tech snafus

FCMs, including Goldman and JP, stump up $44 million to fund FIA Tech push to standardise trade processing

Nomura hires McKinsey to examine Archegos failings

Risk framework under external review as DOJ reportedly opens probe into fund’s collapse

Trouble in the family: regulators’ options after Archegos

What rule changes are needed in response to the messy collapse of Bill Hwang’s firm?

CCP open access meets ‘disappointing’ death in UK

All eyes turn to EU’s review of listed derivatives clearing, after battle is lost in UK

Credit Suisse and the Wild West of synthetic prime brokerage

Industry insiders describe a frontier business with few rules – and plenty of questionable practices

Credit Suisse held just 10% margin against Archegos book

Swiss bank gave family office 10 times leverage, compared with four or five times at Goldman

Initial margin at Ice CCPs surged over 2020

Required IM at Ice Clear US increased 42% year on year

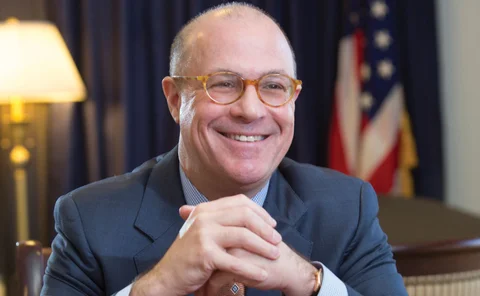

‘Crypto Dad’ Giancarlo says DLT could have aided in Archegos

Former CFTC chair says managing collateral by distributed ledger technology would enable better oversight of risks

UK funds fall out of love with sterling swaps

Lower yields, Libor transition and margin rules help make gilt repo the desired hedging tool for LDI funds

Eurex switches default fund calculation

As whipsawing markets see contributions balloon, CCP will now base charges on stress loss method

Initial margin at the OCC topped $100bn in Q4

Exchange-traded derivatives hub cleared 7.5 billion contracts in 2020

Margin breaches quadrupled at Eurex in 2020

Equity derivatives service witnessed 1,782 breaches last year alone

Games of hazard: NSCC’s margin waiver sets bad precedent

By waiving a $2.2 billion cash call for Robinhood, members worry the NSCC may have dug itself a trap