A new leaf: why a hedge fund manager bought a bank

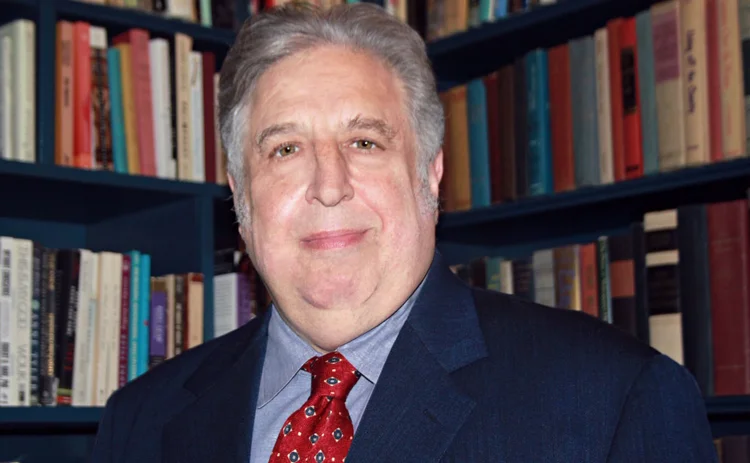

Andy Redleaf founded a $6 billion hedge fund. Now he runs a small community bank

In many ways, Andy Redleaf was a quintessential hedge fund manager. A Yale University maths graduate, he traded options at Gruntal & Co – alongside investing legend-to-be Steven Cohen – and in the Chicago options-trading pits before co-founding Deephaven Capital Management in 1994 and then Whitebox Advisors in 2000. At Whitebox, he predicted the subprime crisis and subsequent economic recovery. Then, he started to go off-script.

In 2015, Redleaf purchased Park State Bank, a small Minneapolis

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Investing

Anacapa’s rapid-fire options strategy hits the target

Investment firm’s novel take on volatility selling avoided big drawdowns in 2020 and 2022

BofA sets its sights on US synthetic risk transfer market

New trading initiative has already notched at least three transactions

Man Group airs climate allocation tool for real-world decarbonisation

Compass is a guide for steering $200 trillion investment toward decarbonising high-emission industries

Neil Chriss sets out to codify the game theory of trading

The co-author of the benchmark Almgren-Chriss model has updated his thinking on market impact

Talking Heads 2024: All eyes on US equities

How the tech-driven S&P 500 surge has impacted thinking at five market participants

To liquidity and beyond: new funding strategies for UK pensions and insurance

Prompted by policy shifts and macro events, pension funds and insurance firms are seeking alternative solutions around funding and liquidity

Why the Basel III rollback won’t halt US risk transfer deals

New structures could free up reserves as well as regulatory capital, says lawyer who helped launch market

Beware the macro elephant that could stomp on stocks

Macro risks have the potential to shake equities more than investors might be anticipating