United States (US)

Spectre of mass swap unwinds looms ahead of VM deadline

Dealers warn of market disruption if trades lacking new CSAs are terminated before September 1

Delay revised Basel capital rules, say bankers

Regulatory heads at JP Morgan and BNP Paribas recommend regulatory recess

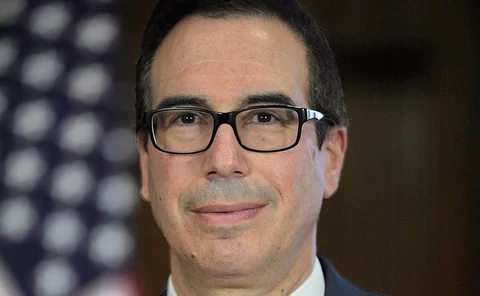

Mnuchin: new Glass-Steagall would not separate banks

US treasury secretary’s stance on banking reform appears to contrast with that of Donald Trump

People: Noble shuffles board in wake of Elman exit

Shell swaps trading chiefs; ex-Dreyfus head joins Cofco; Glencore adds Aberdeen’s Gilbert to board

Banks diving into credit data pools as official support grows

European regulators embrace external data for internal modelling of credit risk capital

‘Standstill’ agreement gives trueEX a lifeline

Temporary deal allows start-up Sef to continue operations until at least July 29

Compliance chiefs call on CFTC to end position limits uncertainty

Energy Risk USA: market participants say delay in rulemaking is ‘very frustrating’

Giancarlo: SLR change would cut clearing capital by 70%

Isda AGM: netting of clearing collateral would boost activity without weakening banks, claims CFTC chair

Hedging advisory of the year: Aegis Energy Risk

Energy Risk Awards 2017: Strength in capabilities drives business to Texan advisory

Electricity house of the year: Citi

Energy Risk Awards 2017: Citi stands out with sophisticated power deals

Trump’s Basel stance is key for Asian banks

Donald Trump may have strengthened ties with the region, but the true impact of his administration on Asia remains to be seen

Andrew Lo’s theory to beat a theory

Author of Adaptive Markets tells Risk.net what his ideas mean for investors and regulators

BrokerTec dominance ‘unhealthy’, says Nasdaq’s Shay

More clearing needed to improve US Treasury competition

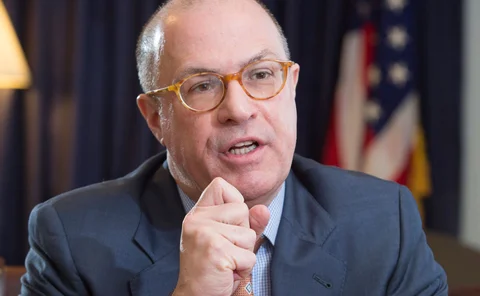

Is wholesale banking disruption-proof?

Fintech threatens market-making, research and wealth management, writes eCo Financial Technology CEO

Robo-traders and robo-labour

Banks and buy-siders are starting to harvest the benefits of machine learning beyond the front office

Banks seek escape from inter‑affiliate margin burden

Internal transactions contributing “substantial” amount of banks’ initial margin requirement

Fears of fragmentation over Basel shadow banking rules

Step-in risk guidelines could be taken more seriously in the EU than in the US

Critical Mass: why US Treasury swallowed unloved Volcker rule

Bank prop trading ban drafted in a lunch break after Democrat defeat in Massachusetts

CFTC counsel warns of threat to clearing portability

Leverage ratio seen as biggest impediment to porting client positions

US shale fluffing its feathers in mating dance with banks

Cash-addicted producers are making greater use of hedging to attract loans

People: CFTC picks enforcement and legislative affairs chiefs

Other changes at Eni, Societe Generale, Danske Commodities, Glencore, Global Coal, Six plus more

Mnuchin: FSOC working on revised Volcker rule

US Treasury secretary wants revamp of prop trading ban; not repeal

Fed’s Powell joins chorus of Volcker rule critics

Governor seeks to simplify rule banning prop trading

Volcker fights back as prop-trading ban comes under attack

Former Fed chair tells Risk.net that calls for total overhaul of eponymous rule are misplaced